Samsung 2000 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2000 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

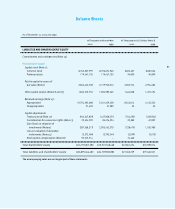

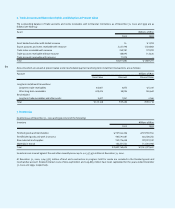

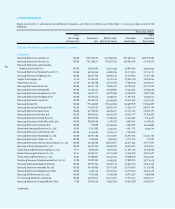

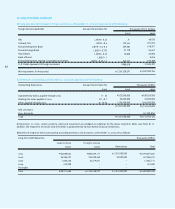

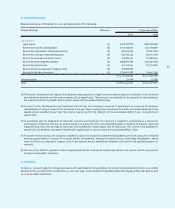

8. Property, Plant and Equipment

Property, plant and equipment as of December 31, 2000 and 1999 consist of the following:

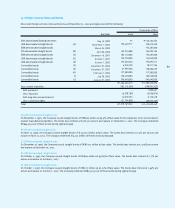

At December 31, 2000, certain portions of the Company’s property, plant and equipment, up to a maximum of 1,133,413 million, are

pledged as collateral for various loans from Korea Development Bank (see Note 12).

As of December 31, 2000, property, plant and equipment are insured against fire and other casualty losses and business interruption losses

up to 26,869,541 million and 6,336,077 million, respectively. Of the insured amount, Korea Development Bank is the beneficiary for

789,621 million, held as collateral for borrowings.

At December 31, 2000 and 1999, the value of land based on the posted price issued by the Korean tax authority is 1,277,325 million and

1,099,429 million, respectively.

Interest costs of 82,245 million and 45,418 million were capitalized for the year ended December 31, 2000 and 1999, respectively.

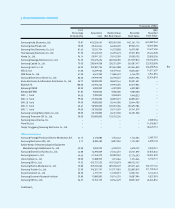

In accordance with the Asset Revaluation Law, on January 1, 1980, 1982, 1998, and April 1, 1999, the Company revalued a substantial portion

of its property, plant, equipment and investments in equity securities by 3,054,518 million. The remaining revaluation increments of

1,216,054 million, net of revaluation tax and credits to deferred foreign currency translation losses, were credited to other capital surplus,

a component of shareholders’ equity.

The Company has also reversed the revaluation of property, plant, equipment and investment performed on April 1, 1999 as allowed for in

the Asset Revaluation Law for assets which are sold within a year of the revaluation date. As a result, 2,819 million was deducted from

other capital surplus.

61

Property, Plant & Equipment Millions of Won

2000 1999

Buildings and auxiliary facilities 2,420,800,450 2,046,105,987

Machinery and equipment 12,498,044,648 8,406,254,860

Tools and fixtures 1,047,094,582 924,901,314

Structures and other 219,483,897 173,440,082

16,185,423,577 11,550,702,243

Less: accumulated depreciation (6,799,853,811) (4,380,933,468)

9,385,569,766 7,169,768,775

Land 1,778,542,402 1,708,831,071

Construction in progress 1,160,316,481 943,651,433

Total 12,324,428,649 9,822,251,279