Samsung 2000 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2000 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

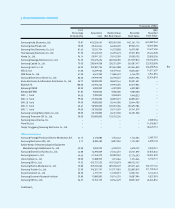

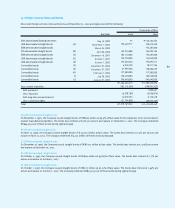

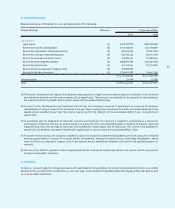

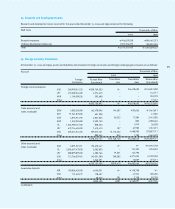

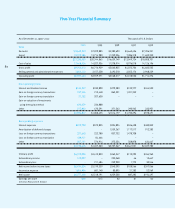

Components of deferred taxes as of December 31, 2000 are as follows:

The Company periodically assesses its ability to recover deferred tax assets. In the event of significant uncertainty regarding the Company’s

ultimate ability to recover such assets, a valuation allowance is recorded to reduce the asset to its estimated net realizable value.

The Company has not recognized the income tax effect of a temporary difference of 415,090 million resulting from the revaluation of land

it has no immediate plans to dispose of. In addition, a change in accounting policy in the current year (see Note 2) resulted in a cumulative

increase in deferred income tax of 3,009 million that was adjusted to opening retained earnings.

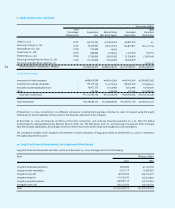

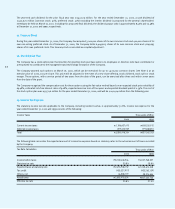

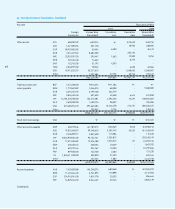

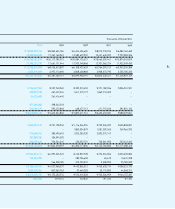

20. Earnings Per Share

Earnings per share and diluted earnings per share are calculated as follows:

73

Deferred Tax Asset Calculation

Deferred tax assets:

Loss on valuation of investments using the equity method

Deferred foreign exchange losses

Investment stock reduction losses

Depreciation

Other

Tax credits

Total deferred tax assets

Deferred tax liabilities:

Special reserves appropriated for tax purposes

Capitalized interest expense

Accrued income

Gain on valuation of investments using the equity method

Other

Total deferred tax liabilities

Net deferred tax assets

Beginning

Balance

320,422,447

236,486,776

85,782,593

311,472,320

89,287,880

240,187,881

1,283,639,897

160,301,578

34,669,575

4,031,119

–

4,110,702

203,112,974

1,080,526,923

Increase

(Decrease)

(320,422,447)

(104,366,080)

(80,546,470)

(165,310,076)

17,817,975

(240,187,881)

(893,014,979)

(49,322,141)

20,141,152

4,948,678

35,918,457

(2,380,699)

9,305,447

(902,320,426)

Ending

Balance

–

132,120,696

5,236,123

146,162,244

107,105,855

–

390,624,918

110,979,437

54,810,727

8,979,797

35,918,457

1,730,003

212,418,421

178,206,497

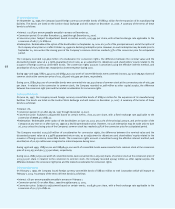

EPS Calculation

Net income

Adjustments:

Dividends for preferred stock

Undeclared participating preferred stock dividend

Net income available for common stock

Weighted average number of shares of common stock

Earnings per share in Korean Won

6,014,530,192

(69,202,389)

(738,754,987)

5,206,572,816

148,735,383

35,006

Thousands of Won

Thousands of Won