TCF Bank 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 TCF Financial Corporation and Subsidiaries

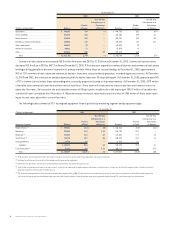

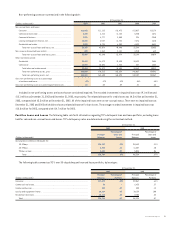

Non-Performing Assets Non-performing assets consist

of non-accrual loans and leases and other real estate owned.

The decrease in total non-performing assets reflects decreases of

$4.7 million, $3.9 million and $3.1 million, respectively, in leasing

and equipment finance, residential real estate and commercial

business non-performing assets, partially offset by increases of

$7 million and $3.4 million, respectively, in consumer and com-

mercial real estate non-performing assets.

Approximately 53% of non-performing assets at December 31, 2003

consisted of, or were secured by, residential real estate. Non-accrual

loans and leases in the truck and trailer marketing segment of the

leasing and equipment finance portfolio totaled $3.5 million at

December 31, 2003, compared with $7.5 million at December 31,

2002. The accrual of interest income is generally discontinued when

loans and leases become 90 days or more past due with respect to

either principal or interest (150 days or six payments past due for

loans secured by residential real estate) unless such loans and

leases are adequately secured and in the process of collection.

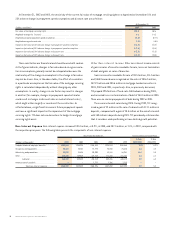

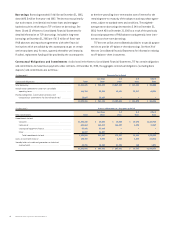

The following table sets forth additional information regarding net charge-offs:

Year Ended December 31,

2003 2002

% of Average % of Average

Net Loans and Net Loans and

(Dollars in thousands) Charge-offs Leases Charge-offs Leases

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,189 .10% $ 3,974 .15%

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,336 .07 2,138 .12

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 782 .18 5,898 1.35

Leasing and equipment finance:

Middle market . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,883 .40 1,017 .39

Winthrop . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (32) – 113 .04

Wholesale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,774 1.13 2,998 1.57

Small ticket . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,422 1.28 759 .83

Leveraged leases . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ––––

Subtotal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,047 .31 4,887 .56

Truck and trailer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,490 3.03 3,079 2.50

Total leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,537 .69 7,966 .80

Subtotal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,844 .19 19,976 .34

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77 .01 50 –

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,921 .16 $20,026 .25

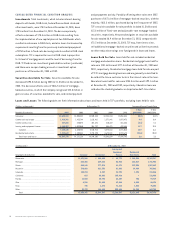

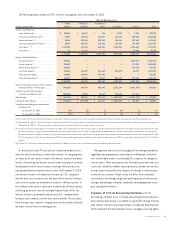

The allocated allowance balances for TCF’s residential and

consumer loan portfolios, at December 31, 2003, reflect the

Company’s credit quality and related low level of net loan charge-

offs for these portfolios. The increase in the allocated allowance for

commercial real estate losses reflects the growth in the portfolio.

The decline in the allocated allowance for commercial business

reflects the decline in the portfolio coupled with declines in net

charge-offs, non-performing loans and potential problem loans

in the commercial business portfolio during 2003. The allocated

allowance for the loan and lease portfolios do not reflect any

significant changes in estimation methods or assumptions.

The decrease in TCF’s allowance for loan and lease losses as a

percentage of total loans and leases, at December 31, 2003, reflects

the impact of the reduction in commercial and commercial real

estate, consumer and leasing and equipment finance charge-offs

and the reduction in non-accrual loans and leases, partially offset

by growth in loans and leases.