Qantas 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144

|

|

75Qantas |Annual Report 2007

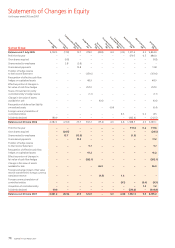

Statements of Changes in Equity continued

for the year ended 30 June 2007

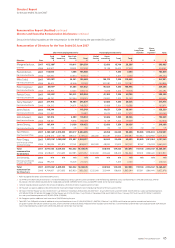

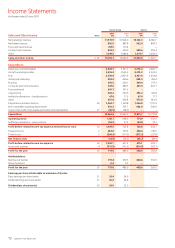

Qantas

Balance as at 1 July 2005 4,192.3 (17.8) 13.7 377.9 682.3 5,248.4

Profit for the year – – – – 392.0 392.0

Own shares acquired – (9.8) – – – (9.8)

Shares vested to employees – 3.8 (3.8) – – –

Share-based payments – – 13.8 – – 13.8

Transfer of hedge reserve to the Income Statement – – – (351.6) – (351.6)

Recognition of effective cash flow hedges on

capitalised assets – – – 48.9 – 48.9

Effective portion of changes in fair value

of cash flow hedges – – – 257.0 – 257.0

Dividends declared 189.9 – – – (402.1) (212.2)

Balance as at 30 June 2006 4,382.2 (23.8) 23.7 332.2 672.2 5,386.5

Profit for the year –– ––458.6458.6

Own shares acquired –(24.5) – – –(24.5)

Shares vested to employees –15.7(13.9) –(1.8) –

Share-based payments – – 17.2 – – 17.2

Transfer of hedge reserve to the Income Statement – – – 9.7 – 9.7

Recognition of effective cash flow hedges on

capitalised assets –– –41.2–41.2

Effective portion of changes in fair value

of cash flow hedges – – –(261.5) –(261.5)

Dividends declared 99.0 – – – (512.8) (413.8)

Balance as at 30 June 2007 4,481.2 (32.6) 27.0 121.6 616.2 5,213.4

Issued Capital

$M

Treasury Shares

$M

Employee

Compensation Reserve

$M

Hedge Reserve

$M

Retained Earnings

$M

Total Equity

$M