TCF Bank 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

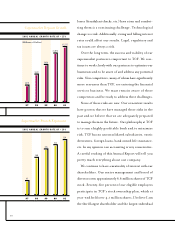

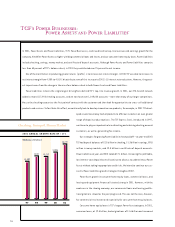

One of TCF’s most important assets is its management bench strength and depth. TCF is organized geographically and by function and

we believe strongly that local management teams make the best decisions regarding local issues. Each of our bank management teams

is responsible for local business decisions, business development initiatives, customer relations, and community involvement. Managers

are given an incentive to achieve specific goals in many of these areas.

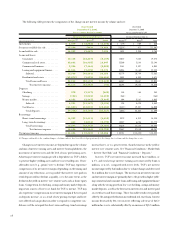

TCF’s Minnesota franchise has been in business for 78 years and has been in many ways the bellwether bank of the organization.

TCF Minnesota continues to focus on growth in higher-yielding consumer and commercial loans as well as increasing and fostering the

development of our lower interest-cost checking account base. In 2001, TCF Minnesota introduced its Small Business Banking Group

to bring TCF’s convenience-based products and services to this underserved market. We will continue to expand in Minnesota by adding

branches in growing areas and developing innovative new products.

The Lakeshore region in Illinois, Wisconsin and Indiana is TCF’s fastest growing franchise, and has the largest branch network and

employee base in our markets. Lakeshore now has supermarket branches in almost all existing Jewel-Osco®stores and will continue

to expand as Jewel builds new stores. This year, TCF added two important branch locations in the Loop area of downtown Chicago. The

Power Liabilities team is going strong; Lakeshore’s focus now turns to developing resources in the Power Assets area, by adding expe-

rienced new lenders in the commercial real estate and consumer lending areas. TCF Lakeshore is well positioned for growth.

Michigan represents one of TCF’s best opportunities for future growth, as there are many areas of Detroit in which we do not have a

presence. We are actively acquiring land for new traditional branches and plan to open approximately five branches in 2002. This year,

TCF Michigan was proud to forge a partnership with the University of Michigan to offer the “M Card” – a multi-functional ID and bank-

ing card for University of Michigan students, faculty and staff.

Our Colorado franchise in Denver and Colorado Springs also represents an area of great potential for TCF’s future expansion. TCF

Colorado now has 12 supermarket branches. TCF Colorado is also aggressively acquiring land to build additional traditional branches

and will build three or four branches in 2002. In addition, we are focused on increasing our emerging consumer lending base by adding

experienced lenders to develop this business. We are confident that TCF’s strategy of offering convenience products and services will

thrive in this market, as it has in other states.

GEOGRAPHIC STRUCTURE

TCF’s proven expertise in providing campus card programs, along with our unique product line and branch presence, allowed us the opportunity to partner with the

University of Michigan to provide students, faculty and staff with the “M Card.” TCF is now recognized as a premier provider of innovative campus card banking services.