Redbox 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

facility. Additionally, on December 7, 2005 we signed an asset purchase option agreement that allows Coinstar to

purchase substantially all of DVDXpress’ business assets and liabilities in exchange for any outstanding debt and

accrued interest on the credit facility plus $10,000 and contingent consideration of up to $3.5 million based on

achievement of specific conditions. Effective December 7, 2005, we have consolidated the fair value of

DVDXpress’ financial results into our consolidated financial statements in accordance with FIN 46R.

ACMI Holdings, Inc.: On July 7, 2004, we acquired ACMI for $235.0 million. As part of this acquisition,

we acquired cash totaling $11.5 million. The acquisition was effected pursuant to the “Agreement and Plan of

Merger” dated May 23, 2004 between ACMI and Coinstar. ACMI offered various entertainment services,

including skill-crane machines, bulk vending, kiddie rides and video games to consumers in mass merchandisers,

supermarkets, warehouse clubs, restaurants, entertainment centers, truck stops and other distribution channels. In

addition to the purchase price, we incurred $4.3 million in transaction costs, including investment banking fees

and amounts relating to legal and accounting charges. The results of operations of ACMI since July 7, 2004, are

included in our statement of operations. Goodwill of approximately $136.1 million resulted from the acquisition

and is not being amortized, consistent with the guidance in SFAS 142. Of this amount, approximately

$39.0 million is deductible for tax purposes. Based on identified assets of $34.4 million and assuming no

subsequent impairment of the underlying assets, the annual estimated aggregate amortization expense will

approximate $3.4 million each year through July 2014.

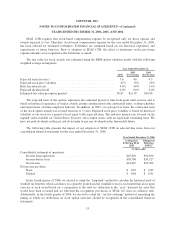

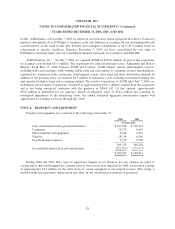

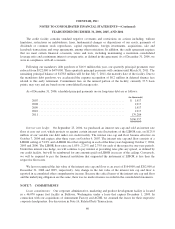

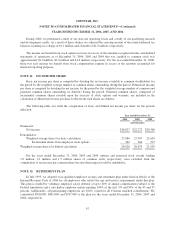

NOTE 4: PROPERTY AND EQUIPMENT

Property and equipment, net, consisted of the following at December 31:

2006 2005

(in thousands)

Coin, entertainment and e-payment machines ................ $345,938 $ 308,151

Computers ............................................ 10,732 6,962

Office furniture and equipment ........................... 6,018 4,332

Vehicles ............................................. 18,514 6,549

Leasehold improvements ................................ 2,353 2,290

383,555 328,284

Accumulated depreciation and amortization ................. (222,593) (179,473)

$ 160,962 $ 148,811

During 2006 and 2005, there were no significant changes in our business, nor any changes in events or

circumstances that would suggest the carrying value of fixed assets were impaired. In 2004, we recorded a charge

of approximately $1.9 million for the write down of certain equipment of our prepaid services. This charge is

reported in the line item titled “depreciation and other” in our consolidated statements of operations.

58