Samsung 2000 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2000 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

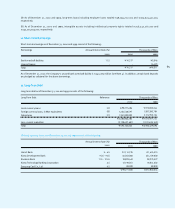

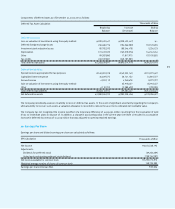

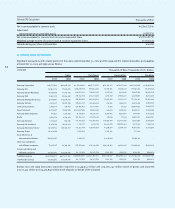

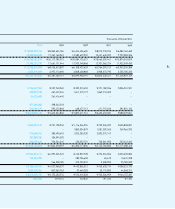

The year-end cash dividend for the prior fiscal year was 342,729 million. For the year ended December 31, 2000, a cash dividend of

422,670 million (common stock: 50%, preferred stock: 51%) excluding the interim dividend is proposed for the general shareholders’

meeting to be held on March 16, 2001. Including this proposed final dividend, the dividend payout ratio is approximately 8.46% and 13.48%

at December 31, 2000 and 1999, respectively.

17. Treasury Stock

During the year ended December 31, 2000, the Company has acquired 3,000,000 shares of its own common stock and 400,000 shares of its

own non-voting preferred stock. As of December 31, 2000, the Company holds 6,449,625 shares of its own common stock and 1,269,693

shares of its own preferred stock. This treasury stock is recorded as a capital adjustment .

18. Stock Option Plan

The Company has a stock option plan that provides for granting stock purchase options to employees or directors who have contributed or

are expected to contribute to the management and technology innovation of the Company.

The Company granted such options on March 16, 2000, which can be exercised for up to 1,500,000 common shares (see Note 1) at an

exercise price of 272,700 per share. This price will be adjusted in the event of a new share offering, stock dividend, stock split or stock

merger. These options, with a service period of two years from the date of the grant, can be exercised after three and within seven years

from the date of the grant.

The Company recognized the compensation cost for these options using the fair value method based on an expected stock price volatility of

69.48%, estimated risk-free interest rates of 9.08%, expected exercise term of four years and expected dividend yield of 0.39%. The cost of

the stock option plan was 93,746 million for the year ended December 31, 2000, and will be 141,424 million from the following year.

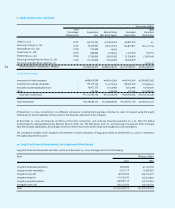

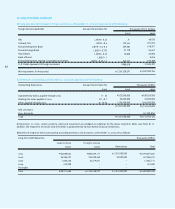

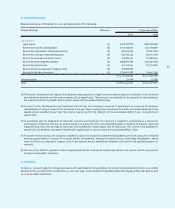

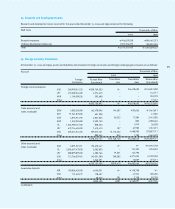

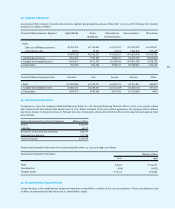

19. Income Tax Expense

The statutory income tax rate applicable to the Company, including resident surtax, is approximately 30.8%. Income tax expense for the

year ended December 31, 2000 and 1999 consists of the following:

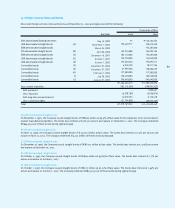

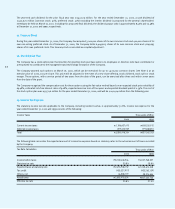

The following table reconciles the expected amount of income tax expense based on statutory rates to the actual amount of taxes recorded

by the Company:

72

Income Taxes

Current income taxes

Deferred income taxes

Total

1,186,607,415

899,310,939

2,085,918,354

658,526,912

199,038,851

857,565,763

Thousands of Won

2000 1999

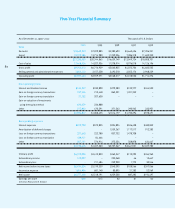

Tax Rate Calculation

Income before taxes

Statutory tax rate

Expected taxes at statutory rate

Tax credit

Others, net

Actual taxes

Effective tax rate

8,100,448,546

30.8%

2,494,938,152

(455,027,917)

46,008,119

2,085,918,354

25.8%

4,027,968,337

30.8%

1,240,614,248

(403,263,139)

20,214,654

857,565,763

21.3%

Thousands of Won

2000 1999