TCF Bank 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

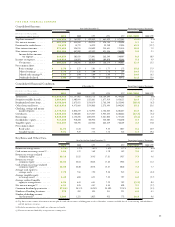

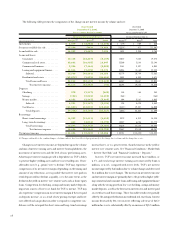

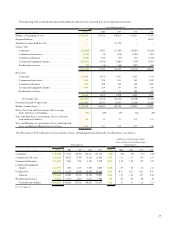

due to volume changes. Interest expense decreased $42.8 million in

2001, reflecting a decrease of $53.4 million due to lower cost of funds,

partially offset by a $10.6 million increase due to volume changes. The

increase in net interest income due to volume changes reflects the

increase in total average interest-earning assets and an increase in the

balance of non-interest bearing deposits. The decrease in net interest

income due to rate changes reflects the impact of declining rates on

interest earning assets greater than the impact of declining rates on

interest bearing liabilities.

In 2000, TCF’s net interest income increased $14.3 million, or

3.4%, and total average interest-earning assets increased by $578.7 mil-

lion, or 6.1%, compared with 1999 levels. TCF’s net interest income

improved by $32.8 million due to volume changes and decreased

$18.4 million due to rate changes. The favorable impact of the growth

in consumer lending volumes and rates, leasing and equipment

finance volumes, and commercial real estate volumes and rates was

partially offset by decreased consumer finance automobile and secu-

rities available for sale volumes and increased borrowings volumes.

Interest income increased $74.6 million in 2000, reflecting increases

of $55.2 million due to volume and $19.4 million due to rate changes.

Interest expense increased $60.3 million in 2000, reflecting increases

of $37.8 million due to a higher cost of funds and $22.4 million due

to volume. The increase in net interest income due to volume changes

reflects the increase in total average interest-earning assets and an

increase in the balance of non-interest bearing deposits. The decrease

in net interest income due to rate changes reflects a higher cost of funds.

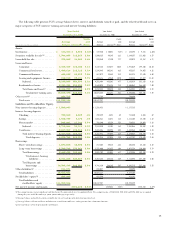

In 1999, TCF’s net interest income decreased $1.5 million, or

.4%, and total average interest-earning assets increased by $692 mil-

lion, or 7.9%, compared with 1998 levels. TCF’s net interest income

improved by $15.5 million due to volume changes. The increase in

net interest income due to volume reflects the increase in total aver-

age interest-earning assets. Net interest income decreased $17 mil-

lion due to rate changes in 1999, reflecting loan prepayments and

the discontinuation of TCF’s higher-yielding consumer finance busi-

ness. TCF’s 1999 net interest income and net interest margin were

negatively impacted, as compared with 1998, by $17.4 million or 11

basis points due to the discontinuation and sale of TCF’s higher-

yielding consumer finance automobile business. The unfavorable

impact of the discontinuation of TCF’s consumer finance automo-

bile business, decreased yields on loans and leases resulting, in part,

from the implementation of new tiered pricing for home equity loans

in early 1999, and increased borrowing volumes was partially offset

by increased securities available for sale and loan and lease volumes,

decreased rates paid on interest-bearing liabilities and decreased cer-

tificate of deposit volumes. Interest income increased $3.2 million

in 1999, reflecting an increase of $45.9 million due to volume, par-

tially offset by a decrease of $42.7 million due to rate changes. Interest

expense increased $4.7 million in 1999, reflecting an increase of

$30.4 million due to volume, partially offset by a decrease of $25.7

million due to a lower cost of funds.

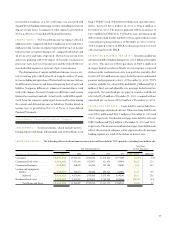

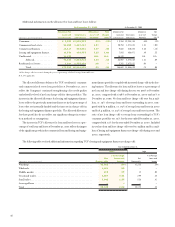

PROVISION FOR CREDIT LOSSES – TCF provided $20.9

million for credit losses in 2001, compared with $14.8 million in

2000 and $16.9 million in 1999. Net loan and lease charge-offs were

$12.5 million, or .15% of average loans and leases, in 2001, com-

pared with $3.9 million, or .05%, in 2000 and $26.4 million, or

.35% of average loans and leases in 1999. The increase in provisions

and net loan and lease charge-offs from 2000 reflects the impact of

the growth in commercial loan and leasing and equipment finance

portfolios coupled with increased charge-offs in the leasing and equip-

ment finance portfolio. Leasing and equipment finance net charge-

offs were $9.1 million, or 1% of related average loans and leases dur-

ing 2001, compared with $2.2 million, or .33% in 2000 and $1.6

million, or .39% of related average loans and leases in 1999. The pro-

vision for credit losses is calculated as part of the determination of the

allowance for loan and lease losses. The determination of the allowance

for loan and lease losses and the related provision for credit losses is

a critical accounting policy which involves a number of factors such as

net charge-offs, delinquencies in the loan and lease portfolio, gen-

eral economic conditions and management’s assessment of credit risk

in the current loan and lease portfolio. The allowance for loan and

lease losses totaled $75 million at December 31, 2001, compared with

$66.7 million at December 31, 2000, and was 144% of non-accrual

loans and leases. See “Financial Condition – Allowance for Loan and

Lease Losses.”

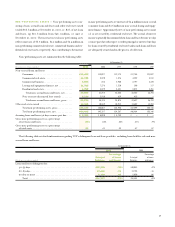

NON-INTEREST INCOME – Non-interest income is a signifi-

cant source of revenues for TCF, representing 43.6% of total rev-

enues in 2001, and is an important factor in TCF’s results of

operations. Providing a wide range of retail banking services is an

integral component of TCF’s business philosophy and a major strat-

egy for generating additional non-interest income. Excluding gains

on sales of securities available for sale, loan servicing, branches, sub-

sidiaries and title insurance revenues, non-interest income increased

$43.8 million, or 13.6%, during 2001 to $367.3 million. The

increase was primarily due to increased fees and service charges and

electronic funds transfer and leasing revenues, reflecting TCF’s

expanded retail banking and leasing operations and customer base.

The increases in fees and service charges and electronic funds trans-

fer revenues primarily reflect the increase in the number of retail

checking accounts, which totaled 1,249,000 accounts at December

31, 2001, up from 1,131,000 at December 31, 2000. The average

annual fee revenue per retail checking account was $209 for 2001,

compared with $190 for 2000.