TCF Bank 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

This financial review presents management’s discussion and analysis

of the consolidated financial condition and results of operations of

TCF Financial Corporation (“TCF” or the “Company”) and should

be read in conjunction with the consolidated financial statements

and other financial data beginning on page 44.

Corporate Profile

TCF is the national financial holding company of two federally char-

tered banks, TCF National Bank headquartered in Minnesota and

TCF National Bank Colorado. The Company has 375 banking offices

in Minnesota, Illinois, Michigan, Wisconsin, Colorado and Indiana.

Other affiliates provide leasing and equipment finance, mortgage

banking, discount brokerage and investment and insurance sales.

TCF provides convenient financial services through multiple

channels to customers located primarily in the Midwest. TCF has

developed products and services designed to meet the needs of all

consumers with a primary focus on middle- and lower-income indi-

viduals. The Company focuses on attracting and retaining customers

through service and convenience, including branches that are open

seven days a week and on most holidays, extensive full-service super-

market branch and automated teller machine (“ATM”) networks,

and telephone and Internet banking. TCF’s philosophy is to gener-

ate top-line revenue growth (net interest income and fees and other

revenues) through business lines that emphasize higher yielding assets

and lower interest-cost deposits. The Company’s growth strategies

include de novo branch expansion and the development of new prod-

ucts and services designed to build on its core businesses and expand

into complementary products and services through emerging busi-

nesses and strategic initiatives.

TCF’s core businesses are comprised of mature traditional bank

branches, EXPRESS TELLER ATMs, and commercial, consumer

and mortgage lending. TCF emphasizes the “Totally Free” checking

account as its anchor account, which provides opportunities to cross

sell other convenience products and services and generate additional

fee income. TCF’s strategy is to originate high credit quality, pri-

marily secured loans and earn profits through lower interest-cost

deposits. Commercial loans are generally made on local properties

or to local customers, and are virtually all secured. TCF’s largest core

lending business is its consumer home equity loan portfolio, com-

prised of fixed- and variable-rate closed-end loans and lines of credit.

TCF’s emerging businesses and products are comprised of super-

market bank branches, including supermarket consumer lending,

leasing and equipment finance, debit cards, and Internet and col-

lege campus banking. TCF’s most significant de novo strategy has

been its supermarket branch expansion. The Company opened its

first supermarket branch in 1988, and now has 234 supermarket

branches, with more than $1.2 billion in deposits. TCF has the

nation’s fourth largest supermarket branch network. See “Financial

Condition – Deposits.” TCF entered the leasing business through its

1997 acquisition of Winthrop Resources Corporation (“Winthrop”),

a leasing company that leases computers and other business-essential

equipment to companies nationwide. The Company expanded its

leasing operations in September 1999 through TCF Leasing, Inc.

(“TCF Leasing”), a de novo general equipment leasing business to

serve the transportation, general middle-market equipment, lease

discounting, and syndication sectors. See “Financial Condition –

Loans and Leases.” The Company’s VISA®debit card program has

also grown significantly since its inception in 1996. According to a

September 30, 2001 statistical report issued by VISA, TCF is the 13th

largest VISA debit card issuer in the United States, with 1.2 million

cards outstanding and the 12th largest based on sales volume.

TCF’s strategic initiatives are businesses that complement the

Company’s core and emerging businesses. TCF’s new products have

been significant contributors to the growth in fees and other rev-

enues generated by checking accounts and loan products. Currently,

TCF’s strategic initiatives include continued investment in de novo

branch expansion, new loan and deposit products, including card

products, designed to provide additional convenience to deposit and

loan customers and to further leverage its EXPRESS TELLER ATM

network. In June 2001, the Company launched its discount broker-

age, TCF Express Trade, Inc. The Company is also planning to launch

additional insurance and investment products in 2002.

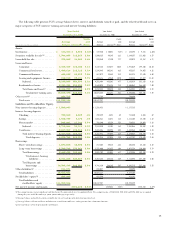

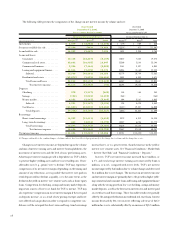

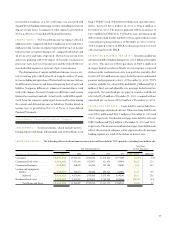

Results of Operations

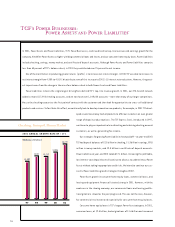

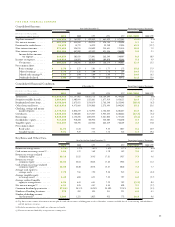

PERFORMANCE SUMMARY – TCF reported diluted earnings

per common share of $2.70 for 2001, compared with $2.35 for

2000 and $2.00 for 1999. Net income was $207.3 million for 2001,

up from $186.2 million for 2000 and $166 million for 1999. Return

on average assets was 1.79% in 2001, compared with 1.72% in 2000

and 1.61% in 1999. Return on average realized common equity was

23.18% in 2001, compared with 21.53% in 2000 and 19.83% in

1999. Diluted cash earnings per common share, which excludes amor-

tization of goodwill net of income tax benefits, was $2.80 for 2001,

compared with $2.44 for 2000 and $2.09 for 1999. On the same

basis, cash return on average assets was 1.86% for 2001, compared

with 1.79% for 2000 and 1.69% for 1999, and cash return on aver-

age realized common equity was 24.03% for 2001, compared with

22.40% for 2000 and 20.74% for 1999.

Financial Review