Qantas 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

126 Qantas |Annual Report 2007

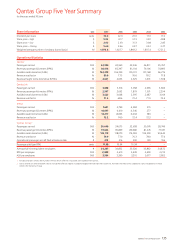

2007

$M

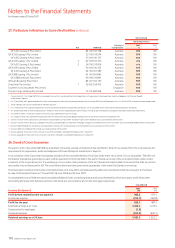

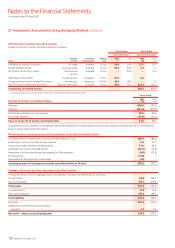

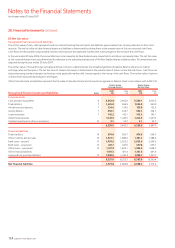

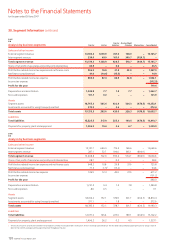

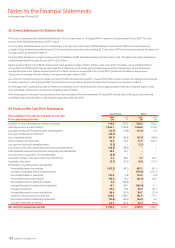

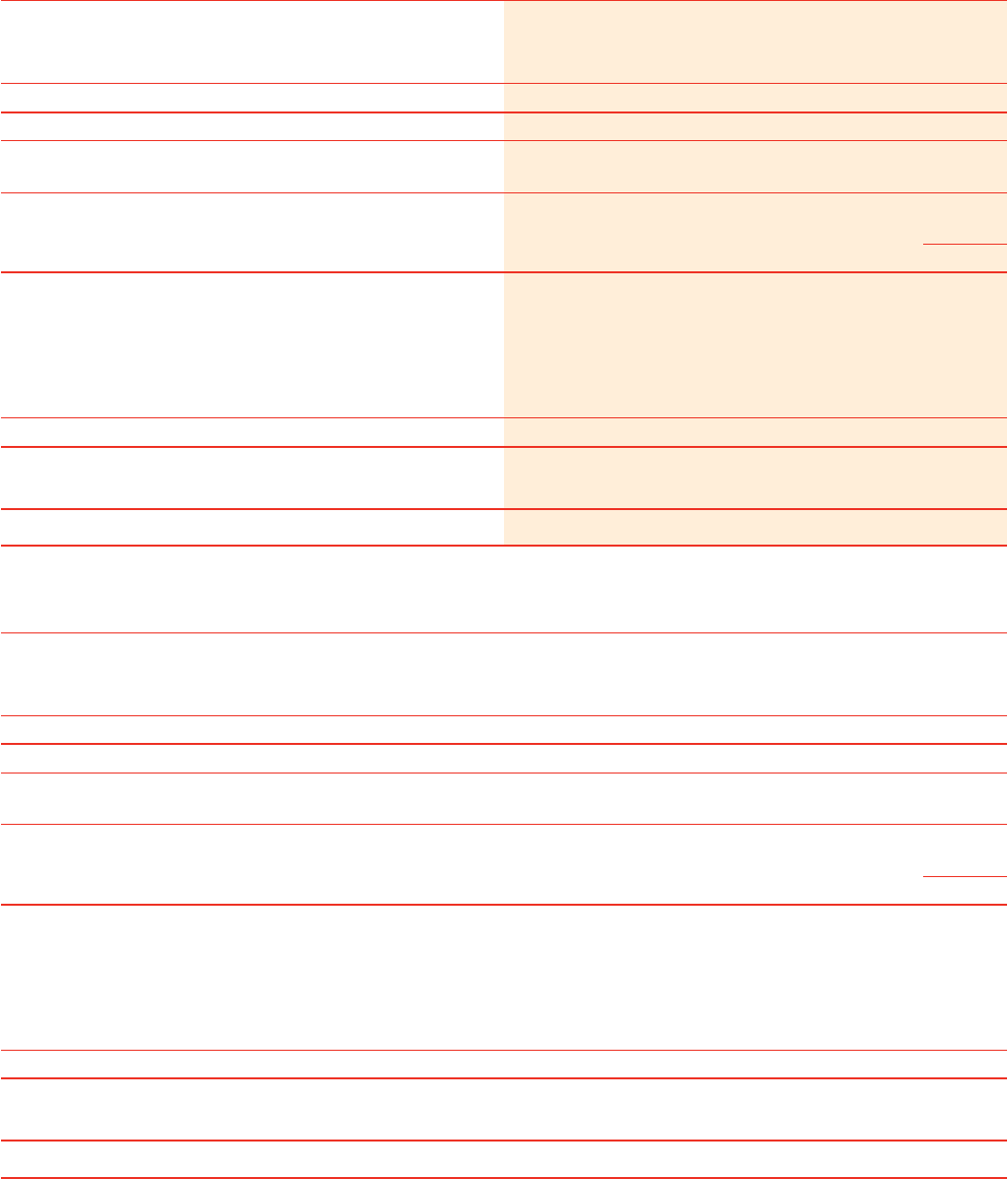

Analysis by business segments Qantas Jetstar

Qantas

Holidays

Qantas Flight

Catering Eliminations Consolidated

Sales and other income

External segment revenue 13,180.3 1,059.9 767.5 158.0 – 15,165.7

Inter-segment revenue 339.0 69.0 161.0 360.7 (929.7) –

Total segment revenue 13,519.3 1,128.9 928.5 518.7 (929.7) 15,165.7

Share of net profit of associates and jointly controlled entities 45.9 – 0.6 – – 46.5

Profit before related income tax expense and net finance costs 906.0 76.8 31.4 32.8 – 1,047.0

Net finance costs/(revenue) 41.0 (10.6) (15.5) – – 14.9

Profit before related income tax expense 865.0 87.4 46.9 32.8 – 1,032.1

Income tax expense (312.5)

Profit for the year 719.6

Depreciation and amortisation 1,345.9 7.7 1.4 7.7 – 1,362.7

Non-cash expenses 101.7 0.2 – – – 101.9

Assets

Segment assets 18,765.3 385.6 432.4 326.3 (676.5) 19,233.1

Investments accounted for using the equity method 370.0 – 2.6 – – 372.6

Total assets 19,135.3 385.6 435.0 326.3 (676.5) 19,605.7

Liabilities

Total liabilities 13,325.5 317.9 253.3 190.5 (676.5) 13,410.7

Payments for property, plant and equipment 1,206.0 19.6 3.6 6.7 – 1,235.9

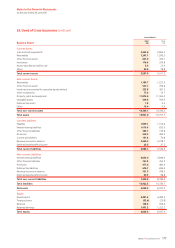

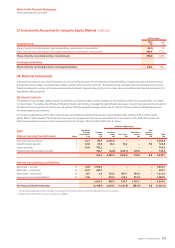

