TCF Bank 2001 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

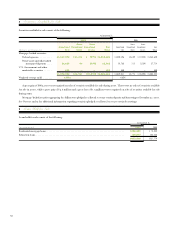

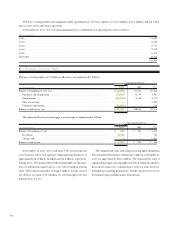

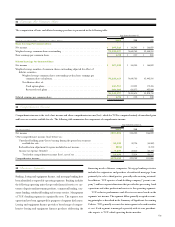

14 Stockholders’ Equity

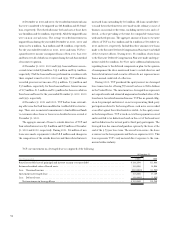

RESTRICTED RETAINED EARNINGS – Retained earnings at

December 31, 2001 includes approximately $134.4 million for which

no provision for federal income tax has been made. This amount

represents earnings appropriated to bad debt reserves and deducted

for federal income tax purposes and is generally not available for pay-

ment of cash dividends or other distributions to shareholders.

Payments or distributions of these appropriated earnings could invoke

a tax liability for TCF based on the amount of earnings removed and

current tax rates.

In general, TCF’s subsidiary banks may not declare or pay a div-

idend to TCF in excess of 100% of their net profits for that year com-

bined with their retained net profits for the preceding two calendar

years without prior approval of the Office of the Comptroller of the

Currency (“OCC”). Additional limitations on dividends declared

or paid on, or repurchases of, TCF’s subsidiary banks’ capital stock

are tied to the national banks’ regulatory capital levels.

SHAREHOLDER RIGHTS PLAN – TCF’s preferred share pur-

chase rights will become exercisable only if a person or group acquires

or announces an offer to acquire 15% or more of TCF’s common

stock. When exercisable, each right will entitle the holder to buy one

one-hundredth of a share of a new series of junior participating pre-

ferred stock at a price of $100. In addition, upon the occurrence of

certain events, holders of the rights will be entitled to purchase either

TCF’s common stock or shares in an “acquiring entity” at half of the

market value. TCF’s Board of Directors (the “Board”) is generally

entitled to redeem the rights at one cent per right at any time before

they become exercisable. The rights will expire on June 9, 2009, if

not previously redeemed or exercised.

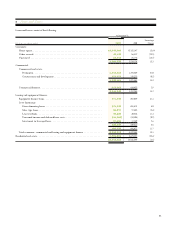

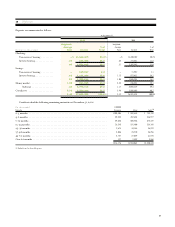

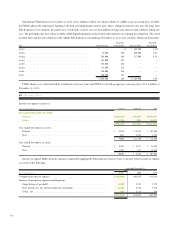

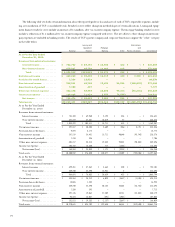

The significant components of the Company’s deferred tax assets and deferred tax liabilities are as follows:

At December 31,

(In thousands) 2001 2000

Deferred tax assets:

Securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ – $ 5,755

Allowance for loan and lease losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,829 20,471

Pension and other compensation plans. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,034 15,710

Total deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38,863 41,936

Deferred tax liabilities:

Securities available for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,580 –

Lease financing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53,158 50,653

Loan fees and discounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,596 12,570

Mortgage servicing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,912 2,884

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 399 4,240

Total deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,645 70,347

Net deferred tax assets (liabilities) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(41,782) $(28,411)

61

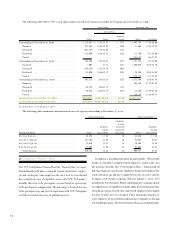

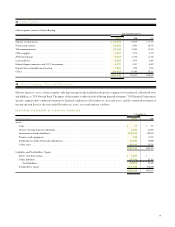

TREASURY STOCK AND OTHER – Treasury stock and other consists of the following:

At December 31,

(In thousands) 2001 2000

Treasury stock, at cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(463,394) $(325,026)

Shares held in trust for deferred compensation plans, at cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (71,652) (61,908)

Unamortized deferred compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (31,688) (33,056)

Loans to deferred compensation plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,783) (5,137)

$(576,517) $(425,127)