Redbox 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

Apart from the credit facility limitations, on October 27, 2004, our board of directors authorized repurchase

of up to $22.5 million of our common stock plus additional shares equal to the aggregate amount of net proceeds

received after January 1, 2003, from our employee equity compensation plans. This authorization would

currently allow us to repurchase up to $20.6 million of our common stock, however, we will not exceed our

credit facility limits.

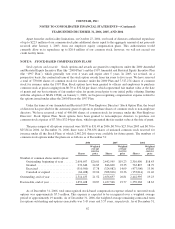

NOTE 9: STOCK-BASED COMPENSATION PLANS

Stock options and awards: Stock options and awards are granted to employees under the 2000 Amended

and Restated Equity Incentive Plan (the “2000 Plan”) and the 1997 Amended and Restated Equity Incentive Plan

(the “1997 Plan”), which generally vest over 4 years and expire after 5 years. In 2005, we revised, on a

prospective basis, the contractual term of the stock option awards from ten years to five years. We have reserved

a total of 770,000 shares of common stock for issuance under the 2000 Plan and 7,517,274 shares of common

stock for issuance under the 1997 Plan. Stock options have been granted to officers and employees to purchase

common stock at prices ranging from $0.70 to $32.64 per share, which represented fair market value at the date

of grants and our best estimate of fair market value for grants issued prior to our initial public offering. Starting

with the adoption of SFAS 123(R) on January 1, 2006, we began recognizing compensation expense related to

the options issued under either the 2000 Plan or the 1997 Plan.

Under the terms of our Amended and Restated 1997 Non-Employee Directors’ Stock Option Plan, the board

of directors has provided for the automatic grant of options to purchase shares of common stock to non-employee

directors. We have reserved a total of 400,000 shares of common stock for issuance under the Non-Employee

Directors’ Stock Option Plan. Stock options have been granted to non-employee directors to purchase our

common stock at prices of $7.38 to $32.64 per share, which represented the fair market value at the date of grant.

The price ranges of all options exercised were $0.70 to $31.49 in 2006, $0.70 to $23.30 in 2005 and $0.70 to

$25.84 in 2004. At December 31, 2006, there were 4,796,636 shares of unissued common stock reserved for

issuance under all the Stock Plans of which 2,462,201 shares were available for future grants. The numbers of

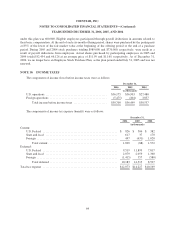

common stock options under the plans are as follows as of December 31:

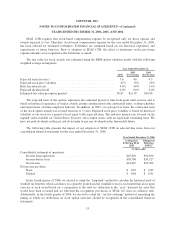

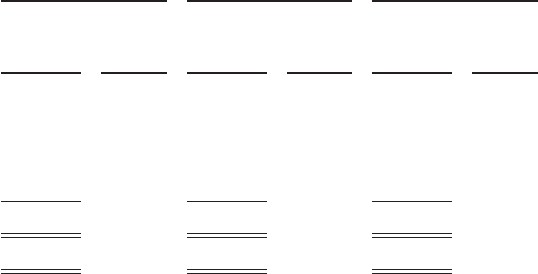

2006 2005 2004

Shares

Weighted

average

exercise

price Shares

Weighted

average

exercise

price Shares

Weighted

average

exercise

price

Number of common shares under option:

Outstanding, beginning of year ...... 2,656,697 $20.81 2,442,995 $19.23 2,310,490 $18.43

Granted ......................... 232,646 24.83 846,600 23.35 763,825 18.79

Exercised ....................... (310,500) 17.78 (324,082) 14.09 (477,506) 13.90

Canceled or expired ............... (64,408) 22.04 (308,816) 22.36 (153,814) 21.46

Outstanding, end of year ............... 2,514,435 21.52 2,656,697 20.81 2,442,995 19.23

Exercisable, end of year ................ 1,652,468 20.87 1,437,546 19.77 1,359,268 18.63

As of December 31, 2006, total unrecognized stock-based compensation expense related to unvested stock

options was approximately $7.5 million. This expense is expected to be recognized over a weighted average

period of approximately 19 months. As of December 31, 2006, the weighted average remaining contractual term

for options outstanding and options exercisable was 5.45 years and 5.57 years, respectively. As of December 31,

62