Qantas 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

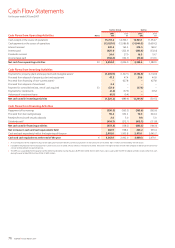

74 Qantas |Annual Report 2007

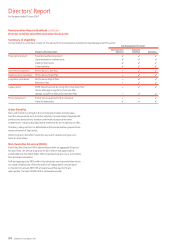

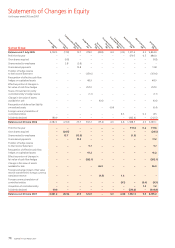

Statements of Changes in Equity

for the year ended 30 June 2007

Qantas Group

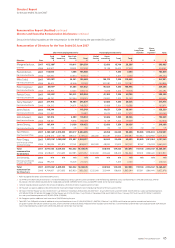

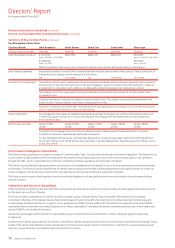

Balance as at 1 July 2005 4,192.3 (17.8) 13.7 379.0 (28.8) 4.4 (3.5) 1,311.4 4.2 5,854.9

Profit for the year – – – – – – – 479.5 0.5 480.0

Own shares acquired – (9.8) – – – – – – – (9.8)

Shares vested to employees – 3.8 (3.8) – – – – – – –

Share-based payments – – 13.8 – – – – – – 13.8

Transfer of hedge reserve

to the Income Statement – – – (351.6) – – – – – (351.6)

Recognition of effective cash flow

hedges on capitalised assets – – – 48.9 – – – – – 48.9

Effective portion of changes in

fair value of cash flow hedges – – – 257.0 – – – – – 257.0

Share of movement in jointly

controlled entity’s hedge reserve – – – (1.1) – – – – – (1.1)

Change in fair value of assets

available for sale – – – – (6.6) – – – – (6.6)

Recognition of deferred tax liability

on revalued assets – – – – – (0.4) – – – (0.4)

Foreign currency translation of

controlled entities – – – – – – 8.3 – 0.2 8.5

Dividends declared 189.9 – – – – – – (402.4) – (212.5)

Balance as at 30 June 2006 4,382.2 (23.8) 23.7 332.2 (35.4) 4.0 4.8 1,388.5 4.9 6,081.1

Profit for the year – – – – – – – 719.4 0.2 719.6

Own shares acquired –(24.5) – – – – – – –(24.5)

Shares vested to employees –15.7 (13.9) – – – – (1.8) – –

Share-based payments – – 17.2 – – – – – – 17.2

Transfer of hedge reserve

to the Income Statement – – – 9.7 – – – – – 9.7

Recognition of effective cash flow

hedges on capitalised assets –– –41.2–––––41.2

Effective portion of changes in

fair value of cash flow hedges – – – (263.1) – – – – – (263.1)

Change in fair value of assets

available for sale – – – – 36.9 – – – – 36.9

Foreign exchange impact of fair value

reserve transferred to foreign currency

translation reserve –– ––(1.5)–1.5–––

Foreign currency translation of

controlled entities –– ––––(9.1)–(0.4)(9.5)

Acquisition of controlled entity –– ––––––1.21.2

Dividends declared 99.0 – – – – – – (513.8) – (414.8)

Balance as at 30 June 2007 4,481.2 (32.6) 27.0 120.0 – 4.0 (2.8) 1,592.3 5.9 6,195.0

Issued Capital

$M

Treasury Shares

$M

Employee

Compensation Reserve

$M

Hedge Reserve

$M

Fair Value

Reserve

$M

Asset Revaluation

Reserve

$M

Foreign Currency

Translation Reserve

$M

Minority Interest

$M

Total Equity

$M

Retained Earnings

$M