Samsung 2000 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2000 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The preparation of financial statements requires management to

make estimates and assumptions that affect amounts reported

therein. Due to the inherent uncertainty involved in making

estimates, actual results reported in future periods may differ from

those estimates.

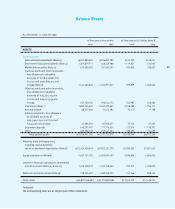

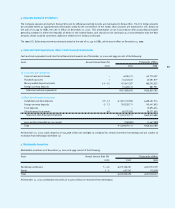

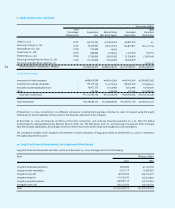

Cash, Cash Equivalents and Short-Term Financial Instruments

Cash and cash equivalents include cash on hand and in bank

accounts with original maturities of three months or less.

Investments which are readily convertible into cash within four to

twelve months of purchase are classified on the balance sheet as

short-term financial instruments. The cost of these investments

approximates fair value.

Marketable Securities

Marketable securities are stated at fair value.

Allowance for Doubtful Accounts

The Company provides an allowance for doubtful accounts and

notes receivable based on the aggregate estimated collectibility of

the receivables.

Inventory Valuation

Inventories are stated at the lower of cost or market. Cost is

determined by the average cost method, except for materials in

transit which are stated at actual cost as determined by the specific

identification method.

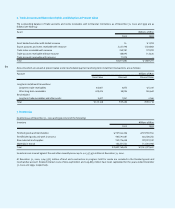

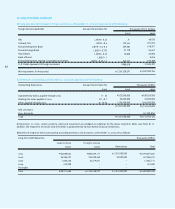

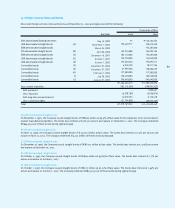

Property, Plant and Equipment and Related Depreciation

Property, plant and equipment are stated at cost, except for certain

assets subject to upward revaluation in accordance with the Asset

Revaluation Law of Korea. The revaluation presents production

facilities and other buildings at their depreciated replacement cost,

and land at the prevailing market price, as of the effective date of

revaluation. The revaluation increment, net of revaluation tax, is

first applied to offset accumulated deficit and deferred foreign

exchange losses, if any. The remainder may be credited to other

capital surplus or transferred to common stock. A new basis for

calculating depreciation is established for revalued assets (see

Note 8).

Depreciation is computed using the straight-line method, based on

the estimated useful lives of the assets as described below.

The Company capitalizes interest expense incurred on borrowings

used to finance the cost of constructing facilities and equipment

(see Note 8).

Maintenance and Repairs

Routine maintenance and repairs are charged to expense as

incurred. Expenditures which enhance the value or extend the

useful life of the related assets are capitalized.

Research and Development Costs

Research and development costs are charged to expense as

incurred.

