Redbox 2006 Annual Report Download - page 26

Download and view the complete annual report

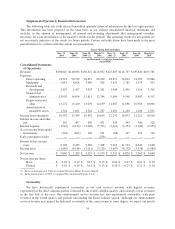

Please find page 26 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.processed. This estimate is based on the average daily revenue per machine, multiplied by the number of

days since the coin in the machine has been collected;

• E-payment services revenue is recognized at the point of sale based on our commissions earned, net of

retailer fees. Money transfer revenue is recognized at the time the customer completes the transaction.

Cash and cash equivalents, cash in machine or in transit, and cash being processed: We consider all

highly liquid securities purchased with a maturity at purchase of three months or less to be cash equivalents.

Cash in machine or in transit represents coin residing in our coin-counting or entertainment services

machines, cash being processed by carriers, or cash deposits in transit. Cash being processed represents cash

which we are obligated to use to settle our accrued liabilities payable to retailers. We have the contractual right

and obligation to pick up and process all coins in our machines, although in certain circumstances, we may not be

able to immediately access the coins until they have been deposited into one of our regional bank accounts.

Coin-in-machine represents the cash deposited into our entertainment services machines at period end which

has not yet been collected. Based on our estimate of coin-in-machine, we have recognized the related revenue,

the corresponding reduction to inventory and increase to accrued liabilities which represents the direct operating

expenses associated with the coin-in-machine estimate. The estimated value of our entertainment services

coin-in-machine was approximately $7.1 million and $5.0 million at December 31, 2006 and 2005, respectively.

Inventory: Inventory, which consists primarily of plush toys and other products dispensed from our

entertainment services machines, is stated at the lower of cost or market. The cost of inventory includes mainly

the cost of materials, and to a lesser extent, labor, overhead and freight. Cost is determined using the average cost

method. Inventory, which is considered finished goods, consists of purchased items ready for resale or use in

vending operations. Also included in inventory are prepaid airtime, prepaid phones and prepaid phone cards; cost

is determined using the first-in-first-out method.

Property and equipment: Property and equipment are depreciated in accordance with the methods

disclosed in Note 2 to our Consolidated Financial Statements. We are depreciating the cost of our coin-counting

and entertainment services machines over periods that range from 3 to 10 years and have determined that these

lives are appropriate based on our analysis which included a review of historical data and other relevant factors.

We will continue to evaluate the useful life of our coin-counting and entertainment services machines, as well as

our other property and equipment as necessary, and will determine the need to make changes when and if

appropriate. Any changes to the estimated lives of our machines may cause actual results to differ based on

different assumptions or conditions.

Purchase price allocations: In connection with our acquisitions of our entertainment and e-payment

subsidiaries, we have allocated the respective purchase prices plus transaction costs to the estimated fair values

of assets acquired and liabilities assumed. These purchase price allocations were based on our estimates of fair

values and estimates from third-party consultants. Adjustments to our purchase price allocation estimates are

made based on our final analysis of the fair value during the allocation period, which is within one year of the

purchase date.

Goodwill and intangible assets: Goodwill represents the excess of cost over the estimated fair value of net

assets acquired, which is not being amortized. We test goodwill for impairment at the reporting unit level on an

annual or more frequent basis as determined necessary. We determined our reporting units for the purpose of

performing our goodwill impairment test as our operating segments, as each is comprised of a single component.

Financial Accounting Standards Board (“FASB”) Statement No. 142, Goodwill and Other Intangible Assets

(“SFAS 142”) requires a two-step goodwill impairment test whereby the first step, used to identify potential

impairment, compares the fair value of a reporting unit with its carrying amount including goodwill. If the fair

value of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not impaired

and the second test is not performed. The second step of the impairment test is performed when required and

24