TCF Bank 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 TCF Financial Corporation and Subsidiaries

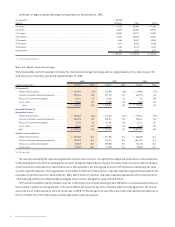

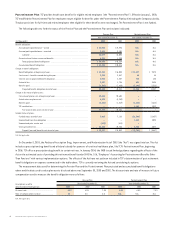

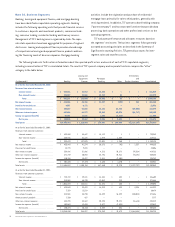

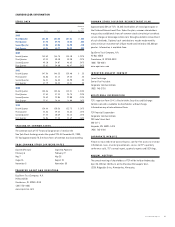

As discussed above, the carrying amounts of certain of the Company’s financial instruments approximate their fair value.

The carrying amounts and fair values of the Company’s remaining financial instruments are set forth in the following table:

At December 31,

2003 2002

Carrying Estimated Carrying Estimated

(In thousands) Amount Fair Value Amount Fair Value

Financial instrument assets:

Loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 335,372 $ 340,189 $ 476,475 $ 480,409

Forward mortgage loan sales commitments (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,105) (1,105) (7,454) (7,454)

Loans:

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,630,341 3,649,810 3,005,882 3,068,900

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,916,701 1,947,267 1,835,788 1,883,183

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 427,696 429,727 440,074 438,106

Equipment finance loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 309,740 312,948 289,558 299,035

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,212,643 1,247,610 1,800,344 1,868,132

Allowance for loan losses (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (67,654) – (68,143) –

$ 7,763,734 $ 7,926,446 $ 7,772,524 $ 8,030,311

Financial instrument liabilities:

Checking, savings and money market deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,999,626 $ 5,999,626 $ 5,791,233 $ 5,791,233

Certificates of deposit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,612,123 1,630,511 1,918,755 1,948,947

Short-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 878,412 878,615 842,051 842,051

Long-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,536,413 1,627,253 2,268,244 2,443,653

$10,026,574 $10,136,005 $10,820,283 $11,025,884

Financial instruments with off-balance-sheet risk: (3)

Commitments to extend credit (4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 22,773 $ 22,773 $ 24,569 $ 24,569

Standby letters of credit (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43 43 32 32

Loans serviced with recourse (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (100) (100) (100) (100)

$ 22,716 $ 22,716 $ 24,501 $ 24,501

(1) Carrying amounts are included in accrued expenses and other liabilities.

(2) Excludes the allowance for lease losses.

(3) Positive amounts represent assets, negative amounts represent liabilities.

(4) Carrying amounts are included in other assets.

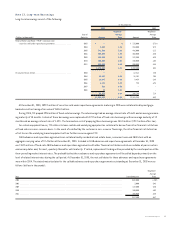

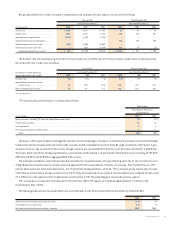

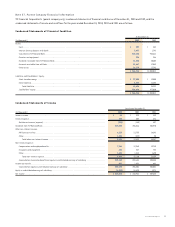

Note 22. Net Income and Goodwill Amortization

On January 1, 2002, TCF adopted SFAS No. 142, “Goodwill and Other Intangible Assets,” which requires that goodwill and other intangible

assets with indefinite useful lives no longer be amortized, but instead be tested for impairment at least annually. The following table reconciles

prior period net income and earnings per share to an adjusted basis, which excludes goodwill amortization, for comparison purposes:

Year Ended December 31,

(In thousands, except per-share data) 2003 2002 2001

Net Income:

Reported net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 215,878 $ 232,931 $ 207,322

Add back: Amortization of goodwill, net of applicable income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .– – 7,600

Adjusted net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 215,878 $ 232,931 $ 214,922

Basic Earnings Per Common Share:

Reported earnings per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.06 $ 3.17 $ 2.73

Amortization of goodwill, net of applicable income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . –– .10

Adjusted earnings per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.06 $ 3.17 $ 2.83

Diluted Earnings Per Common Share:

Reported earnings per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.05 $ 3.15 $ 2.70

Amortization of goodwill, net of applicable income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . –– .10

Adjusted earnings per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3.05 $ 3.15 $ 2.80