Proctor and Gamble 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55 The Procter & Gamble Company

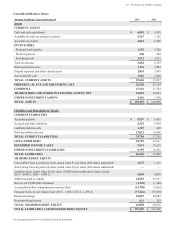

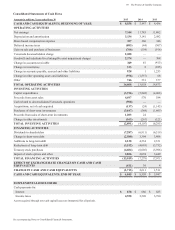

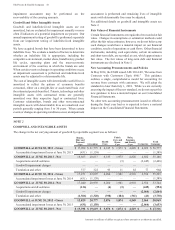

Amounts in millions of dollars except per share amounts or as otherwise specified.

approximately 2,340 and 1,640 non-manufacturing

employees, respectively. These separations were primarily in

North America and estern Europe. The packages were

predominantly voluntary and the amounts were calculated

based on salary levels and past service periods. Severance costs

related to voluntary separations are generally charged to

earnings when the employee accepts the offer. Since its

inception, the restructuring program has incurred separation

charges related to approximately 14,300 employees, of which

approximately 8,620 are non-manufacturing overhead

personnel.

Asset-Related Costs

Asset-related costs consist of both asset write-downs and

accelerated depreciation. Asset write-downs relate to the

establishment of a new fair value basis for assets held-for-sale

or disposal. These assets were written down to the lower of

their current carrying basis or amounts expected to be realized

upon disposal, less minor disposal costs. Charges for

accelerated depreciation relate to long-lived assets that will be

taken out of service prior to the end of their normal service

period. These assets relate primarily to manufacturing

consolidations and technology standardization. The asset-

related charges will not have a significant impact on future

depreciation charges.

Other Costs

Other restructuring-type charges are incurred as a direct result

of the restructuring program. Such charges primarily include

employee relocation related to separations and office

consolidations, termination of contracts related to supply chain

redesign and the cost to change internal systems and processes

to support the underlying organizational changes.

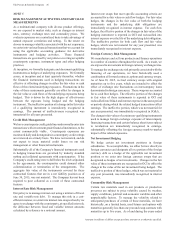

Consistent with our historical policies for ongoing

restructuring-type activities, the restructuring program charges

are funded by and included within Corporate for both

management and segment reporting. Accordingly, all charges

under the program are included within the Corporate reportable

segment. However, for informative purposes, the following

table summarizes the total restructuring costs related to our

reportable segments:

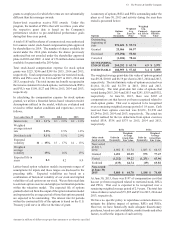

Years ended une 0 2015 2014

eauty, Hair and Personal Care 1 $ 83

Grooming 5 20

Health Care 2 10

Fabric Care and Home Care 19 119

aby, Feminine and Family Care 192 155

Corporate (1) 424 419

Total Company 1,0 $ 806

(1) Corporate includes costs related to allocated overheads,

including charges related to our Sales and Market Operations,

Global usiness Services and Corporate Functions activities and

costs related to discontinued operations from our Pet Care and

atteries businesses.

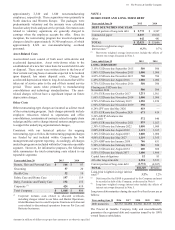

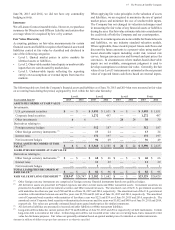

SHORT-TERM AND LONG-TERM DEBT

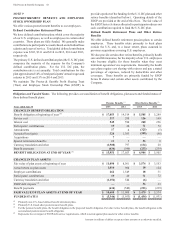

Years ended une 0 2015 2014

DEBT DUE WITHIN ONE YEAR

Current portion of long-term debt 2,2 $ 4,307

Commercial paper ,0 10,818

Other 442 481

TOTAL 12,021 $ 15,606

Short-term weighted average

interest rates (1) 0. 0.7

(1) Short-term weighted average interest rates include the effects of

interest rate swaps discussed in Note 5.

Years ended une 0 2015 2014

LONG-TERM DEBT

3.15 USD note due September 2015 500 500

1.80 USD note due November 2015 1,000 1,000

4.85 USD note due December 2015 00 700

1.45 USD note due August 2016 1,000 1,000

0.75 USD note due November 2016 500 500

Floating rate USD note due

November 2016 500 500

5.13 EUR note due October 2017 1,21 1,501

1.60 USD note due November 2018 1,000 1,000

4.70 USD note due February 2019 1,250 1,250

1.90 USD note due November 2019 550

0.28 JPY note due May 2020 1

4.13 EUR note due December 2020 1 819

9.36 ESOP debentures due

2015-2021 (1) 52 640

2.00 EUR note due November 2021 9 1,023

2.30 USD note due February 2022 1,000 1,000

2.00 EUR note due August 2022 1,119 1,365

3.10 USD note due August 2023 1,000 1,000

4.88 EUR note due May 2027 1,119 1,365

6.25 GP note due January 2030 851

5.50 USD note due February 2034 500 500

5.80 USD note due August 2034 00 600

5.55 USD note due March 2037 1,400 1,400

Capital lease obligations 52 83

All other long-term debt 2,94 5,521

Current portion of long-term debt 2,2 (4,307)

TOTAL 1,29 $19,811

Long-term weighted average interest

rates (2) .2 3.2

(1) Debt issued by the ESOP is guaranteed by the Company and must

be recorded as debt of the Company, as discussed in Note 9.

(2) Long-term weighted average interest rates include the effects of

interest rate swaps discussed in Note 5.

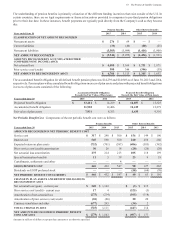

Long-term debt maturities during the next five fiscal years are as

follows:

Years ending une 0 201 201 201 2019 2020

Debt maturities $2,772 $2,094 $1,330 $2,355 $1,929

The Procter & Gamble Company fully and unconditionally

guarantees the registered debt and securities issued by its 100

owned finance subsidiaries.