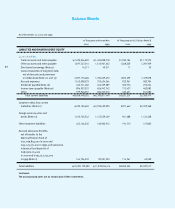

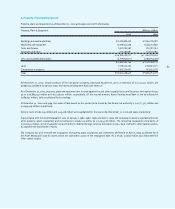

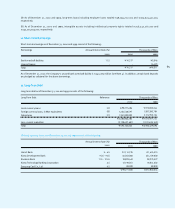

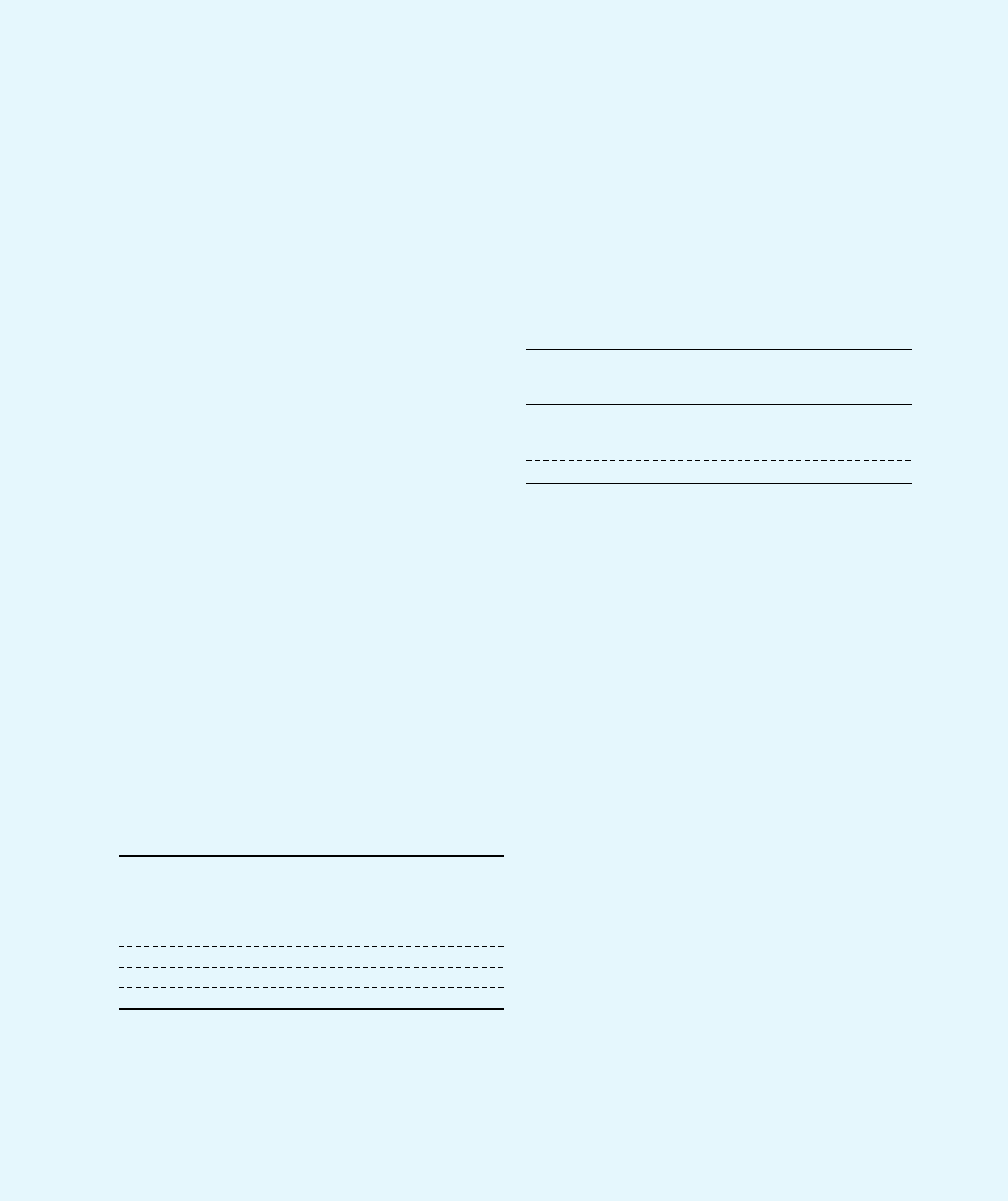

Intangible Assets

Intangible assets are state at cost, net of depreciation calculated

using the straight-line method based on the estimated useful lives

as follows:

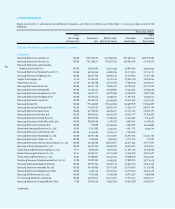

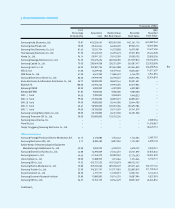

Equity Investments in Subsidiaries and

Affiliated Companies & Other Investments

All investments in equity and debt securities are initially carried at

cost, including incidental expenses. The subsequent accounting for

investments by the type of security is as follows.

Investments in marketable equity securities of non-controlled

investees, classified as other investments, are carried at fair value.

Temporary changes in fair value are accounted for in the capital

adjustment account, a component of shareholders’ equity. Declines

in fair value which are anticipated to be permanent are recorded in

current operations after eliminating any previously recorded capital

adjustment for temporary changes. Subsequent recoveries or other

future changes in fair value are recorded in the capital adjustment

account.

Investments in non-marketable equity securities of non-controlled

investees, classified as other investments, are carried at cost,

except for declines in the Company’s proportionate ownership of

the underlying book value of the invested company which are

anticipated to be permanent. The declines are recorded in current

operations, and subsequent recoveries are also recorded in current

operations up to the original cost of the investment.

Investments in equity securities of companies over which the

Company has the ability to control or exercise significant influence

on, classified as equity investments in subsidiaries and affiliated

companies, are recorded using the equity method of accounting.

Differences between the purchase price and the Company’s

proportionate ownership of the net book value of the invested

company are amortized over 5 years using the straight-line method.

Under the equity method, the Company records changes in its

proportionate ownership of the book value of the invested

57

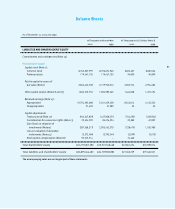

Asset

Goodwill

Intellectual proprietary rights

Other intangibles

Estimated Useful

Life in Years

5

5 - 10

2 - 25

Asset

Buildings and auxiliary facilities

Machinery and equipment

Tools and fixtures

Structures and others

Estimated Useful

Life in Years

7 - 60

2 - 10

2 - 10

2 - 40