Redbox 2006 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

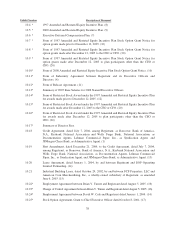

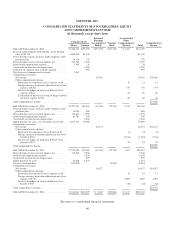

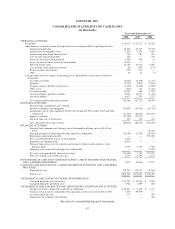

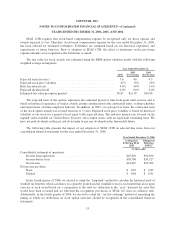

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended December 31,

2006 2005 2004

OPERATING ACTIVITIES:

Net income ...................................................................... $ 18,627 $ 22,272 $ 20,368

Adjustments to reconcile income from operations to net cash provided by operating activities:

Depreciation and other ......................................................... 52,836 45,347 35,302

Amortization of intangible assets ................................................ 6,220 4,556 2,014

Amortization of deferred financing fees ........................................... 760 785 456

Loss on early retirement of debt ................................................. 238 — 706

Non-cash stock-based compensation .............................................. 6,258 340 38

Excess tax benefit from exercise of stock options .................................... (1,033) — —

Deferred income taxes ......................................................... 10,183 14,315 8,597

Loss (income) from equity investments ........................................... 66 (353) (177)

Return on equity investments ................................................... 929 974 —

Other ...................................................................... 38 41 (7)

Cash provided (used) by changes in operating assets and liabilities, net of effects of business

acquisitions:

Accounts receivable ........................................................... (8,464) (2,159) (1,754)

Inventory ................................................................... (9,253) 2,920 (2,956)

Prepaid expenses and other current assets .......................................... (3,138) (2,480) (4,969)

Other assets ................................................................. (444) 172 (1,522)

Accounts payable ............................................................. 25,507 880 2,702

Accrued liabilities payable to retailers ............................................ 9,977 12,722 (1,436)

Accrued liabilities ............................................................ 6,073 2,791 3,237

Net cash provided by operating activities .......................................... 115,380 103,123 60,599

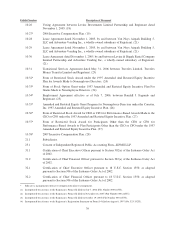

INVESTING ACTIVITIES:

Proceeds from available-for-sale securities ......................................... — — 24

Purchase of property and equipment .............................................. (45,867) (43,905) (42,784)

Acquisitions, net of cash acquired of $2,800, $4,574 and $12,592 in 2006, 2005 and 2004,

respectively ............................................................... (31,254) (20,832) (236,351)

Equity investments ........................................................... (12,109) (20,327) —

Proceeds from sale of fixed assets ................................................ 254 432 218

Net cash used by investing activities .............................................. (88,976) (84,632) (278,893)

FINANCING ACTIVITIES:

Proceeds from common stock offering, net of cash paid for offering costs of $4,626 in

2004 ..................................................................... — — 81,624

Principal payments on long-term debt and capital lease obligations ...................... (24,209) (3,762) (59,199)

Borrowings under long-term debt ................................................ — — 250,000

Excess tax benefit from exercise of stock options .................................... 1,033 — —

Repurchase of common stock ................................................... (8,023) — —

Proceeds from exercise of stock options and issuance of shares under employee stock

purchase plan .............................................................. 5,357 5,548 7,309

Financing costs associated with long-term credit facility .............................. — — (5,459)

Net cash (used) provided by financing activities ..................................... (25,842) 1,786 274,275

Effect of exchange rate changes on cash ........................................... 2,335 (1,797) 1,142

NET INCREASE IN CASH AND CASH EQUIVALENTS, CASH IN MACHINE OR IN TRANSIT,

AND CASH BEING PROCESSED .................................................... 2,897 18,480 57,123

CASH AND CASH EQUIVALENTS, CASH IN MACHINE OR IN TRANSIT, AND CASH BEING

PROCESSED:

Beginning of year ............................................................ 175,267 156,787 99,664

End of year .................................................................. $178,164 $175,267 $ 156,787

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

Cash paid during the year for interest ............................................. $ 14,795 $ 11,516 $ 4,914

Cash paid during the period for taxes ............................................. 1,982 1,089 880

SUPPLEMENTAL DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES:

Purchase of vehicles financed by capital lease obligations ............................. $ 13,811 $ 2,280 $ 2,614

Common stock issued in conjunction with acquisition, net of issue costs of $44 in 2005 ..... 1,673 39,969 —

Accrued acquisition costs ...................................................... 217 — 293

Unpaid fees for common stock offering ........................................... — — 486

See notes to consolidated financial statements

47