Redbox 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

The credit facility contains standard negative covenants and restrictions on actions including, without

limitation, restrictions on indebtedness, liens, fundamental changes or dispositions of our assets, payments of

dividends or common stock repurchases, capital expenditures, foreign investments, acquisitions, sale and

leaseback transactions and swap agreements, among other restrictions. In addition, the credit agreement requires

that we meet certain financial covenants, ratios and tests, including maintaining a maximum consolidated

leverage ratio and a minimum interest coverage ratio, as defined in the agreement. As of December 31, 2006, we

were in compliance with all covenants.

Following our mandatory debt paydown of $16.9 million this year, our quarterly principal payments were

reduced from $522,000 to $479,000. These quarterly principal payments will continue until March 31, 2011. The

remaining principal balance of $178.8 million will be due July 7, 2011, the maturity date of the facility. Due to

the mandatory debt paydown, we accelerated the expense recognition of $0.2 million in deferred finance fees

related to this early retirement. Commitment fees on the unused portion of the facility, currently 37.5 basis

points, may vary and are based on our consolidated leverage ratio.

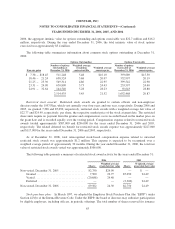

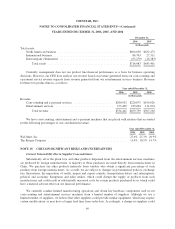

As of December 31, 2006, scheduled principal payments on our long-term debt are as follows:

(in thousands)

2007 .......................................................... $ 1,917

2008 .......................................................... 1,917

2009 .......................................................... 1,917

2010 .......................................................... 1,917

2011 .......................................................... 179,284

$186,952

Interest rate hedge: On September 23, 2004, we purchased an interest rate cap and sold an interest rate

floor at zero net cost, which protects us against certain interest rate fluctuations of the LIBOR rate, on $125.0

million of our variable rate debt under our credit facility. The interest rate cap and floor became effective on

October 7, 2004 and expires after three years on October 9, 2007. The interest rate cap and floor consists of a

LIBOR ceiling of 5.18% and a LIBOR floor that stepped up in each of the three years beginning October 7, 2004,

2005 and 2006. The LIBOR floor rates are 1.85%, 2.25% and 2.75% for each of the respective one-year periods.

Under this interest rate hedge, we will continue to pay interest at prevailing rates plus any spread, as defined by

our credit facility, but will be reimbursed for any amounts paid on LIBOR in excess of the ceiling. Conversely,

we will be required to pay the financial institution that originated the instrument if LIBOR is less than the

respective floor rates.

We have recognized the fair value of the interest rate cap and floor as an asset of $164,000 and $202,000 at

December 31, 2006 and 2005, respectively. Any change in the fair value of the interest rate cap and floor is

reported in accumulated other comprehensive income. Because the critical terms of the interest rate cap and floor

and the underlying obligation are the same, there was no ineffectiveness recorded in the consolidated statements.

NOTE 7: COMMITMENTS

Lease commitments: Our corporate administrative, marketing and product development facility is located

in a 46,070 square foot facility in Bellevue, Washington, under a lease that expires December 1, 2009. In

connection with our acquisitions of Amusement Factory and ACMI, we assumed the leases for their respective

corporate headquarters. See discussion in Note 16, Related Party Transactions.

60