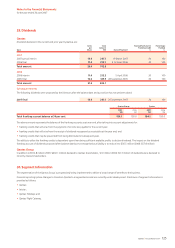

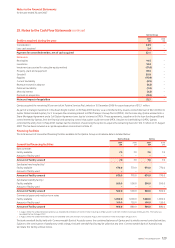

2006

$M

Analysis by business segments

Sales and other income

External segment revenue 12,121.7 649.9 719.4 169.6 – 13,660.6

Inter-segment revenue 287.1 52.7 190.0 365.1 (894.9) –

Total segment revenue 12,408.8 702.6 909.4 534.7 (894.9) 13,660.6

Share of net profit of associates and jointly controlled entities 38.7 – 0.2 – – 38.9

Profit before related income tax expense and net finance costs 648.2 10.8 29.8 37.0 – 725.8

Net finance costs/(revenue) 71.3 (1.5)1(15.2) – – 54.6

Profit before related income tax expense 576.9 12.3 45.0 37.0 – 671.2

Income tax expense (191.2)

Profit for the year 480.0

Depreciation and amortisation 1,231.2 9.4 1.4 7.8 – 1,249.8

Non-cash expenses 8.6 0.5 – – – 9.1

Assets

Segment assets 18,414.2 152.1 376.9 301.7 (434.5) 18,810.4

Investments accounted for using the equity method 371.1 – 1.8 – – 372.9

Total assets 18,785.3 152.1 378.7 301.7 (434.5) 19,183.3

Liabilities

Total liabilities 12,977.2 145.4 225.0 189.1 (434.5) 13,102.2

Payments for property, plant and equipment 1,496.2 26.2 0.2 4.5 – 1,527.1

The results of Qantas and Jetstar have been restated by $1.5 million to include interest revenue on Jetstar’s working capital balance. This has been calculated by applying the Qantas Group’s cost of

debt to the monthly average working capital balance throughout the year.

1

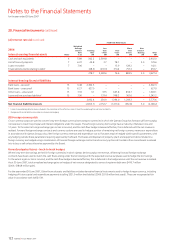

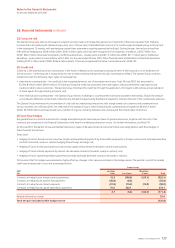

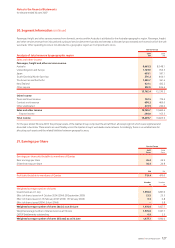

30. Segment Information continued

Notes to the Financial Statements

for the year ended 30 June 2007