Redbox 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

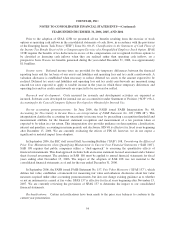

SFAS 123R requires that stock-based compensation expense be recognized only for those options and

awards expected to vest. Therefore, stock-based compensation expense for the year ended December 31, 2006,

has been reduced for estimated forfeitures. Forfeitures are estimated based on our historical experience and

expectations of future behavior. Prior to adoption of SFAS 123R, the effect of forfeitures on the pro forma

expense amounts was recognized as the forfeitures occurred.

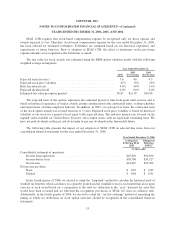

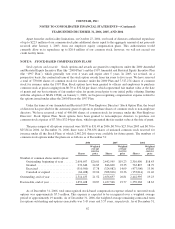

The fair value for stock awards was estimated using the BSM option valuation model with the following

weighted average assumptions.

Year Ended December 31,

2006

2005

(Pro Forma)

2004

(Pro Forma)

Expected term (in years) ........................................... 3.6 4.6 4.5

Expected stock price volatility ....................................... 47% 52% 69%

Risk-free interest rate .............................................. 4.6% 4.0% 3.4%

Expected dividend yield ............................................ 0.0% 0.0% 0.0%

Estimated fair value per option granted ................................ $9.87 $11.07 $10.98

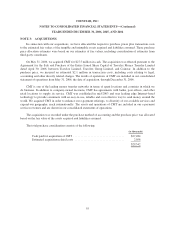

The expected term of the options represents the estimated period of time from grant until exercise and is

based on historical experience of similar awards, giving consideration to the contractual terms, vesting schedules

and expectations of future employee behavior. In addition, in 2005, on a prospective basis, the contractual term

of the stock option awards was revised from ten to 5 years. Expected stock price volatility is based on historical

volatility of our stock for a period at least equal to the expected term. The risk-free interest rate is based on the

implied yield available on United States Treasury zero-coupon issues with an equivalent remaining term. We

have not paid dividends in the past and do not plan to pay any dividends in the foreseeable future.

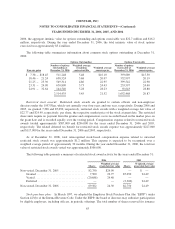

The following table presents the impact of our adoption of SFAS 123R on selected line items from our

consolidated financial statements for the year ended December 31, 2006.

Year Ended December 31, 2006

As Reported

Following SFAS

123R

If Reported

Following

APB 25

(in thousands)

Consolidated statement of operations:

Income from operations ............................................ $45,209 $50,836

Income before taxes ............................................... $30,700 $36,327

Net income ...................................................... $18,627 $22,902

Net income per share:

Basic ........................................................... $ 0.67 $ 0.83

Diluted ......................................................... $ 0.66 $ 0.81

In the fourth quarter of 2006, we elected to adopt the “long-haul” method to calculate the historical pool of

windfall tax benefits, which calculates on a grant by grant basis the windfall or excess tax benefit that arose upon

exercise of each award based on a comparison to the total tax deduction to the “as-if” deferred tax asset that

would have been recorded had we followed the recognition provisions of SFAS 123 since its effective date.

Additionally, in the fourth quarter of 2006, we elected to adopt the “tax-law ordering” method of measuring the

timing in which tax deductions on stock option exercises should be recognized in the consolidated financial

statements.

53