Redbox 2006 Annual Report Download - page 25

Download and view the complete annual report

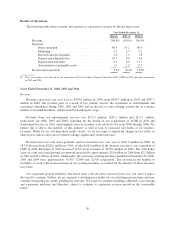

Please find page 25 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.convenient and trouble free service to retailers. We generate revenue from money deposited in our machines that

dispense plush toys, novelties and other items.

E-payment services

We offer e-payment services, including activating and reloading value on prepaid wireless accounts, selling

stored value cards, loading and reloading prepaid debit cards and prepaid phone cards, prepaid phones, providing

payroll card services and, with the acquisition of CMT, now offer money transfer services. We believe these and

other e-payment services represent a significant growth opportunity for us. We offer various e-payment services

in the United States and the United Kingdom through 14,000 point-of-sale terminals, 400 stand-alone e-payment

kiosks and 8,200 e-payment-enabled coin-counting machines in supermarkets, drugstores, universities, shopping

malls and convenience stores.

We have relationships with national wireless carriers, such as Sprint, Verizon, T-Mobile, Virgin Mobile and

Cingular Wireless. We generate revenue primarily through commissions or fees charged per e-payment

transaction and pay our retailers a fee based on commissions earned on the sales of e-payment services.

Strategy

Our strategy, embodied in our 4th Wall concept, is based on cross-selling our full range of products and

services to our retailers. In addition, we believe that we will continue to increase operating efficiencies by

combining and concentrating our products and services in our retailers’ storefront. While the entertainment

services market is relatively mature and has experienced slow growth, we believe that we have significant

opportunities in combining it with self-service coin counting, e-payment services and DVD kiosks.

We expect to continue devoting significant resources to building our sales organization in connection with

our 4th Wall cross-selling strategy, adding administrative personnel to support our growing organization and

developing the information technology systems and technology infrastructure necessary to support our products

and services. We expect to continue evaluating new marketing and promotional programs to increase consumer

utilization of our services as well as further expand our product research and development efforts.

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations is based upon our

consolidated financial statements, which have been prepared in accordance with accounting principles generally

accepted in the United States of America (“GAAP”). The preparation of these financial statements requires us to

make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and

related disclosure of contingent assets and liabilities. On an ongoing basis, we evaluate our estimates, including

those related to coin-in-machine and accrued expenses, property and equipment, stock-based compensation,

income taxes and contingencies. We base our estimates on historical experience and on various other

assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for

making judgments about the carrying values of assets and liabilities that are not readily apparent from other

sources. Actual results may differ from these estimates under different assumptions or conditions.

Revenue recognition: We recognize revenue as follows:

• Coin-counting revenue is recognized at the time the consumers’ coins are counted by our coin-counting

machines;

• Entertainment services revenue is recognized at the time cash is deposited in our machines. Cash

deposited in the machines that has not yet been collected is referred to as coin-in-machine and is

estimated at period end and reported on the balance sheet as cash in machine or in transit and cash being

23