TCF Bank 2001 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

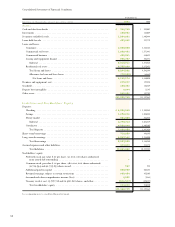

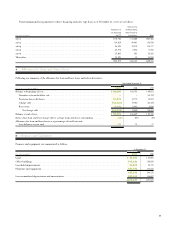

51

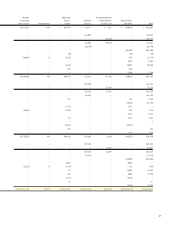

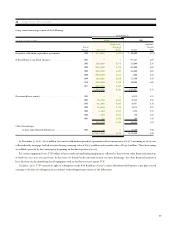

3Investments

The carrying values of investments, which approximate their fair values, consist of the following:

At December 31,

(In thousands) 2001 2000

Federal Home Loan Bank stock, at cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $131,181 $110,441

Federal Reserve Bank stock, at cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,847 23,286

Interest-bearing deposits with banks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 914 332

$155,942 $134,059

The carrying value, which approximates fair value, and yield of investments at December 31, 2001, by contractual maturity, are shown below:

Carrying

(Dollars in thousands) Value Yield

Due in one year or less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 914 2.64%

No stated maturity(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 155,028 4.17

$ 155,942 4.16

(1) Balance represents FRB and Federal Home Loan Bank (“FHLB”) stock, required regulatory investments.

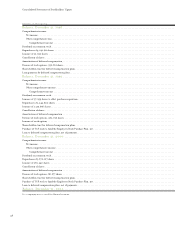

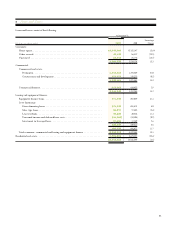

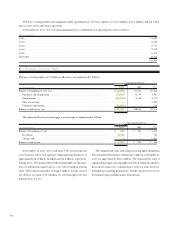

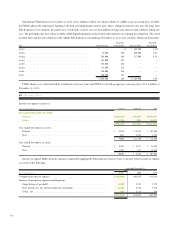

PREMISES AND EQUIPMENT – Premises and equipment are

carried at cost and are depreciated or amortized on a straight-line

basis over their estimated useful lives.

OTHER REAL ESTATE OWNED – Other real estate owned is

recorded at the lower of cost or fair value minus estimated costs to

sell at the date of transfer to other real estate owned. If the fair value

of an asset minus the estimated costs to sell should decline to less than

the carrying amount of the asset, the deficiency is recognized in the

period in which it becomes known and is included in other non-

interest expense.

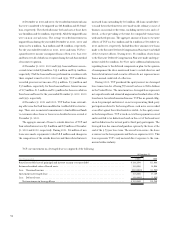

INTANGIBLE ASSETS – Goodwill resulting from acquisitions is

amortized over 20 to 25 years on a straight-line basis. Deposit base

intangibles are amortized over 10 years on an accelerated basis. The

Company reviews the recoverability of the carrying values of these

assets whenever an event occurs indicating that they may be impaired.

On January 1, 2002, TCF adopted Statement of Financial Accounting

Standards (“SFAS”) No. 142, “Goodwill and Other Intangible Assets,”

which requires that goodwill and intangible assets with indefinite lives

no longer be amortized, but instead tested for impairment annually.

DERIVATIVE FINANCIAL INSTRUMENTS – TCF utilizes

derivative financial instruments to meet the ongoing credit needs

of its customers and in order to manage the market exposure of its

residential loans held for sale and its commitments to extend credit

for residential loans. Derivative financial instruments include com-

mitments to extend credit and forward mortgage loan sales commit-

ments. TCF does not use interest rate contracts (e.g. swaps, caps,

floors) or other derivatives to manage interest rate risk and has none

of these instruments outstanding. See Notes 18 and 19 for additional

information concerning these derivative financial instruments.

2Cash and Due from Banks

At December 31, 2001, TCF was required by Federal Reserve Board

(“FRB”) regulations to maintain reserve balances of $39 million in

cash on hand or at various Federal Reserve Banks.