Qantas 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 Qantas |Annual Report 2007

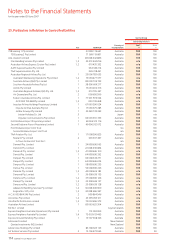

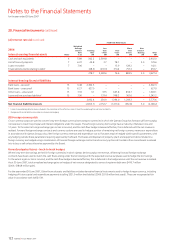

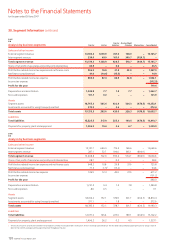

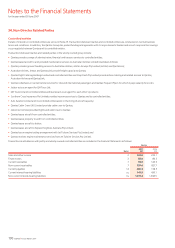

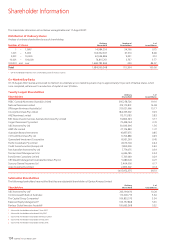

(F) Net fair value

Recognised financial assets and liabilities

The net fair value of cash, cash equivalents and non-interest-bearing financial assets and liabilities approximates their carrying value due to their short

maturity. The net fair value of other financial assets and liabilities is determined by valuing them at the present value of future contracted cash flows.

Cash flows are discounted using standard valuation techniques at the applicable market yield, having regard to the timing of the cash flows.

In the year ended 30 June 2006, the convertible loan notes issued by Air New Zealand were convertible to a 4.40 per cent equity stake. The net fair value

of the convertible loan notes was determined by reference to the prevailing market price of Air New Zealand shares at balance date. This investment was

disposed during the year ended 30 June 2007.

The net fair value of forward foreign exchange and fuel contracts is determined as the unrealised gain/loss at balance date by reference to market

exchange rates and fuel prices. The net fair value of interest rate swaps is determined as the present value of future contracted cash flows. Cash flows are

discounted using standard valuation techniques at the applicable market yield, having regard to the timing of the cash flows. The net fair value of options

is determined using standard valuation techniques.

Other financial assets and liabilities represent the fair value of derivative financial instruments recognised on Balance Sheet in accordance with AASB 139.

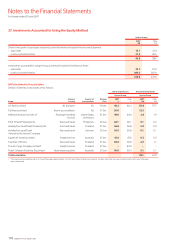

Notes

Qantas Group

Carrying Amount

Qantas Group

Net Fair Value

Recognised financial assets and liabilities 2007

$M

2006

$M

2007

$M

2006

$M

Financial assets

Cash and cash equivalents 6 3,362.9 2,902.0 3,389.1 2,920.5

Trade debtors 71,030.8 969.9 1,030.8 969.9

Aircraft security deposits 7 124.4 129.6 125.8 132.6

Sundry debtors 7 452.1 224.7 452.1 224.7

Loans receivable 7 142.2 142.1 142.2 142.1

Other financial assets 1,142.5 1,243.5 1,142.5 1,243.5

Unlisted investment in other corporations 10 3.1 53.7 3.1 53.7

6,258.0 5,665.5 6,285.6 5,687.0

Financial liabilities

Trade creditors 14 674.6 596.7 674.6 596.7

Other creditors and accruals 14 1,331.1 1,388.6 1,331.2 1,388.6

Bank loans – secured 15 1,976.5 2,302.3 2,052.6 2,396.2

Bank loans – unsecured 15 627.7 627.0 657.8 650.1

Other loans – unsecured 15 1,411.9 1,603.1 1,480.4 1,638.7

Other financial liabilities 1,151.5 491.4 1,151.5 491.4

Lease and hire purchase liabilities 15 1,058.5 1,243.2 1,035.7 1,237.7

8,231.8 8,252.3 8,383.8 8,399.4

Net financial liabilities 1,973.8 2,586.8 2,098.2 2,712.4

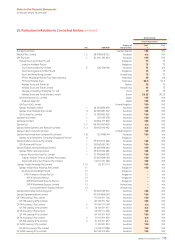

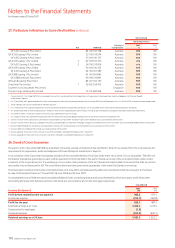

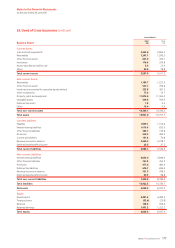

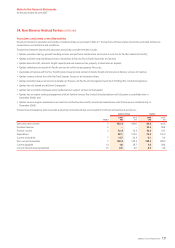

28. Financial Instruments continued

Notes to the Financial Statements

for the year ended 30 June 2007