TCF Bank 2001 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

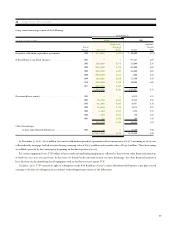

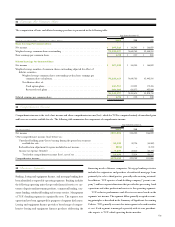

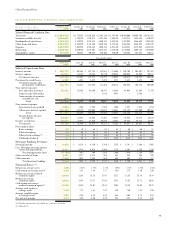

21 Earnings Per Common Share

The computation of basic and diluted earnings per share is presented in the following table:

Year Ended December 31,

(Dollars in thousands, except per-share data) 2001 2000 1999

Basic Earnings Per Common Share

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 207,322 $ 186,245 $ 166,039

Weighted average common shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75,825,017 78,648,765 82,445,288

Basic earnings per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.73 $ 2.37 $ 2.01

Diluted Earnings Per Common Share

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 207,322 $ 186,245 $ 166,039

Weighted average number of common shares outstanding adjusted for effect of

dilutive securities:

Weighted average common shares outstanding used in basic earnings per

common share calculation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 75,825,017 78,648,765 82,445,288

Net dilutive effect of:

Stock option plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149,711 113,338 172,486

Restricted stock plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 868,209 626,572 452,944

76,842,937 79,388,675 83,070,718

Diluted earnings per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2.70 $ 2.35 $ 2.00

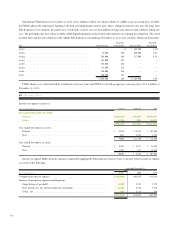

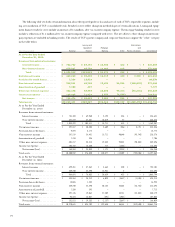

22 Comprehensive Income

Comprehensive income is the total of net income and other comprehensive income (loss), which for TCF is comprised entirely of unrealized gains

and losses on securities available for sale. The following table summarizes the components of comprehensive income:

Year Ended December 31,

(In thousands) 2001 2000 1999

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $207,322 $186,245 $166,039

Other comprehensive income (loss) before tax:

Unrealized holding gains (losses) arising during the period on securities

available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26,295 59,726 (84,503)

Reclassification adjustment for gains included in net income . . . . . . . . . . . . . . . . . (863) – (3,194)

Income tax expense (benefit) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,335 22,212 (32,724)

Total other comprehensive income (loss), net of tax . . . . . . . . . . . . . . . . . . . . . 16,097 37,514 (54,973)

Comprehensive income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $223,419 $223,759 $111,066

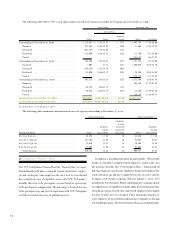

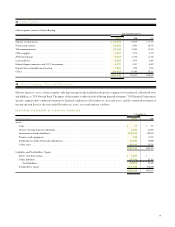

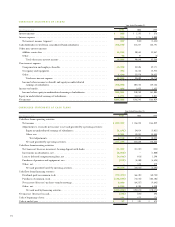

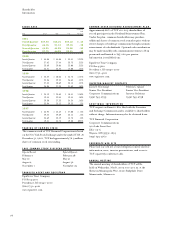

23 Business Segments

Banking, leasing and equipment finance, and mortgage banking have

been identified as reportable operating segments. Banking includes

the following operating units that provide financial services to cus-

tomers: deposits and investment products, commercial lending, con-

sumer lending, residential lending and treasury services. Management

of TCF’s banking segment is organized by state. The separate state

operations have been aggregated for purposes of segment disclosures.

Leasing and equipment finance provides a broad range of compre-

hensive leasing and equipment finance products addressing the

financing needs of diverse companies. Mortgage banking activities

include the origination and purchase of residential mortgage loans

primarily for sale to third parties, generally with servicing retained.

In addition, TCF operates a bank holding company (“parent com-

pany”) and has corporate functions that provide data processing, bank

operations and other professional services to the operating segments.

TCF evaluates performance and allocates resources based on the

segments’ net income. The segments follow generally accepted account-

ing principles as described in the Summary of Significant Accounting

Policies. TCF generally accounts for intersegment sales and transfers

at cost. Each segment is managed separately with its own president,

who reports to TCF’s chief operating decision maker.