Redbox 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COINSTAR, INC.

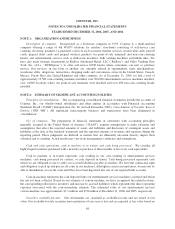

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

Prior to the adoption of SFAS 123R we presented all tax benefits resulting from the exercise of stock

options as operating cash inflows in the consolidated statements of cash flows, in accordance with the provisions

of the Emerging Issues Task Force (“EITF”) Issue No. 00-15, Classification in the Statement of Cash Flows of

the Income Tax Benefit Received by a Company upon Exercise of a Nonqualified Employee Stock Option. SFAS

123R requires the benefits of tax deductions in excess of the compensation cost recognized for those options to

be classified as financing cash inflows when they are realized rather than operating cash inflows, on a

prospective basis. Excess tax benefits generated during the year ended December 31, 2006, was approximately

$1.0 million.

Income taxes: Deferred income taxes are provided for the temporary differences between the financial

reporting basis and the tax basis of our assets and liabilities and operating loss and tax credit carryforwards. A

valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be

realized. Deferred tax assets and liabilities and operating loss and tax credit carryforwards are measured using

enacted tax rates expected to apply to taxable income in the years in which those temporary differences and

operating loss and tax credit carryforwards are expected to be recovered or settled.

Research and development: Costs incurred for research and development activities are expensed as

incurred. Software costs developed for internal use are accounted for under Statement of Position (“SOP”) 98-1,

Accounting for the Costs of Computer Software Developed or Obtained for Internal Use.

Recent accounting pronouncements: In June 2006, the FASB issued FASB Interpretation No. 48,

Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109 (“FIN 48”). This

interpretation clarifies the accounting for uncertainty in income taxes by prescribing a recognition threshold and

measurement attribute for the financial statement recognition and measurement of a tax position taken or

expected to be taken in a tax return. This interpretation also provides guidance on derecognition, classification,

interest and penalties, accounting in interim periods, and disclosure. FIN 48 is effective for fiscal years beginning

after December 15, 2006. We are currently evaluating the effects of FIN 48; however, we do not expect a

significant or material impact from adoption.

In September 2006, the SEC staff issued Staff Accounting Bulletin (“SAB”) 108, Considering the Effects of

Prior Year Misstatements when Quantifying Misstatement in Current Year Financial Statements (“SAB 108”).

SAB 108 requires that public companies utilize a “dual-approach” to assessing the quantitative effects of

financial misstatements. This dual approach includes both an income statement focused assessment and a balance

sheet focused assessment. The guidance in SAB 108 must be applied to annual financial statements for fiscal

years ending after November 15, 2006. The impact of the adoption of SAB 108 was not material to the

consolidated financial statements as of and for the year ended December 31, 2006.

In September 2006, the FASB issued FASB Statement No. 157, Fair Value Measures (“SFAS 157”), which

defines fair value, establishes a framework for measuring fair value and enhances disclosures about fair value

measures required under other accounting pronouncements, but does not change existing guidance as to whether

or not an instrument is carried at fair value. SFAS 157 is effective for fiscal years beginning after November 15,

2007. We are currently reviewing the provisions of SFAS 157 to determine the impact to our consolidated

financial statements.

Reclassifications: Certain reclassifications have been made to the prior year balances to conform to the

current year presentation.

54