Proctor and Gamble 2015 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 56

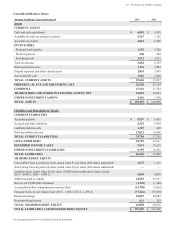

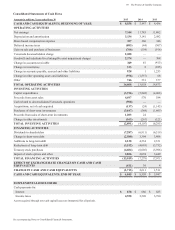

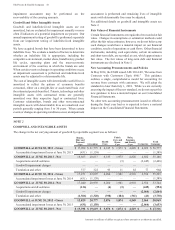

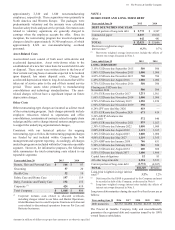

Amounts in millions of dollars except per share amounts or as otherwise specified.

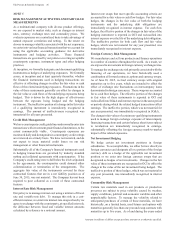

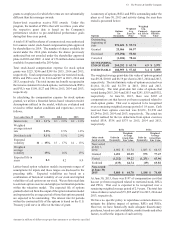

RISK MANAGEMENT ACTIVITIES AND FAIR VALUE

MEASUREMENTS

As a multinational company with diverse product offerings,

we are exposed to market risks, such as changes in interest

rates, currency exchange rates and commodity prices. e

evaluate exposures on a centralized basis to take advantage of

natural exposure correlation and netting. To the extent we

choose to manage volatility associated with the net exposures,

we enter into various financial transactions that we account for

using the applicable accounting guidance for derivative

instruments and hedging activities. These financial

transactions are governed by our policies covering acceptable

counterparty exposure, instrument types and other hedging

practices.

At inception, we formally designate and document qualifying

instruments as hedges of underlying exposures. e formally

assess, at inception and at least quarterly thereafter, whether

the financial instruments used in hedging transactions are

effective at offsetting changes in either the fair value or cash

flows of the related underlying exposures. Fluctuations in the

value of these instruments generally are offset by changes in

the fair value or cash flows of the underlying exposures being

hedged. This is driven by the high degree of effectiveness

between the exposure being hedged and the hedging

instrument. The ineffective portion of a change in the fair value

of a qualifying instrument is immediately recognized in

earnings. The amount of ineffectiveness recognized was

immaterial for all years presented.

Credit Risk Management

e have counterparty credit guidelines and normally enter into

transactions with investment grade financial institutions, to the

extent commercially viable. Counterparty exposures are

monitored daily and downgrades in counterparty credit ratings

are reviewed on a timely basis. e have not incurred, and do

not expect to incur, material credit losses on our risk

management or other financial instruments.

Substantially all of the Company's financial instruments used

in hedging transactions are governed by industry standard

netting and collateral agreements with counterparties. If the

Company's credit rating were to fall below the levels stipulated

in the agreements, the counterparties could demand either

collateralization or termination of the arrangements. The

aggregate fair value of the instruments covered by these

contractual features that are in a net liability position as of

June 30, 2015, was not material. The Company has not been

required to post collateral as a result of these contractual

features.

Interest Rate Risk Management

Our policy is to manage interest cost using a mixture of fixed-

rate and variable-rate debt. To manage this risk in a cost-

efficient manner, we enter into interest rate swaps whereby we

agree to exchange with the counterparty, at specified intervals,

the difference between fixed and variable interest amounts

calculated by reference to a notional amount.

Interest rate swaps that meet specific accounting criteria are

accounted for as fair value or cash flow hedges. For fair value

hedges, the changes in the fair value of both the hedging

instruments and the underlying debt obligations are

immediately recognized in interest expense. For cash flow

hedges, the effective portion of the changes in fair value of the

hedging instrument is reported in OCI and reclassified into

interest expense over the life of the underlying debt obligation.

The ineffective portion for both cash flow and fair value

hedges, which was not material for any year presented, was

immediately recognized in interest expense.

Foreign Currenc Risk Management

e manufacture and sell our products and finance operations

in a number of countries throughout the world. As a result, we

are exposed to movements in foreign currency exchange rates.

To manage the exchange rate risk primarily associated with the

financing of our operations, we have historically used a

combination of forward contracts, options and currency swaps.

As of June 30, 2015, we had currency swaps with original

maturities up to five years, which are intended to offset the

effect of exchange rate fluctuations on intercompany loans

denominated in foreign currencies. These swaps are accounted

for as cash flow hedges. The effective portion of the changes

in fair value of these instruments is reported in OCI and

reclassified into SG&Aand interest expense in the same period

or periods during which the related hedged transactions affect

earnings. The ineffective portion, which was not material for

any year presented, was immediately recognized in SG&A.

The change in fair values of certain non-qualifying instruments

used to manage foreign exchange exposure of intercompany

financing transactions and certain balance sheet items subject

to revaluation are immediately recognized in earnings,

substantially offsetting the foreign currency mark-to-market

impact of the related exposures.

Net Inestment Hedging

e hedge certain net investment positions in foreign

subsidiaries. To accomplish this, we either borrow directly in

foreign currencies and designate all or a portion of the foreign

currency debt as a hedge of the applicable net investment

position or we enter into foreign currency swaps that are

designated as hedges of net investments. Changes in the fair

value of these instruments are recognized in OCI to offset the

change in the value of the net investment being hedged. The

ineffective portion of these hedges, which was not material in

any year presented, was immediately recognized in interest

expense.

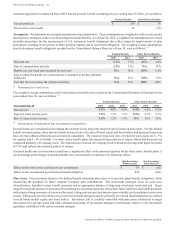

Commodit Risk Management

Certain raw materials used in our products or production

processes are subject to price volatility caused by weather,

supply conditions, political and economic variables and other

unpredictable factors. To manage the volatility related to

anticipated purchases of certain of these materials, we have

historically, on a limited basis, used futures and options with

maturities generally less than one year and swap contracts with

maturities up to five years. As of and during the years ended