Samsung 2000 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2000 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

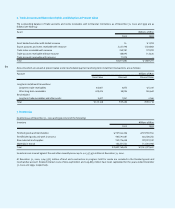

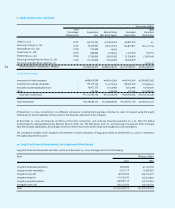

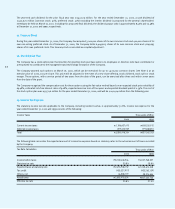

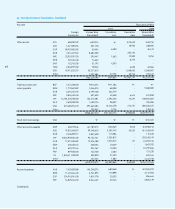

•In addition, at December 31, 2000, the Company has entered into lease agreements that were recognized as operating leases. Related

rental payments were charged to operations as incurred. Rental expense incurred under these operating lease agreements amounts to

407 million for the year ended December 31, 2000, and future rental payments of US$108,000 are due within a year.

• As of December 31, 2000, the Company has entered into seven forward exchange contracts with various foreign and Korean financial

institutions to hedge currency risk on foreign currency long-term debts. In addition, the Company has entered into three interest rate swap

contracts with various foreign and Korean financial institutions to hedge interest rate risk on floating-rate foreign currency long-term

debts.

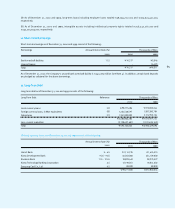

•For the year ended December 31, 2000, the Company recognized gains of 9,069 million and losses of 8,971 million, charged to current

operations, from the valuation of forward exchange contracts. In addition, from the valuation of interest rate swap contracts, the Company

recognized losses of 83 million, charged to current operations, and deferred 3,272 million, charged to capital adjustment, of which

127 million is expected to be realized by December 31, 2001.

• As of December 31, 2000, the Company has entered into an agreement to issue asset backed securities based on export accounts and

notes receivable with Atlantic Asset Securitization Corporation for up to US$100 million, an agreement to discount trade notes receivable

with three Korean banks for up to 300,000 million and a credit sales facility agreement with Hanvit Bank for up to 200,000 million (see

Note 6).

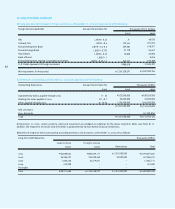

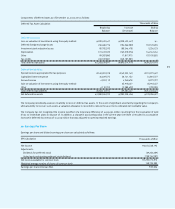

• At December 31, 2000 the Company has been named as a defendant in three legal actions for alleged patent infringements and one legal

action for breach of contract, and as the plaintiff for two legal actions for patent infringements and two for unpaid debts in a foreign

country. In addition, the Company is a party to various other legal claims and proceedings in Korea, all of which are pending as of

December 31, 2000. The Company’s management believes that, although the outcome of these matters is uncertain, the resolution of

these matters will not have a material adverse effect on the operations or financial position of the Company.

• At December 31, 2000, six promissory notes totaling 14,175 million, and 15 blank notes and checks were provided to financial

institutions as collateral for bank borrowings and for the fulfillment of certain contracts.

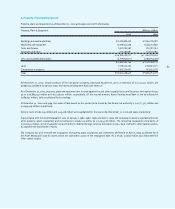

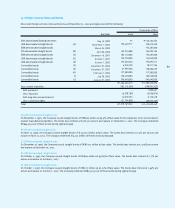

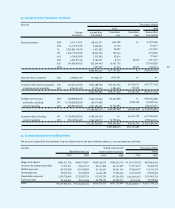

• In June 1999, Samsung Motors Inc. (“SMI”), an affiliate of the Company, filed a petition for court receivership. In connection with this

petition, the Company and 30 Samsung Group affiliates (the “Affiliates”) entered into an agreement with the institutional creditors (“the

Creditors”) of SMI in August, 1999. In accordance with this agreement, the Company and the Affiliates agreed to sell 3,500,000 shares of

Samsung Life Insurance Co., Ltd. stock and transfer the proceeds to the Creditors in connection with the petition for court receivership of

SMI by December 31, 2000. In the event that the sale proceeds fall short of 2,450,000 million, the Company and the Affiliates have

agreed to compensate the Creditors for the shortfall by other means, including participation in any equity offering or subordinated

debentures issued by the Creditors. Any proceeds in excess of 2,450,000 million are to be distributed to the Company and the Affiliates.

•As of December 31, 2000, the shares in Samsung Life Insurance Co., Ltd. were not sold and certain shareholders of the Company have

filed an injunction against the directors of the Company, alleging that the directors were acting in contravention to the law when entering

into this agreement and accordingly, that this agreement is void. The ultimate effect of these matters on the financial position of the

Company as of the balance sheet date cannot reasonably be determined, and accordingly, no adjustments have been made in the

accompanying financial statements in relation to these matters.

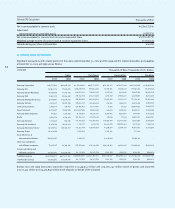

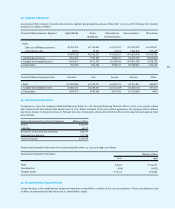

• Beginning in 1997, Korea and other countries in the Asia Pacific region experienced a severe contraction in substantially all aspects of

their economies. This situation is commonly referred to as the 1997 Asian financial crisis. In response to this situation, the Korean

government and the private sector began implementing structural reforms to historical business practices.

•The Korean economy is currently experiencing additional difficulties, particularly in the areas of restructuring private enterprises and

reforming the banking industry. The Korean government continues to apply pressure to Korean companies to restructure into more

efficient and profitable firms. The banking industry is currently undergoing consolidations and significant uncertainty exists with regard to

the availability of short-term financing during the coming year. The Company may be either directly or indirectly affected by the situation

described above.

•The accompanying financial statements reflect management’s current assessment of the impact to date of the economic situation on the

financial position of the Company. Actual results may differ materially from management’s current assessment.

70