Qantas 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.81Qantas |Annual Report 2007

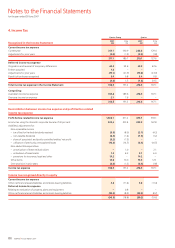

(K) Tax Consolidation continued

The tax funding arrangements require payments to/(from) the head entity

equal to the current tax liability/asset assumed by the head entity and any

tax loss deferred tax asset assumed by the head entity. The members of

the tax consolidated group have also entered into a valid tax sharing

agreement under the tax consolidation legislation which sets out the

allocation of income tax liabilities between the entities should the head

entity default on its tax payment obligations and the treatment of entities

leaving the tax consolidated group. In the opinion of the Directors, the tax

sharing agreement limits, subject to any ASIC Class Order, the joint and

several income tax related liability of the wholly-owned entities of the tax

consolidated group in the case of default by Qantas.

(L) Receivables

Current receivables are recognised and carried at original invoice amount

less impairment losses. Bad debts are written off as incurred. Non-current

receivables are carried at the present value of future net cash inflows

expected to be received.

(M) Contract Work in Progress

Contract work in progress is stated at cost plus profit recognised to date,

in accordance with accounting policy Note 1(G), less an allowance for

foreseeable losses and less progress billings. Cost includes all expenditure

related directly to specific projects and an allocation of fixed and variable

overheads incurred in the Qantas Group’s contract activities based on

normal operating capacity.

Contract work in progress is presented as part of trade and other

receivables in the Balance Sheet. If payments received from customers

exceed the income recognised, then the difference is presented as

deferred income in the Balance Sheet.

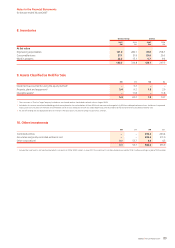

(N) Inventories

Engineering expendables, consumable stores and work in progress

are valued at weighted average cost, less any applicable allowance

for obsolescence.

(O) Impairment

The carrying amounts of assets (other than inventories and deferred

tax assets) are reviewed at each balance date to determine whether

there is any indication of impairment. If any such conditions exists,

the assets’ recoverable amount is estimated. The recoverable amount

of other assets is the greater of their fair value less costs to sell and value

in use. Assets which primarily generate cash flows as a group, such as

aircraft, are assessed on a cash generating unit (CGU) basis inclusive of

related infrastructure and intangible assets and compared to net cash

flows for the unit. Estimated net cash flows used in determining

recoverable amounts have been discounted to their net present value,

using a rate as described in Note 12.

When a decline in the fair value of an available for sale financial asset

has been recognised directly in equity and there is objective evidence that

the asset is impaired, the cumulative loss that had been recognised directly

in equity is recognised in the Income Statement. The amount of the

cumulative loss that is recognised in the Income Statement is the

difference between the acquisition cost and current fair value, less any

impairment loss on that financial asset previously recognised in the

Income Statement.

An appropriate impairment charge is made if the carrying amount of

a non-current asset exceeds its recoverable amount. The impairment

is expensed in the year in which it occurs. An impairment loss is reversed

if there has been a change in the estimates used to determine the

recoverable amount. An impairment loss with respect to goodwill

is not reversed.

(P) Investments

The investment in Air New Zealand Limited (Air New Zealand) was classified

as being available for sale and was stated at fair value in the prior year,

with any resultant gain or loss recognised directly in equity, except for

impairment losses. This investment was sold in June 2007 and the

cumulative gain previously recognised directly in equity was included

in the Income Statement.

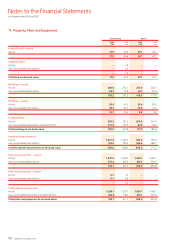

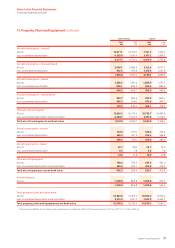

(Q) Property, Plant and Equipment

Owned Assets

Items of property, plant and equipment are stated at cost or deemed cost

less accumulated depreciation and impairment losses. Items of property,

plant and equipment are initially recorded at cost, being the fair value

of the consideration provided plus incidental costs directly attributable

to the acquisition. The cost of acquired assets includes the initial estimate

at the time of installation and during the period of use, when relevant, of

the costs of dismantling and removing the items and restoring the site on

which they are located, and changes in the measurement of existing

liabilities recognised for these costs resulting from changes in the timing or

outflow of resources required to settle the obligation or from changes in

the discount rate.

Certain items of property, plant and equipment that had been revalued to

fair value on or prior to 1 July 2004, the date of transition to A-IFRS, are

measured on the basis of deemed cost, being the revalued amount at the

date of that revaluation.

An element of the cost of an acquired aircraft is attributed on acquisition

to its service potential reflecting the maintenance condition of its engines

and airframe. This cost is depreciated over the shorter of the period to

the next major inspection event or the remaining life of the asset.

The standard cost of subsequent major airframe and engine maintenance

checks is capitalised and depreciated over the shorter of the scheduled

usage period to the next major inspection event or the remaining life of

the aircraft. Manpower costs in relation to employees that are dedicated

to major modifications to aircraft are capitalised as part of the cost of

the modification to which they relate.

Borrowing costs associated with the acquisition of qualifying assets such

as aircraft and the acquisition, construction or production of significant

items of other property, plant and equipment are capitalised as part

of the cost of the asset to which they relate.

When an obligation exists to dismantle and remove an item of property,

the present value of the estimated cost to restore the site is capitalised

into the cost of the asset to which they relate and a provision created.

The unwinding of the discount is treated as a finance charge.

Notes to the Financial Statements

for the year ended 30 June 2007

1. Statement of Significant Accounting Policies continued