TCF Bank 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

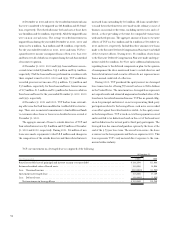

tax assets and liabilities of a change in tax rates is recognized in income

in the period that includes the enactment date.

The determination of current and deferred income taxes is based

on complex analyses of many factors including interpretation of

Federal and state income tax laws, the difference between tax and

financial reporting basis of assets and liabilities (temporary differ-

ences), estimates of amounts due or owed such as the timing of rever-

sals of temporary differences and current financial accounting

standards. Actual results could differ significantly from the estimates

and interpretations used in determining the current and deferred

income tax liabilities.

Other Significant Accounting Policies

INVESTMENTS – Investments are carried at cost, adjusted for

amortization of premiums or accretion of discounts using methods

which approximate a level yield.

SECURITIES AVAILABLE FOR SALE – Securities available for

sale are carried at fair value with the unrealized holding gains or losses,

net of related deferred income taxes, reported as accumulated other

comprehensive income (loss), which is a separate component of stock-

holders’ equity. Cost of securities sold is determined on a specific

identification basis and gains or losses on sales of securities available

for sale are recognized at trade dates. Declines in the value of secu-

rities available for sale that are considered other than temporary are

recorded in noninterest income as a loss on securities available for sale.

LOANS HELD FOR SALE – Loans held for sale include resi-

dential mortgage and education loans. Residential mortgage loans

held for sale are carried at the lower of cost or market as adjusted

for the effects of fair value hedges using quoted market prices. See

Note 18 for additional information concerning derivative instru-

ments and hedging activities. Education loans held for sale are car-

ried at the lower of cost or market. Net fees and costs associated

with originating and acquiring loans held for sale are deferred and

are included in the basis for determining the gain or loss on sales

of loans held for sale. Gains on sales are recorded at the settlement

date and cost is determined on a specific identification basis.

LOANS AND LEASES – Net fees and costs associated with origi-

nating and acquiring loans and leases are deferred and amortized

over the lives of the assets. Discounts and premiums on loans pur-

chased, net deferred fees and costs, unearned discounts and finance

charges, and unearned lease income are amortized using methods

which approximate a level yield over the estimated remaining lives of

the loans and leases.

Lease financings include direct financing and sales-type leases as

well as a leveraged lease. Leases that transfer substantially all of the

benefits and risks of equipment ownership to the lessee are classified

as direct financing or sales-type leases and are included in loans and

leases. Direct financing and sales-type leases are carried at the com-

bined present value of the future minimum lease payments and the

lease residual value. The lease residual value represents the estimated

fair value of the leased equipment at the termination of the lease.

Lease residual values are reviewed on an ongoing basis and any down-

ward revisions are recorded in the periods in which they become

known. Interest income on direct financing and sales-type leases is

recognized using methods which approximate a level yield over the

term of the leases. Sales-type leases generate dealer profit which is rec-

ognized at lease inception by recording lease revenue net of the lease

cost. Lease revenue consists of the present value of the future mini-

mum lease payments discounted at the rate implicit in the lease. Lease

cost consists of the leased equipment’s book value, less the present

value of its residual. The investment in a leveraged lease is the sum

of all lease payments (less nonrecourse debt payments) plus estimated

residual values, less unearned income. Income from the leveraged

lease is recognized using a method which approximates a level yield

over the term of the lease based on the unrecovered equity investment.

Loans and leases, including loans that are considered to be

impaired, are reviewed regularly by management and are placed on

non-accrual status when the collection of interest or principal is 90

days or more past due (150 days or more past due for loans secured

by residential real estate), unless the loan or lease is adequately secured

and in the process of collection. When a loan or lease is placed on

non-accrual status, unless collection of all principal and interest is

considered to be assured, uncollected interest accrued in prior years

is charged off against the allowance for loan and lease losses. Interest

accrued in the current year is reversed. For those non-accrual leases

that have been funded on a non-recourse basis by third-party finan-

cial institutions, the related debt is also placed on non-accrual sta-

tus. Interest payments received on non-accrual loans and leases are

generally applied to principal unless the remaining principal balance

has been determined to be fully collectible.