TCF Bank 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

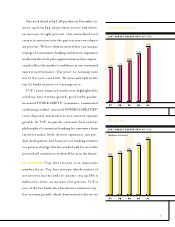

growing our core businesses, not just cutting expenses

as many of our competitors are doing. Growing busi-

nesses generate premium price-to-earnings ratios.

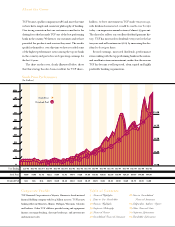

Growth in top-line revenue results from the increase

of Power Assets and Power Liabilities. Net interest

income growth is driven by a changed balance sheet.

Expanding the number of fee income producing

products and services while growing the overall cus-

tomer base fuels fee income growth. TCF added

117,900 new checking accounts in 2001, bringing

our total to over 1,249,000 accounts. We have a 78

percent debit card penetration rate, one of the highest

in the country, and we are now the 13th largest VISA®

debit card issuer in the United States with 1.2 million

debit cards outstanding.

TCF relies on attracting a large number of customers

from varied economic levels. Each of these customers

contributes incrementally to our profitability. We do

not believe in the old 80/20 rule, which suggests that

banks earn 80 percent of their profits from the wealth-

iest 20 percent of the customer base.

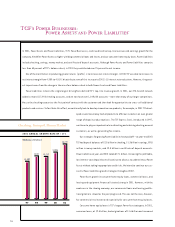

POWER ASSETS AND POWER LIABILITIES Despite a year of economic

uncertainty, economic slowdown and rate reductions,

TCF enjoyed substantial growth in our Power Assets,

up $638 million for the year, a 13 percent increase

from year-end 2000. Commercial real estate lending

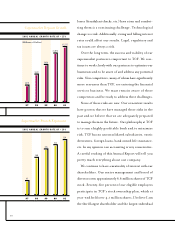

2001 ANNUAL GROWTH RATE OF +14%

(Millions of Dollars)

2001 ANNUAL GROWTH RATE OF +10%

(Millions of Dollars)

$184

$236

$274

$323

$367

97 98 99 00 01

$394

$426 $424 $439

$481

97 98 99 00 01

Fees and Other Revenues

Net Interest Income

4