TCF Bank 2001 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

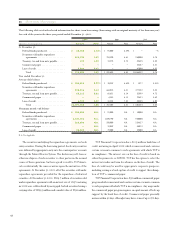

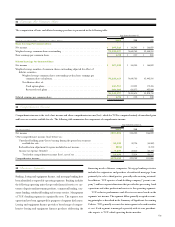

LOANS – The fair value of residential loans is estimated using quoted

market prices. For certain variable-rate loans that reprice frequently

and that have experienced no significant change in credit risk, fair

values are based on carrying values. The fair values of other loans are

estimated by discounting contractual cash flows adjusted for prepay-

ment estimates, using interest rates currently being offered for loans

with similar terms to borrowers with similar credit risk characteristics.

DEPOSITS – The fair value of checking, savings and money market

deposits is deemed equal to the amount payable on demand. The fair

value of certificates is estimated based on discounted cash flow analy-

ses using interest rates offered by TCF for certificates with similar

remaining maturities. The intangible value of long-term relationships

with depositors is not taken into account in the fair values disclosed

in the table below.

BORROWINGS – The carrying amounts of short-term borrowings

approximate their fair values. The fair values of TCF’s long-term

borrowings are estimated based on quoted market prices or discounted

cash flow analyses using interest rates for borrowings of similar

remaining maturities.

FINANCIAL INSTRUMENTS WITH OFF-BALANCE-SHEET

RISK – The fair values of TCF’s commitments to extend credit and

standby letters of credit are estimated using fees currently charged to

enter into similar agreements. For fixed-rate loan commitments and

standby letters of credit issued in conjunction with fixed-rate loan

agreements, fair value also considers the difference between current

levels of interest rates and the committed rates. The fair value of VA

loans serviced with partial recourse approximates the carrying value

recorded in other liabilities. The fair values of forward settlements

of FHLB advances are based on the difference between current lev-

els of interest rates and the committed rates.

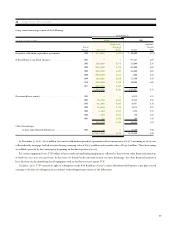

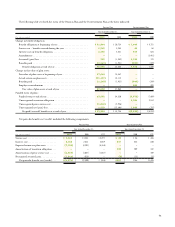

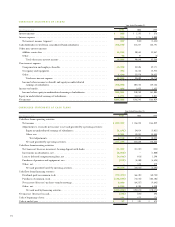

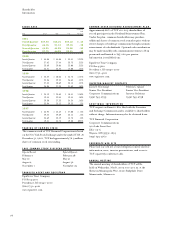

As discussed above, the carrying amounts of certain of the Company’s financial instruments approximate their fair value. The carrying

amounts and fair values of the Company’s remaining financial instruments are set forth in the following table:

At December 31,

2001 2000

2

Carrying Estimated Carrying Estimated

(In thousands) Amount Fair Value Amount Fair Value

Financial instrument assets:

Loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 451,609 $ 454,536 $ 227,779 $ 231,306

Forward mortgage loan sales commitments. . . . . . . . . . . . . . . . . 7,352 7,352 ––

Loans:

Consumer. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,509,333 2,548,617 2,234,134 2,408,672

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,622,461 1,644,263 1,371,841 1,381,222

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 422,381 417,896 410,422 410,003

Equipment finance loans . . . . . . . . . . . . . . . . . . . . . . . . . . 271,398 275,148 207,059 210,434

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,733,290 2,795,894 3,673,831 3,712,568

Allowance for loan losses(1) . . . . . . . . . . . . . . . . . . . . . . . . . (66,876) – (60,816) –

$ 7,943,596 $ 8,136,354 $ 8,064,250 $ 8,354,205

Financial instrument liabilities:

Checking, savings and money market deposits . . . . . . . . . . . . . . $ 4,778,714 $ 4,778,714 $ 4,086,219 $ 4,086,219

Certificates. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,320,244 2,357,872 2,805,605 2,836,340

Short-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 719,859 719,859 898,695 898,695

Long-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,303,166 2,410,329 2,285,550 2,309,323

$10,121,983 $10,266,774 $10,076,069 $10,130,577

Financial instruments with off-balance-sheet risk:(2)

Commitments to extend credit(3) . . . . . . . . . . . . . . . . . . . . . . . $ 13,767 $ 13,767 $ 12,045 $ 12,045

Standby letters of credit(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,409 2,409 (2) (2)

Federal Home Loan Bank advance forward settlements. . . . . . . . –– – (6,985)

$ 16,176 $ 16,176 $ 12,043 $ 5,058

(1) Excludes the allowance for lease losses.

(2)Positive amounts represent assets, negative amounts represent liabilities.

(3)Carrying amounts are included in other assets.

(4)Carrying amounts are included in accrued expenses and other liabilities.