Proctor and Gamble 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Procter & Gamble Company 38

progress of tax audits, and adjust them accordingly. e have

a number of audits in process in various jurisdictions. Although

the resolution of these tax positions is uncertain, based on

currently available information, we believe that the ultimate

outcomes will not have a material adverse effect on our

financial position, results of operations or cash flows.

ecause there are a number of estimates and assumptions

inherent in calculating the various components of our tax

provision, certain changes or future events such as changes in

tax legislation, geographic mix of earnings, completion of tax

audits or earnings repatriation plans could have an impact on

those estimates and our effective tax rate. For additional details

on the Company's income taxes, see Note 10 to the

Consolidated Financial Statements.

Emloee Benefits

e sponsor various post-employment benefits throughout the

world. These include pension plans, both defined contribution

plans and defined benefit plans, and other post-employment

benefit (OPE) plans, consisting primarily of health care and

life insurance for retirees. For accounting purposes, the defined

benefit pension and OPE plans require assumptions to

estimate the projected and accumulated benefit obligations,

including the following variables: discount rate expected

salary increases certain employee-related factors, such as

turnover, retirement age and mortality expected return on

assets and health care cost trend rates. These and other

assumptions affect the annual expense and obligations

recognized for the underlying plans. Our assumptions reflect

our historical experiences and management's best judgment

regarding future expectations. As permitted by U.S. GAAP,

the net amount by which actual results differ from our

assumptions is deferred. If this net deferred amount exceeds

10 of the greater of plan assets or liabilities, a portion of the

deferred amount is included in expense for the following year.

The cost or benefit of plan changes, such as increasing or

decreasing benefits for prior employee service (prior service

cost), is deferred and included in expense on a straight-line

basis over the average remaining service period of the

employees expected to receive benefits.

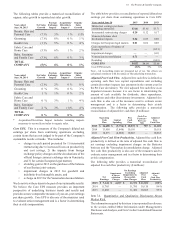

The expected return on plan assets assumption impacts our

defined benefit expense, since many of our defined benefit

pension plans and our primary OPE plan are partially funded.

The process for setting the expected rates of return is described

in Note 9 to the Consolidated Financial Statements. For 2015,

the average return on assets assumptions for pension plan assets

and OPE assets was 7.2 and 8.3, respectively. A change

in the rate of return of 100 basis points for both pension and

OPE assets would impact annual after-tax benefit expense by

approximately $101 million.

Since pension and OPE liabilities are measured on a

discounted basis, the discount rate impacts our plan obligations

and expenses. Discount rates used for our U.S. defined benefit

pension and OPE plans are based on a yield curve constructed

from a portfolio of high quality bonds for which the timing and

amount of cash outflows approximate the estimated payouts

of the plan. For our international plans, the discount rates are

set by benchmarking against investment grade corporate bonds

rated AA or better. The average discount rate on the defined

benefit pension plans and OPE plans of 3.1 and 4.5,

respectively, represents a weighted average of local rates in

countries where such plans exist. A 100-basis point change in

the pension discount rate would impact annual after-tax defined

benefit pension expense by approximately $195 million. A

change in the OPE discount rate of 100 basis points would

impact annual after-tax OPE expense by approximately $60

million. For additional details on our defined benefit pension

and OPE plans, see Note 9 to the Consolidated Financial

Statements.

Goodwill and Intangile Assets

Significant judgment is required to estimate the fair value of

intangible assets and in assigning their respective useful lives.

Accordingly, we typically obtain the assistance of third-party

valuation specialists for significant tangible and intangible

assets. The fair value estimates are based on available

historical information and on future expectations and

assumptions deemed reasonable by management, but are

inherently uncertain.

e typically use an income method to estimate the fair value

of intangible assets, which is based on forecasts of the expected

future cash flows attributable to the respective assets.

Significant estimates and assumptions inherent in the

valuations reflect a consideration of other marketplace

participants, and include the amount and timing of future cash

flows (including expected growth rates and profitability), the

underlying product or technology life cycles, economic

barriers to entry, a brand's relative market position and the

discount rate applied to the cash flows. Unanticipated market

or macroeconomic events and circumstances may occur, which

could affect the accuracy or validity of the estimates and

assumptions.

Determining the useful life of an intangible asset also requires

judgment. Certain brand intangible assets are expected to have

indefinite lives based on their history and our plans to continue

to support and build the acquired brands. Other acquired

intangible assets (e.g., certain trademarks or brands, customer

relationships, patents and technologies) are expected to have

determinable useful lives. Our assessment as to brands that

have an indefinite life and those that have a determinable life

is based on a number of factors including competitive

environment, market share, brand history, underlying product

life cycles, operating plans and the macroeconomic

environment of the countries in which the brands are sold. Our

estimates of the useful lives of determinable-lived intangible

assets are primarily based on these same factors. All of our

acquired technology and customer-related intangible assets are

expected to have determinable useful lives.

The costs of determinable-lived intangible assets are amortized

to expense over their estimated lives. The value of indefinite-

lived intangible assets and residual goodwill is not amortized,

but is tested at least annually for impairment. Our impairment

testing for goodwill is performed separately from our

impairment testing of indefinite-lived intangible assets. e