Redbox 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

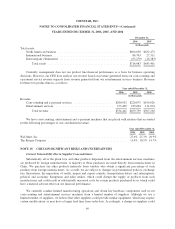

In addition, we have entered into capital lease agreements to finance the acquisition of certain automobiles.

These capital leases have terms of 36 to 60 months at imputed interest rates that range from 3.0% to 16.0%.

Assets under capital lease obligations aggregated $11.6 million and $6.2 million, net of $6.7 million and $2.5

million of accumulated amortization, at December 31, 2006 and 2005, respectively.

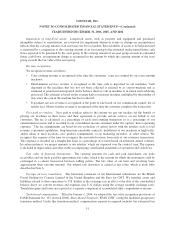

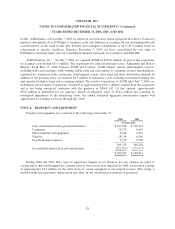

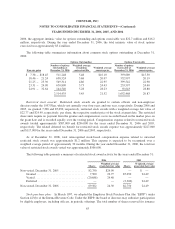

A summary of our minimum lease obligations at December 31, 2006 is as follows:

Capital

Leases

Operating

Leases*

(in thousands)

2007 ........................................................... $ 6,567 $ 4,928

2008 ........................................................... 4,167 2,463

2009 ........................................................... 2,036 1,526

2010 ........................................................... 569 709

2011 ........................................................... 138 542

Thereafter ....................................................... — 492

Total minimum lease commitments ................................... 13,477 $10,660

Less amounts representing interest ................................... (1,138)

Present value of lease obligation ..................................... 12,339

Less current portion ............................................... (5,966)

Long-term portion ................................................ $ 6,373

* One of our lease agreements is a triple net operating lease. Accordingly, we are responsible for other obligations under the lease

including, but not limited to, taxes, insurance, utilities and maintenance as incurred.

Rental expense on our operating leases was $9.2 million, $11.0 million and $4.9 million for the years ended

December 31, 2006, 2005 and 2004, respectively.

Purchase commitments: We have entered into certain purchase agreements with suppliers of our

machines, which result in total purchase commitments of $16.1 million as of December 31, 2006.

Letters of credit: As of December 31, 2006, we had six irrevocable letters of credit that totaled $10.9

million. These standby letters of credit, which expire at various times through December 31, 2007, are used to

collateralize certain obligations to third parties. We expect to renew these letters of credit. As of December 31,

2006, no amounts were outstanding under these standby letter of credit agreements.

NOTE 8: STOCKHOLDERS’ EQUITY

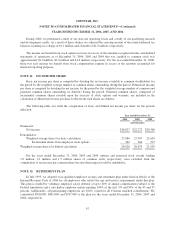

Treasury stock: Under the terms of our existing credit facility, we are permitted to repurchase up to $3.0

million of our common stock plus proceeds received after July 7, 2004, from the issuance of new shares of

capital stock under our employee equity compensation plans. As of December 31, 2006, the authorized

cumulative proceeds received from option exercises or other equity purchases under our equity compensation

plans totaled $16.1 million bringing the total authorized for purchase under our credit facility to $19.1 million.

After taking into consideration our share repurchases of $8.0 million during 2006, the remaining amount

authorized for repurchase under our credit facility is $11.1 million.

61