Redbox 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

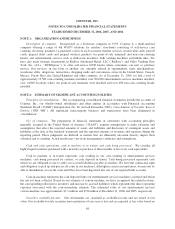

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

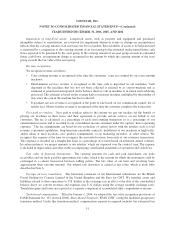

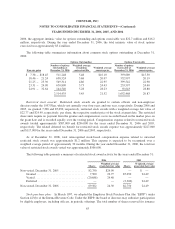

The total purchase consideration has been allocated to the assets acquired and liabilities assumed, including

identifiable intangible assets, based on their respective fair values at the acquisition date. The accounting for the

purchase price allocation is preliminary and is subject to possible adjustments in the future, based on our final

analysis of certain liabilities. The following unaudited condensed balance sheet data presents the preliminary

determination of the fair value of the assets acquired and liabilities assumed as of the acquisition date.

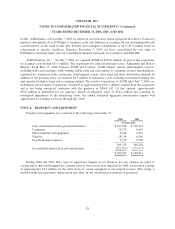

(in thousands)

Assets acquired:

Cash and cash equivalents ..................................... $ 2,801

Trade accounts receivable ..................................... 3,642

Prepaid expenses and other assets ............................... 1,488

Property and equipment ....................................... 1,991

Intangible assets ............................................. 8,890

Goodwill .................................................. 22,718

41,530

Liabilities assumed:

Accounts payable ............................................ 4,264

Accrued liabilities ........................................... 5,129

Deferred tax liability ......................................... 2,595

Total consideration .............................................. $29,542

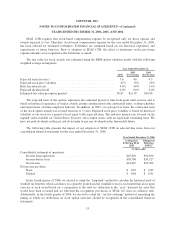

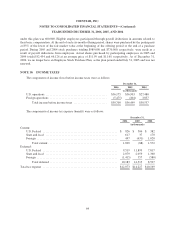

Goodwill of $22.7 million, representing the excess of the purchase price over the fair value of tangible and

identifiable intangible assets acquired in the merger, will not be amortized, consistent with the guidance in SFAS

142. No amount of this goodwill is expected to be deductible for tax purposes. We engaged a third-party

consultant which used expectations of future cash flows to estimate the fair value of the acquired intangible

assets and a portion of the purchase price was allocated to the following identifiable intangible assets:

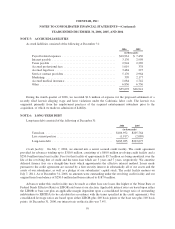

(in thousands, except years)

Purchase

Price

Estimated

Useful lives

in Years

Estimated

Weighted Average

Useful lives

in Years

Intangible assets:

Internal use software ..................................... $4,690 5.00 2.64

Agent relationships ...................................... 2,900 10.00 3.26

Trademark ............................................. 1,020 7.00 0.80

Tradename and non-compete agreements ..................... 280 2.00 0.07

Total ...................................................... $8,890 6.77

56