Qantas 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

128 Qantas |Annual Report 2007

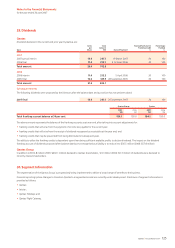

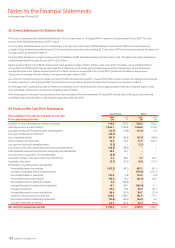

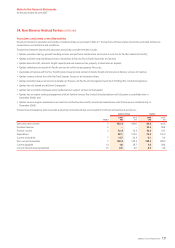

The Directors declared a fully franked final dividend of 15.0 cents per share on 15 August 2007 in relation to the year ended 30 June 2007. The total

amount of the dividend declared was $297.7 million.

On 2 July 2007, Qantas acquired, via a controlled entity, 67.27 per cent of the equity of DPEX Transport Group Pte Ltd (DPEX) by converting a loan

to Jupiter Global Limited as described in Note 33. Qantas holds an option over the remaining 32.73 per cent of DPEX and intends to exercise this option on

31 August 2007, as disclosed in Note 21.

On 9 July 2007, Qantas announced it would purchase 20 additional B787 Dreamliners taking total firm orders to 65. This takes total capital expenditure

commitments entered into post 30 June 2007 to $3.5 billion.

Qantas acquired 18 per cent of Pacific Airlines Joint Stock Aviation Company (Pacific Airlines), a low cost carrier in Vietnam, via a controlled entity on

31 July 2007 for US$30 million. Qantas exerts significant influence over the entity given its Board representation and provision of operational and

management personnel. Qantas will equity account for Pacific Airlines as an associate from 31 July 2007. Qantas has the ability to acquire up to

30 per cent of the equity of Pacific Airlines in the period through to March 2010.

As a result of oil and jet fuel price increases over recent months, Qantas announced on 1 August 2007 that it would increase international fuel surcharges

for tickets issued on or after 9 August 2007. Should fuel prices drop in future, Qantas will reduce the surcharges as on previous occasions.

On 16 August 2007, Qantas announced its intention to undertake an on-market buy-back of up to approximately 10 per cent of Qantas shares, which

once completed, will amount to a reduction of capital of over $1 billion.

With the exception of the items disclosed above, there has not arisen in the interval between 30 June 2007 and the date of this report, any event that

would have had a material effect on the Financial Statements at 30 June 2007.

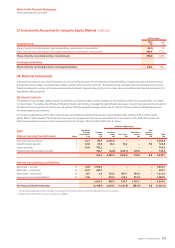

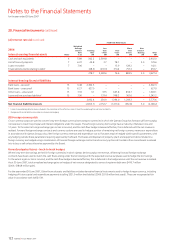

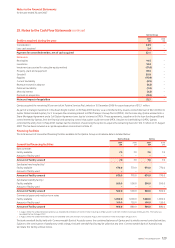

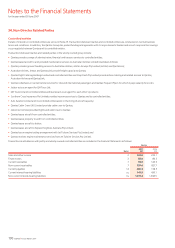

33. Notes to the Cash Flow Statements

Reconciliation of profit for the year to net cash

from operating activities

Qantas Group Qantas

2007

$M

2006

$M

2007

$M

2006

$M

Profit for the year attributable to members of Qantas 719.4 479.5 458.6 392.0

Add: depreciation and amortisation 1,362.7 1,249.8 1,266.8 1,110.0

Less: gain on disposal of property, plant and equipment (12.9) (10.8) (13.3) (7.7)

Less: gain on disposal of investment (30.6) –––

Less: capitalised interest (83.3) (68.4) (83.3) (68.4)

Add: writedown of investments 14.5 22.4 13.5 220.6

Less: gain on disposal of intangible assets (3.2) –(3.2) –

Less: share of net profit of associates and jointly controlled entities (46.5) (38.9) ––

Add: dividends received from associates and jointly controlled entities 28.4 33.7 ––

Less: discount on acquisition of controlled entity (8.8) –––

(Less)/add: changes in fair value of financial instruments 4.6 88.3 3.9 40.7

(Less)/add: other items (5.3) (12.4) (6.1) (79.7)

Movements in operating assets and liabilities:

(Increase)/decrease in receivables (165.2) (58.1) 497.3 (92.1)

Increase in receivables from controlled entities ––(178.8) (271.1)

Decrease/(increase) in inventories 167.4 (1.8) 173.2 (2.0)

(Increase)/decrease in other assets (16.1) 16.9 (22.8) 40.7

Decrease/(increase) in deferred tax assets 2.8 (165.8) ––

Increase/(decrease) in trade and other payables 16.1 80.7 (105.4) 21.1

Increase in provisions 69.0 73.4 59.9 66.3

Increase/(decrease) in current tax liabilities 80.6 (20.7) 80.7 (12.9)

Increase in revenue received in advance 234.6 208.7 152.9 171.1

(Decrease)/increase in deferred lease benefits (37.5) (45.9) (33.7) 2.0

Increase in deferred tax liabilities 62.7 195.4 65.4 50.3

Net cash from operating activities 2,353.4 2,026.0 2,325.6 1,580.9

32. Events Subsequent to Balance Date

Notes to the Financial Statements

for the year ended 30 June 2007