TCF Bank 2001 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

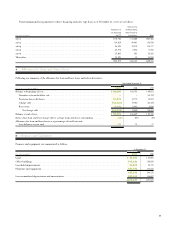

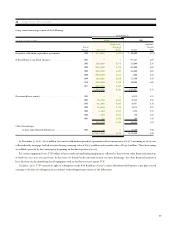

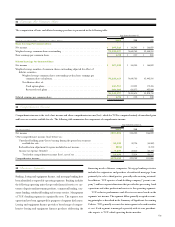

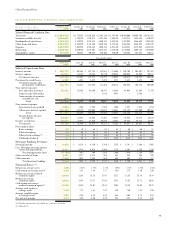

The following table sets forth the status of the Pension Plan and the Postretirement Plan at the dates indicated:

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

(In thousands) 2001 2000 2001 2000

Change in benefit obligation:

Benefit obligation at beginning of year . . . . . . . . . . . . . . . . . . . . . . $ 32,544 $ 30,728 $ 7,609 $ 9,721

Service cost - benefits earned during the year . . . . . . . . . . . . . . . . . 2,969 3,248 49 56

Interest cost on benefit obligation . . . . . . . . . . . . . . . . . . . . . . . . . 2,480 2,431 547 523

Amendments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . –––(2,481)

Actuarial (gain) loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 323 (1,942) 2,182 179

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,263) (1,921) (809) (389)

Benefit obligation at end of year . . . . . . . . . . . . . . . . . . . . . . . . 36,053 32,544 9,578 7,609

Change in fair value of plan assets:

Fair value of plan assets at beginning of year . . . . . . . . . . . . . . . . . . 87,064 74,867 ––

Actual return on plan assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (25,197) 14,118 ––

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,263) (1,921) (809) (389)

Employer contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ––809 389

Fair value of plan assets at end of year . . . . . . . . . . . . . . . . . . . . 59,604 87,064 ––

Funded status of plans:

Funded status at end of year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,551 54,520 (9,578) (7,609)

Unrecognized transition obligation . . . . . . . . . . . . . . . . . . . . . . . . ––2,304 2,513

Unrecognized prior service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,869) (2,926) ––

Unrecognized net (gain) loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,678 (32,808) 1,388 (797)

Prepaid (accrued) benefit cost at end of year . . . . . . . . . . . . . . . $ 23,360 $ 18,786 $(5,886) $(5,893)

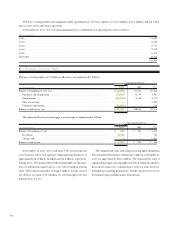

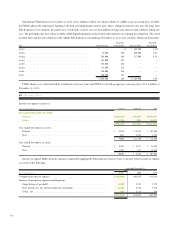

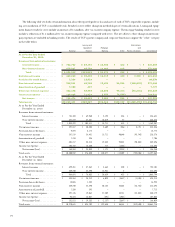

Net periodic benefit cost (credit) included the following components:

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

(In thousands) 2001 2000 1999 2001 2000 1999

Service cost . . . . . . . . . . . . . . . . . . . . . $ 2,969 $ 3,248 $ 3,297 $ 49 $ 56 $ 426

Interest cost. . . . . . . . . . . . . . . . . . . . . 2,480 2,431 2,059 547 523 630

Expected return on plan assets . . . . . . . (7,156) (6,207) (5,155) –––

Amortization of transition obligation . . . –––209 209 342

Amortization of prior service cost . . . . . (1,057) (1,057) (1,057) –– 109

Recognized actuarial gain . . . . . . . . . . . (1,810) (915) – (3) (22) (12)

Net periodic benefit cost (credit) . . . $(4,574) $(2,500) $ (856) $802 $766 $1,495