Redbox 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COINSTAR, INC.

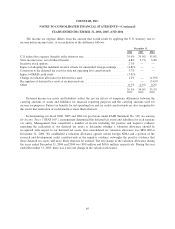

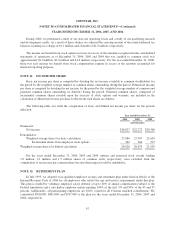

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

cause a delay in manufacturing and a possible slow-down of growth, which could have a materially adverse

affect on future operating results.

NOTE 16: RELATED PARTY TRANSACTIONS

Randall J. Fagundo, President of our entertainment services subsidiary, is a member of a limited liability

company which has agreed to lease to Coinstar a 31,000 square foot building located in Louisville, Colorado.

The terms of the agreement provide for a ten year lease term, commencing March 1, 2003, at monthly rental

payments ranging from $25,353 for the first year to $33,076 for the tenth year, together with additional payments

in respect of the tenant’s proportionate share of the maintenance and insurance costs and property tax

assessments for the leased premises. We believe that the terms of this lease are comparable to those that would be

entered into between unrelated parties on an arms’ length basis.

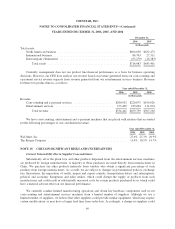

Levine Investments Limited Partnership (“Levine Investments”), a shareholder of Coinstar, agreed to lease

to Coinstar three buildings located in Arlington Heights, Illinois, Van Nuys, California and Chandler, Arizona.

The terms of these agreements, commencing November 1, 2005, provide for monthly rental payments ranging

from $16,250 to $22,000, together with additional payments in respect of the tenant’s proportionate share of the

maintenance and insurance costs and property tax assessments for the leased premises. As of December 31, 2006,

two of the three leases, Chandler and Arlington Heights, were terminated. We believe that the terms of these

leases are comparable to those that would be entered into between unrelated parties on an arms’ length basis.

Approximately $448,000 and $1.8 million of our accounts receivable balance is due from a related party of

our e-payment subsidiary, as of December 31, 2006 and 2005, respectively. This receivable arose in the ordinary

course of business and relates to the purchase of prepaid air time.

70