Qantas 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

7Qantas |Annual Report 2007

Report from the Chairman & the Chief Executive Officer

To our fellow shareholders

During the difficult first six years of this century, the aviation industry

confronted the challenges of war, terrorism, fuel price rises, the SARS

virus and a massive industry downturn.

However, Qantas remained focused on long-term growth, developing

an innovative two brand strategy and investing billions of dollars in

fleet, product and customer service, while also working hard to attack

inefficiencies, change work practices and lower our cost base.

Today, we are in a new global operating environment for aviation.

Passenger numbers are up, productivity has increased, costs have been

reduced, and some industry consolidation is underway. The Asia

Pacific region, centred around China and India, is expected to become

the world’s single largest aviation market by 2010.

Next year, new generation aircraft, led by the Airbus A380 and the

Boeing 787 Dreamliner, will come online and offer passengers an

exciting new standard in flying.

The Qantas Group has worked hard to position itself to take advantage

of this very positive environment – and our results reflect the skill and

dedication of all our people.

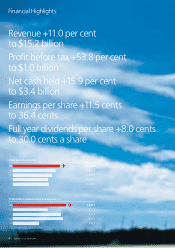

Our Results

Qantas announced a record profit before tax of $1,032.1 million for

the year ended 30 June 2007, a 53.8 per cent increase on the prior

year, achieved in a strong operating environment.

At the same time, jet fuel prices remained high, increasing costs by

around $500 million before hedging benefits.

Highlights included:

• profit before tax of $1,032.1 million;

• net profit after tax of $719.6 million;

• revenue of $15.2 billion;

• earnings per share of 36.4 cents; and

• operating cash flow $2.4 billion.

The Directors declared a fully franked final ordinary dividend of 15.0

cents per share, bringing the full year dividend to 30.0 cents per share.

This strong result was based on the ongoing strengths of the

company’s fundamentals and driven by:

• the robust economic environment, domestically and internationally,

with high levels of demand in both business and leisure markets

leading to a 6.9 per cent yield improvement and a 2.9 percentage

point improvement in seat factor to 79.9 per cent;

• a significant improvement in international operations and continuing

improvement in domestic operations, driven by high yields and

loads; and

• continued pressure on the cost base, with unit costs improving by

1.9 per cent following a further $753 million in efficiencies achieved

by the Sustainable Future Program.

Airline Partners Australia Bid

Between December 2006 and May 2007, the private equity group

Airline Partners Australia (APA) conducted an off-market bid to acquire

100 per cent of the Qantas Group.

The Offer provided a substantial premium for shareholders and the

Independent Non-Executive Directors and Executive Directors believed

it was fair and reasonable. Following an independent expert’s opinion,

the Non-Executive Directors unanimously recommended that

shareholders consider the Offer.

The bid period coincided with very strong growth in the Australian

sharemarket, with the benchmark (S&P/ASX 200) index rising by more

than 13 per cent. Global airline stocks also rose over the period.

After clearing all regulatory requirements, the bid failed to reach a

50 per cent acceptance level at its close on 4 May 2007. On 8 May

2007, APA announced that its Offer would not be renewed.

The bid triggered widespread and detailed attention to the underlying

value in Qantas.

Between December 2006 and May 2007, Qantas’ shareholder base

changed significantly. Nearly 2.8 billion shares were traded – the

equivalent of turning over all the Qantas shares on issue. Since the bid

ended, turnover in Qantas shares went even higher, averaging

70 million shares a day.

Following the collapse of the APA bid, the Qantas share price has

traded in the range of $4.92 to $5.85, reflecting newfound confidence

by shareholders in Qantas’ prospects.

In2006/07,theQantasGroupbegantoreapthebenefitsofasustainedperiodof

investment, innovation and cost-containment in an environment of unprecedented

market growth. A private equity bid to take over the company attracted widespread

attention,butdidnotdistractQantasanditspeoplefromacorecommitmentto

safety, reliability, technical innovation and customer service.

As always, Qantas honoured its responsibility to the Australian people through

extensive contributions to arts, sport and charitable organisations. Qantas continued

toinvest,changeandgrowtoprovideaplatformforfuturesuccess.