TCF Bank 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

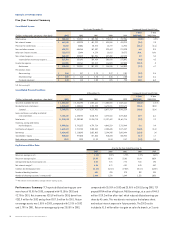

18 TCF Financial Corporation and Subsidiaries

MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s discussion and analysis of the consolidated financial

condition and results of operations of TCF Financial Corporation

(“TCF” or the “Company”) should be read in conjunction with the

consolidated financial statements and other financial data begin-

ning on page 48.

OVERVIEW

TCF is a national financial holding company located in Wayzata,

Minnesota. Its principal subsidiary, TCF National Bank, is

headquartered in Minnesota and had 401 banking offices in

Minnesota, Illinois, Michigan, Wisconsin, Colorado and Indiana

at December 31, 2003.

TCF provides convenient financial services through multiple chan-

nels to customers located primarily in the Midwest. TCF has developed

products and services designed to meet the needs of all consumers.

The Company focuses on attracting and retaining customers through

service and convenience, including branches that are open seven

days a week and on most holidays, extensive full-service supermarket

branch and automated teller machine (“ATM”) networks, and tele-

phone and Internet banking. TCF’s philosophy is to generate net

interest income and fees and other revenue growth through business

lines that emphasize higher yielding assets and lower or no interest-

cost deposits. The Company’s growth strategies include new branch

expansion and the development of new products and services. New

products and services are designed to build on existing businesses

and expand into complementary products and services through

strategic initiatives.

TCF’s core businesses are comprised of traditional and supermar-

ket bank branches, campus banking, EXPRESS TELLER®ATMs, VISA®

debit cards, commercial lending, small business banking, consumer

lending, mortgage banking, leasing and equipment finance and

investment, brokerage and insurance services. TCF emphasizes the

“Totally Free” checking account as its anchor account, which

provides opportunities to cross sell other convenience products and

services and generate additional fee income.

TCF has opened 239 new branches since January 1, 1998; 196

supermarket branches and 43 traditional branches. Opening new

branches is an integral part of TCF’s growth strategy for generating

new deposit accounts and the related revenue that is associated

with the accounts and other products. New branches typically pro-

duce net losses during the first 24 - 30 months of operations before

they become profitable, and therefore the level and timing of new

branch expansion can have a significant impact on TCF’s reported

profitability. TCF’s growth in checking accounts is primarily occurring

in new branches with growth in older, mature branches being slower

and more difficult to generate. During 2003, TCF closed twelve

supermarket branches and one traditional branch. Closure of the

twelve supermarket branches was the result of the supermarket

owner closing the stores and discontinuing TCF’s license agreements

for these locations. The deposits in all these branches were transferred

to other nearby branches. The success of TCF’s branch expansion is

dependent on the continued long-term success and viability of

branch banking. Success in the supermarket branches is also depen-

dent on the success and viability of the supermarket branch locations.

Economic slowdowns, financial or labor difficulties and competitive

pressures from new grocery retailers may have an adverse impact on

the supermarket industry and therefore reduce customer activity in

TCF’s supermarket branches. TCF is subject to the risk, among others,

that its license for its supermarket branches will terminate in con-

nection with the sale or closure of a store by a supermarket chain.

TCF’s lending strategy is to originate high credit quality, primarily

secured, loans and leases. Commercial loans are generally made on

local properties or to local customers, and are virtually all secured.

TCF’s largest core lending business is its consumer home equity loan

operation, which offers fixed- and variable-rate loans and lines of

credit secured by residential real estate properties. The leasing

and equipment finance businesses consist of Winthrop Resources

Corporation (“Winthrop”), a leasing company that leases technology

and data processing equipment to companies nationwide and

TCF Leasing, Inc. (“TCF Leasing”), a general leasing and equipment

finance leasing business. TCF’s leasing and equipment finance

businesses operate in all 50 states.

As a primarily secured lender, TCF emphasizes credit quality over

asset growth. As a result, TCF’s credit losses are generally lower than

those experienced by other banks. The allowance for loan and lease

losses, while generally lower as a percent of loans and leases than the

average in the banking industry, reflects the lower historical charge-

offs and management’s expectation of the risk of loss inherent in

the loan and lease portfolio. See “Consolidated Financial Condition

Analysis – Allowance for Loan and Lease Losses.”