Redbox 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

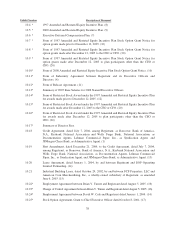

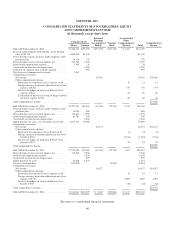

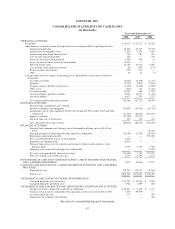

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME

(in thousands, except share data)

Common Stock

Retained

Earnings

(Accumulated

Deficit)

Treasury

Stock

Accumulated

Other

Comprehensive

Income Total

Comprehensive

IncomeShares Amount

BALANCE, December 31, 2003 ................... 21,228,311 $191,370 $(55,798) $(22,783) $ 1,401 $114,190

Proceeds from common stock offering, net of offering

costs of $5,112 ............................... 3,450,000 81,138 81,138

Proceeds from issuance of shares under employee stock

purchase plan ................................ 66,126 770 770

Proceeds from exercise of stock options, net .......... 475,784 6,539 6,539

Stock-based compensation expense ................. 3,699 38 38

Tax benefit on share-based compensation ............ 1,596 1,596

Valuation of common stock warrants granted ......... 595 595

Net exercise of common stock warrants .............. 3,567

Comprehensive income:

Net income .................................. 20,368 20,368 $20,368

Other comprehensive income:

Short-term investments net of tax expense of $8 . . . 13 13 13

Foreign currency translation adjustments net of tax

expense of $482 .......................... 770 770 770

Interest rate hedges on long-term debt net of tax

expense of $44 ........................... 69 69 69

Termination of interest rate swap on long-term debt

net of tax expense of $36 ................... 60 60 60

Total comprehensive income: ...................... $21,280

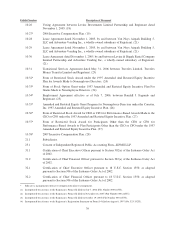

BALANCE, December 31, 2004 ................... 25,227,487 282,046 (35,430) (22,783) 2,313 226,146

Proceeds from issuance of shares under employee stock

purchase plan ................................ 82,454 989 989

Proceeds from exercise of stock options, net .......... 323,633 4,559 4,559

Stock-based compensation expense ................. 84,782 340 340

Tax benefit on share-based compensation ............ 1,048 1,048

Equity purchase of assets, net of issuance cost of $66 . . . 2,057,272 39,969 39,969

Comprehensive income:

Net income .................................. 22,272 22,272 $22,272

Other comprehensive income:

Short-term investments net of tax benefit of $4 .... (6) (6) (6)

Foreign currency translation adjustments net of tax

benefit of $832 ........................... (1,324) (1,324) (1,324)

Interest rate hedges on long-term debt net of tax

expense of $35 ........................... 54 54 54

Total comprehensive income: ...................... $20,996

BALANCE, December 31, 2005 ................... 27,775,628 328,951 (13,158) (22,783) 1,037 294,047

Proceeds from exercise of stock options, net .......... 310,840 5,368 5,368

Stock-based compensation expense ................. 6,258 6,258

Tax benefit on share-based compensation ............ 979 979

Equity purchase of assets ......................... 63,468 1,673 1,673

Treasury stock purchase .......................... (333,925) (8,023) (8,023)

Comprehensive income:

Net income .................................. 18,627 18,627 $18,627

Other comprehensive income: ...................

Short-term investments net of tax expense of $8 . . . 12 12 12

Foreign currency translation adjustments net of tax

expense of $732 .......................... 2,482 2,482 2,482

Interest rate hedges on long-term debt net of tax

benefit of $34 ............................ (58) (58) (58)

Total comprehensive income: ...................... $21,063

BALANCE, December 31, 2006 ................... 27,816,011 $343,229 $ 5,469 $(30,806) $ 3,473 $321,365

See notes to consolidated financial statements

46