Samsung 2000 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2000 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

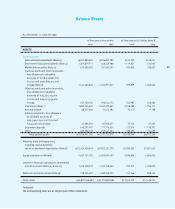

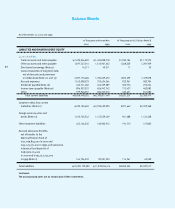

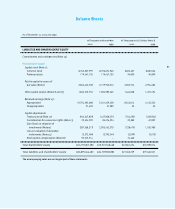

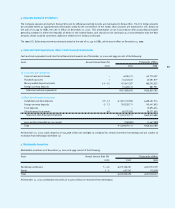

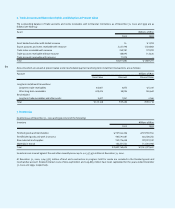

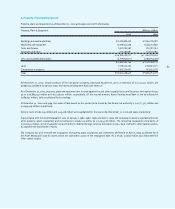

December 31, 2000 and 1999

1. The Company

Samsung Electronics Co., Ltd. (the “Company”) is incorporated

under the laws of the Republic of Korea to manufacture and sell

electronic goods, communication facilities, semiconductors,

telecommunication products and other similar products.

The Company’s stock is publicly traded and all issued and

outstanding shares are listed on the Korea Stock Exchange.

Under its Articles of Incorporation, the Company is authorized to

issue 500,000,000 shares of capital stock (par value 5,000), of

which 100,000,000 shares are cumulative, participating preferred

stock, which are non-voting and entitled to a minimum cash

dividend (9% of par value). The non-cumulative, non-voting

preferred stock issued on or before February 28, 1997 is entitled to

an additional cash dividend (1% of par value) over common stock.

As of December 31, 2000, 152,441,599 shares of common stock and

23,893,427 shares of such preferred stock were issued and

outstanding.

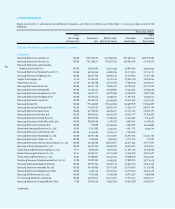

As of December 31, 2000, major shareholders of the Company’s

stock, including preferred stock, and their respective shareholdings

are as follows:

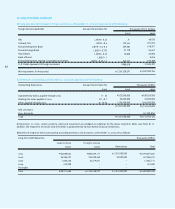

In addition, the Company is authorized to issue convertible

debentures with face values of up to 4,000 billion (3,000 billion

for common stock and 1,000 billion for preferred stock) and

debentures with stock purchase options with face values of up to

2,000 billion (1,500 billion for common stock and 500 billion

for preferred stock). The Company is authorized to issue depository

receipts with the approval of the Board of Directors. Also, the

Company is authorized to issue capital stock through the exercise

of stock options or general public subscription and to domestic and

foreign financial institutions for urgent fund raising or to co-

operating companies for technical assistance with the approval of

the Board of Directors.

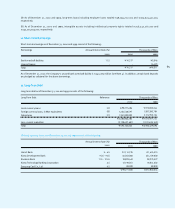

The Company has a stock option plan under which options to

purchase shares of common stock may be granted to key

employees with the approval of shareholders. On March 16, 2000,

stock options were granted to 76 employees and directors (see

Note 18).

The Company issued 1,226,607 shares of common stock upon the

conversion of foreign currency convertible bonds in the amount of

US$146,930,000 during the year ended December 31, 2000 (see

Note 13). The cash proceeds in excess of par value of 123,500

million were credited to paid-in capital in excess of par value.

As of December 31, 2000, 546,427,650,000 (face value of

US$477,080,000) of convertible bonds are outstanding (see Note

13). No debentures with stock purchase options have been issued

as of December 31, 2000.

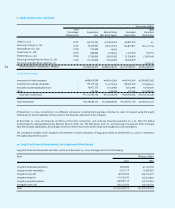

2. Summary of Significant Accounting Policies

The significant accounting policies followed by the Company in the

preparation of its financial statements in accordance with the

Financial Accounting Standards of the Republic of Korea are

summarized below.

Basis of Financial Statement Presentation

The official accounting records of the Company, on which the

Korean language financial statements are based, are maintained in

Korean Won in accordance with the laws and regulations of the

Republic of Korea.

The accompanying financial statements have been extracted from

the Company’s Korean language financial statements that were

prepared using accounting principles, procedures and reporting

practices generally accepted in the Republic of Korea. These

standards vary from International Accounting Standards and the

accounting principles generally accepted in the country of the

reader. The financial statements have been translated from Korean

into English, and have been formatted in a manner different from

the presentation under Korean financial statement practices.

Certain supplementary information included in the Korean

language statutory financial statements, but not required for a fair

presentation of the Company’s financial position or results of

operations, is not presented in the accompanying financial

statements. Accordingly, the accompanying financial statements

are not intended to present the financial position, results of

operations and cash flows in accordance with accounting principles

and practices generally accepted in countries and jurisdictions

other than Korea.

56

Notes to Financial Statements

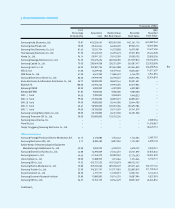

Shareholder

Citibank N.A.

Samsung Life Insurance Co., Ltd.

Samsung Corporation

Lee, Kun-Hee and relatives

Seoul Bank

CMB-Europac Growth Fund

The Government of Singapore

CMB-CAP RE Emerg. Growth Fund

Korea Exchange Bank

CMB-ADIA

Number of

Shares

23,958,134

10,624,693

5,917,362

5,322,559

3,950,559

2,682,771

2,462,839

2,207,122

1,949,946

1,919,098

Percentage of

Ownership (%)

13.59

6.03

3.36

3.02

2.24

1.52

1.40

1.25

1.11

1.09