TCF Bank 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2003 Annual Report 59

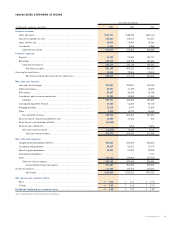

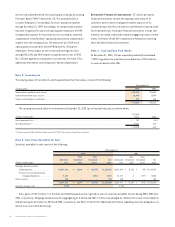

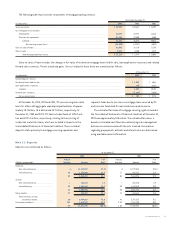

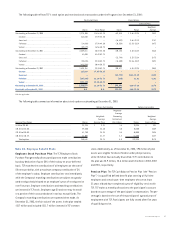

Note 7. Allowance for Loan and Lease Losses

Following is a summary of the allowance for loan and lease losses and selected statistics:

Year Ended December 31,

(Dollars in thousands) 2003 2002 2001

Balance at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 77,008 $ 75,028 $ 66,669

Provision for credit losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,532 22,006 20,878

Charge-offs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (16,369) (24,361) (16,951)

Recoveries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,448 4,335 4,432

Net charge-offs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (12,921) (20,026) (12,519)

Balance at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 76,619 $ 77,008 $ 75,028

Ratio of net loan and lease charge-offs to average loans and leases outstanding . . . . . . . . . . . . . . . . . . . . . . . . . .16% .25% .15%

Allowance for loan and lease losses as a percentage of total loan and lease balances at year end . . . . . . . . . . . .92 .95 .91

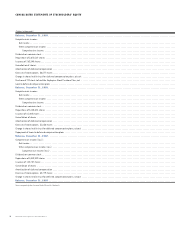

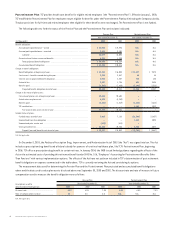

Information relating to impaired loans and non-accrual loans and leases is as follows:

At or For the Year Ended December 31,

(In thousands) 2003 2002 2001

Impaired loans:

Balance, at year-end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9,133 $ 12,090 $ 18,839

Related allowance for loan losses, at year-end(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,456 5,512 4,986

Average recorded investment in impaired loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,770 14,686 9,939

Interest income recognized on impaired loans (cash basis) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27 92 29

Non-accrual loans and leases:

Balance, at year-end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35,328 42,068 51,224

Contractual interest (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,271 4,301 5,450

Interest income recognized on non-accrual loans and leases (cash basis) . . . . . . . . . . . . . . . . . . . . . . . . . . . 783 1,225 1,711

(1) There were no impaired loans at December 31, 2003, 2002 and 2001 which did not have a related allowance for loan losses.

(2) Represents interest which would have been recorded had the loans and leases performed in accordance with their original terms.

At December 31, 2003, 2002 and 2001, TCF had no loans outstanding with terms that had been modified in troubled debt restructurings.

There were no material commitments to lend additional funds to customers whose loans or leases were classified as non-accrual at

December 31, 2003.

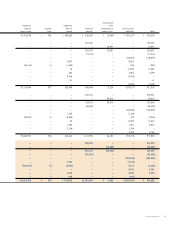

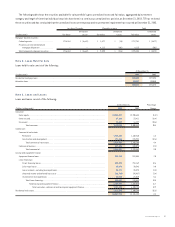

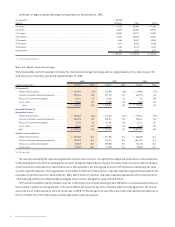

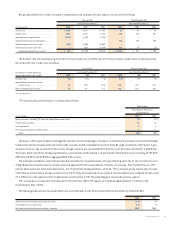

Note 8. Premises and Equipment

Premises and equipment are summarized as follows:

At December 31,

(In thousands) 2003 2002

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 76,902 $ 62,226

Office buildings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 169,098 155,954

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40,927 39,208

Furniture and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 242,958 213,759

529,885 471,147

Less accumulated depreciation and amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 247,692 227,695

$282,193 $243,452

TCF leases certain premises and equipment under operating leases. Net lease expense was $23.5 million, $20.8 million and $20.7 million in

2003, 2002 and 2001, respectively.