Redbox 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

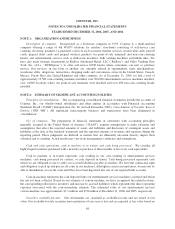

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

NOTE 3: ACQUISITIONS

In connection with our acquisitions, we have allocated the respective purchase prices plus transaction costs

to the estimated fair values of the tangible and intangible assets acquired and liabilities assumed. These purchase

price allocation estimates were based on our estimates of fair values, including consideration of estimates from

third-party consultants.

On May 31, 2006, we acquired CMT for $27.5 million in cash. The acquisition was effected pursuant to the

Agreement for the Sale and Purchase of the Entire Issued Share Capital of Travelex Money Transfer Limited

dated April 30, 2006, between Travelex Limited, Travelex Group Limited, and Coinstar. In addition to the

purchase price, we incurred an estimated $2.1 million in transaction costs, including costs relating to legal,

accounting and other directly related charges. The results of operations of CMT are included in our consolidated

statement of operations from May 31, 2006, the date of acquisition, through December 31, 2006.

CMT is one of the leading money transfer networks in terms of agent locations and countries in which we

do business. In addition to company-owned locations, CMT has agreements with banks, post offices, and other

retail locations to supply its service. CMT was established in mid-2003 and uses leading edge Internet-based

technology to provide consumers with an easy-to-use, reliable and cost-effective way to send money around the

world. We acquired CMT in order to enhance our e-payment offerings, to diversify of our available services and

expand our geographic reach internationally. The assets and operations of CMT are included in our e-payment

services revenues and are shown in our consolidated statements of operations.

The acquisition was recorded under the purchase method of accounting and the purchase price was allocated

based on the fair value of the assets acquired and liabilities assumed.

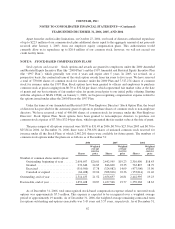

The total purchase consideration consists of the following:

(in thousands)

Cash paid for acquisition of CMT ................................... $27,484

Estimated acquisition related costs .................................. 2,058

$29,542

55