Proctor and Gamble 2015 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 74

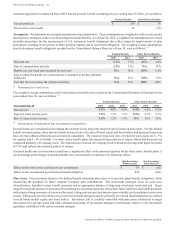

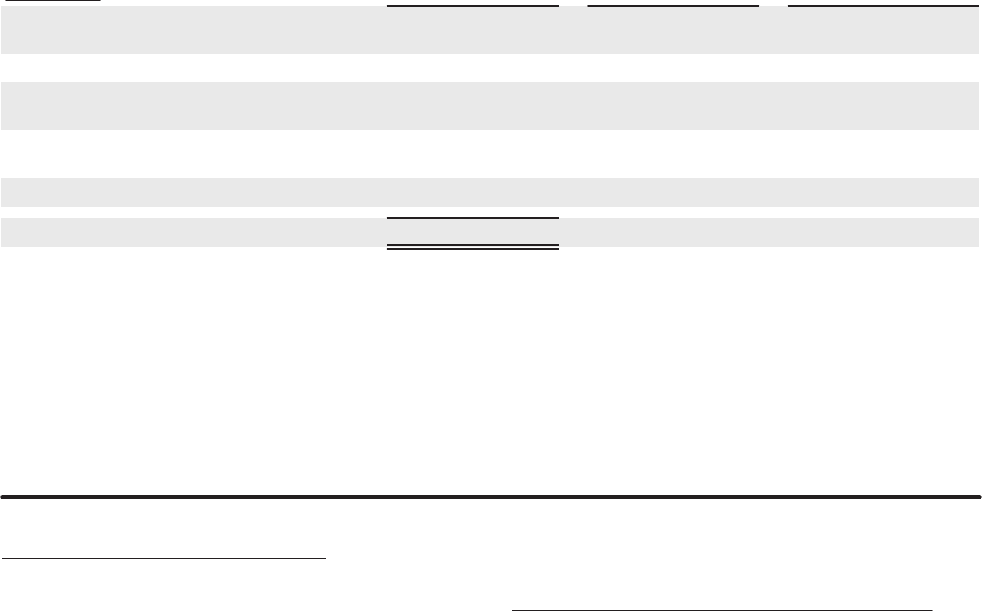

Plan Categor

a

Numer of securities to

e issued uon exercise

of outstanding otions,

warrants and rights

Weighted-

aerage exercise

rice of outstanding

otions, warrants and

rights

c

Numer of securities

remaining aailale for

future issuance under

euit comensation lans

excluding securities

reflected in column a

Euit comensation lans aroed

securit holders 1

Options 254,163,681 $63.8297 (2)

Restricted Stock Units (RSUs)Performance

Stock Units (PSUs) 11,087,436 NA (2)

Euit comensation lans not aroed

securit holders

Options 6,128,201 59.8356 (4)

GRAND TOTAL 21,9,1 .5 (5) 15,05,00

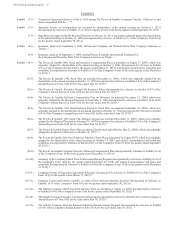

(1) Includes The Procter & Gamble 1992 Stock Plan The Procter & Gamble 1993 Non-Employee Directors' Stock Plan The Procter & Gamble

2001 Stock and Incentive Compensation Plan The Procter & Gamble 2003 Non-Employee Directors' Stock Plan The Procter & Gamble

2009 Stock and Incentive Compensation Plan The Procter & Gamble 2013 Non-Employee Directors' Stock Plan and The Procter & Gamble

2014 Stock and Incentive Compensation Plan.

(2) Of the plans listed in (1), only The Procter & Gamble 2014 Stock and Incentive Compensation Plan allow for future grants of securities.

The maximum number of shares that may be granted under this plan is 185 million shares. Stock options and stock appreciation rights are

counted on a one for one basis while full value awards (such as RSUs and PSUs) will be counted as 5 shares for each share awarded. Total

shares available for future issuance under this plan is 156 million.

(3) Includes The Procter & Gamble Future Shares Plan and The Gillette Company 2004 Long-Term Incentive Plan.

(4) None of the plans listed in (3) allow for future grants of securities.

(5) eighted average exercise price of outstanding options only.

The Procter & Gamble Future Shares Plan

On October 14, 1997, the Company's oard of Directors

approved The Procter & Gamble Future Shares Plan pursuant

to which options to purchase shares of the Company's common

stock may be granted to employees worldwide. The purpose

of this plan is to advance the interests of the Company by giving

substantially all employees a stake in the Company's future

growth and success and to strengthen the alignment of interests

between employees and the Company's shareholders through

increased ownership of shares of the Company's stock. The

plan has not been submitted to shareholders for approval.

Subject to adjustment for changes in the Company's

capitalization, the number of shares to be granted under the

plan is not to exceed 17 million shares. Under the plan's

regulations, recipients are granted options to acquire 100 shares

of the Company's common stock at an exercise price equal to

the average price of the Company's common stock on the date

of the grant. These options vest five years after the date of

grant and expire ten years following the date of grant. If a

recipient leaves the employ of the Company prior to the vesting

date for a reason other than disability, retirement or special

separation (as defined in the plan), then the award is forfeited.

At the time of the first grant following oard approval of the

plan, each employee of the Company not eligible for an award

under the 1992 Stock Plan was granted options for 100 shares.

From the date of this first grant through June 30, 2003, each

new employee of the Company has also received options for

100 shares. Following the grant of options on June 30, 2003,

the Company suspended this part of the plan. The plan

terminated on October 13, 2007.

The Gillette Company 2004 Long-Term Incentive Plan

Shareholders of The Gillette Company approved The Gillette

Company 2004 Long-Term Incentive Plan on May 20, 2004,

and the plan was assumed by the Company upon the merger

between The Procter & Gamble Company and The Gillette

Company. All options became immediately vested and

exercisable on October 1, 2005 as a result of the merger. After

the merger, all outstanding options became options to purchase

shares of The Procter & Gamble Company subject to an

exchange ratio of .975 shares of P&G stock per share of Gillette

stock. Only employees previously employed by The Gillette

Company prior to October 1, 2005 are eligible to receive grants

under this plan.

The plan was designed to attract, retain and motivate

employees of The Gillette Company and, until the effective

date of the merger between The Gillette Company and The

Procter & Gamble Company, non-employee members of the

Gillette oard of Directors. Under the plan, eligible

participants are: (i) granted or offered the right to purchase

stock options, (ii) granted stock appreciation rights andor

(iii) granted shares of the Company's common stock or

restricted stock units (and dividend equivalents). Subject to

adjustment for changes in the Company's capitalization and

the addition of any shares authorized but not issued or

redeemed under The Gillette Company 1971 Stock Option

Plan, the number of shares to be granted under the plan is not

to exceed 19,000,000 shares.