Redbox 2006 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2006 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2006, 2005, AND 2004

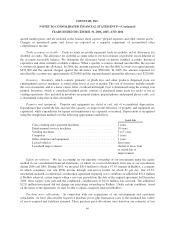

value of stock options granted on and subsequent to January 1, 2006, based on the grant date fair value estimated

in accordance with the provisions of SFAS 123R, and the estimated fair value of the portion vesting in the period

for options granted prior to, but not vested as of January 1, 2006, based on the grant date fair value estimated in

accordance with the original provisions of FASB Statement No. 123, Accounting for Stock-Based Compensation

(“SFAS 123”). Further, in accordance with the modified-prospective transition method, results for prior periods

have not been restated.

Prior to the adoption of SFAS 123R on January 1, 2006, we accounted for stock-based awards to employees

using the intrinsic value method in accordance with APB Opinion No. 25, Accounting for Stock Issued to

Employees. All options granted under the stock-based compensation plans had an exercise price equal to the fair

market value of the stock at the date of grant. Accordingly, no compensation expense, other than for restricted

stock, was recognized for our stock-based compensation associated with stock options.

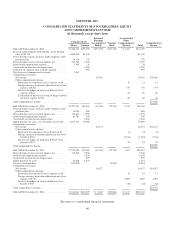

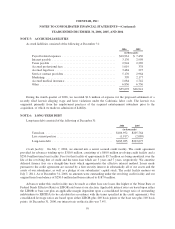

The following table illustrates the effect on net income and net income per share had we applied the fair

value recognition provision of SFAS 123 to the stock option awards. Disclosures for the year ended

December 31, 2006, are not presented because the amounts are recognized in the consolidated financial

statements.

Year Ended

December 31,

2005 2004

(in thousands, except

per share data)

Net income as reported: ....................................................... $22,272 $20,368

Add:

Total stock-based employee compensation included in the determination of net income

as reported, net of tax effect of $133 and $26 in 2005 and 2004, respectively ....... 207 50

Deduct:

Total stock-based employee compensation determined under fair value based method

for all awards, net of tax effect of $2,259 and $2,558 in 2005 and 2004,

respectively .......................................................... (4,588) (4,827)

Pro forma net income: ........................................................ $17,891 $15,591

Net income per share:

Basic:

As reported ........................................................ $ 0.86 $ 0.94

Pro forma .......................................................... $ 0.69 $ 0.72

Diluted:

As reported ........................................................ $ 0.86 $ 0.93

Pro forma .......................................................... $ 0.69 $ 0.71

The fair value for stock awards was estimated at the date of grant using the Black-Scholes-Merton (“BSM”)

option valuation model. Options granted are valued using the single option valuation approach and compensation

expense is recognized using a straight-line method. Total stock-based compensation expense recognized in the

consolidated statement of operations for the year ended December 31, 2006, was $6.3 million, before income

taxes. The related deferred tax benefit for non-qualified stock option expense was approximately $1.4 million for

the year ended December 31, 2006. No amount of stock-based compensation expense was capitalized as part of

the carrying cost of our assets.

52