Redbox 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

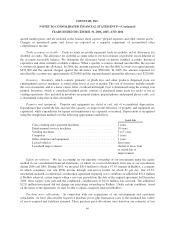

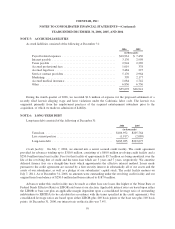

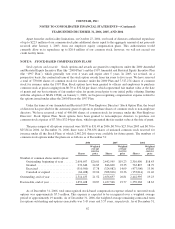

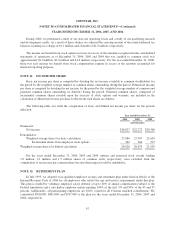

NOTE 5: ACCRUED LIABILITIES

Accrued liabilities consisted of the following at December 31:

2006 2005

(in thousands)

Payroll related expenses .................................... $10,961 $ 7,430

Interest payable ........................................... 3,176 2,998

Taxes payable ............................................ 2,944 2,269

Accrued professional fees ................................... 1,019 378

Accrued legal fees ......................................... 3,484 227

Service contract providers ................................... 5,170 2,964

Marketing ............................................... 399 2,177

Accrued medical insurance .................................. 1,684 1,742

Other ................................................... 6,856 6,756

$35,693 $26,941

During the fourth quarter of 2006, we recorded $1.6 million of expense for the proposed settlement of a

recently filed lawsuit alleging wage and hour violations under the California labor code. The lawsuit was

originated primarily from the employment practices of the acquired entertainment subsidiary prior to the

acquisition, of which we made no admission of liability.

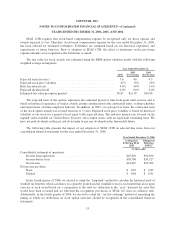

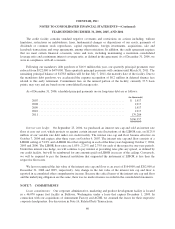

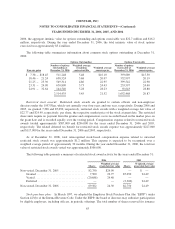

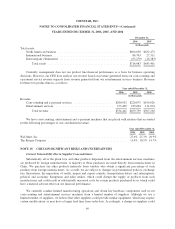

NOTE 6: LONG-TERM DEBT

Long-term debt consisted of the following at December 31:

2006 2005

(in thousands)

Term loan ............................................. $186,952 $205,764

Less current portion ...................................... (1,917) (2,089)

Long-term debt ......................................... $185,035 $203,675

Credit facility: On July 7, 2004, we entered into a senior secured credit facility. The credit agreement

provided for advances totaling up to $310.0 million, consisting of a $60.0 million revolving credit facility and a

$250.0 million term loan facility. Fees for this facility of approximately $5.7 million are being amortized over the

life of the revolving line of credit and the term loan which are 5 years and 7 years, respectively. We amortize

deferred finance fees on a straight-line basis which approximates the effective interest method. Loans made

pursuant to the credit agreement are secured by a first security interest in substantially all of our assets and the

assets of our subsidiaries, as well as a pledge of our subsidiaries’ capital stock. The credit facility matures on

July 7, 2011. As of December 31, 2006, no amounts were outstanding under the revolving credit facility and our

original term loan balance of $250.0 million had been reduced to $187.0 million.

Advances under this credit facility may be made as either base rate loans (the higher of the Prime Rate or

Federal Funds Effective Rate) or LIBOR rate loans at our election. Applicable interest rates are based upon either

the LIBOR or base rate plus an applicable margin dependent upon a consolidated leverage ratio of outstanding

indebtedness to EBITDA (to be calculated in accordance with the terms specified in the credit agreement). Our

consolidated leverage ratios are based upon either LIBOR plus 200 basis points or the base rate plus 100 basis

points. At December 31, 2006, our interest rate on this facility was 7.4%.

59