Proctor and Gamble 2015 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Procter & Gamble Company 66

Amounts in millions of dollars except per share amounts or as otherwise specified.

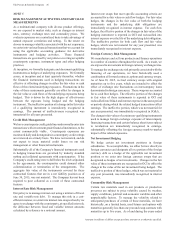

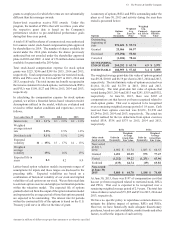

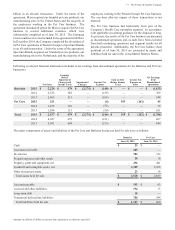

Total benefit payments expected to be paid to participants,

which include payments funded from the Company's assets

and payments from the plans are as follows:

Years ending une 0

Pension

Benefits

Other Retiree

Benefits

EXPECTED BENEFIT PAYMENTS

2016 $ 533 $ 182

2017 542 196

2018 560 210

2019 572 223

2020 587 235

2021 - 2025 3,403 1,334

Emloee Stock Ownershi Plan

e maintain the ESOP to provide funding for certain employee

benefits discussed in the preceding paragraphs.

The ESOPborrowed $1.0 billion in 1989 and the proceeds were

used to purchase Series A ESOP Convertible Class APreferred

Stock to fund a portion of the U.S. DC plan. Principal and

interest requirements of the borrowing were paid by the Trust

from dividends on the preferred shares and from advances

provided by the Company. The original borrowing of $1.0

billion has been repaid in full, and advances from the Company

of $86 remain outstanding at June 30, 2015. Each share is

convertible at the option of the holder into one share of the

Company's common stock. The dividend for the current year

was equal to the common stock dividend of $2.59 per share.

The liquidation value is $6.82 per share.

In 1991, the ESOP borrowed an additional $1.0 billion. The

proceeds were used to purchase Series ESOP Convertible

Class A Preferred Stock to fund a portion of retiree health care

benefits. These shares, net of the ESOP's debt, are considered

plan assets of the other retiree benefits plan discussed above.

Debt service requirements are funded by preferred stock

dividends, cash contributions and advances provided by the

Company, of which $662 is outstanding at June 30, 2015. Each

share is convertible at the option of the holder into one share

of the Company's common stock. The dividend for the current

year was equal to the common stock dividend of $2.59 per

share. The liquidation value is $12.96 per share.

Our ESOP accounting practices are consistent with current

ESOP accounting guidance, including the permissible

continuation of certain provisions from prior accounting

guidance. ESOP debt, which is guaranteed by the Company,

is recorded as debt (see Note 4) with an offset to the reserve

for ESOP debt retirement, which is presented within

shareholders' equity. Advances to the ESOP by the Company

are recorded as an increase in the reserve for ESOP debt

retirement. Interest incurred on the ESOP debt is recorded as

interest expense. Dividends on all preferred shares, net of

related tax benefits, are charged to retained earnings.

The series A and preferred shares of the ESOP are allocated

to employees based on debt service requirements. The number

of preferred shares outstanding at June 30 was as follows:

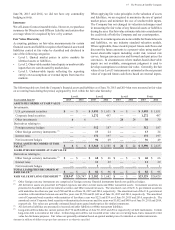

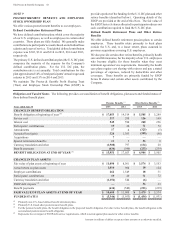

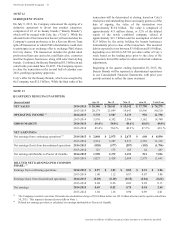

Shares in thousands 2015 2014 201

Allocated 42,044 44,465 45,535

Unallocated ,22 8,474 9,843

TOTAL SERIES A 49,22 52,939 55,378

Allocated 2,04 22,085 21,278

Unallocated 4,09 35,753 37,300

TOTAL SERIES B 5,10 57,838 58,578

For purposes of calculating diluted net earnings per common

share, the preferred shares held by the ESOP are considered

converted from inception.

INCOME TAXES

Income taxes are recognized for the amount of taxes payable

for the current year and for the impact of deferred tax assets

and liabilities, which represent future tax consequences of

events that have been recognized differently in the financial

statements than for tax purposes. Deferred tax assets and

liabilities are established using the enacted statutory tax rates

and are adjusted for any changes in such rates in the period of

change.

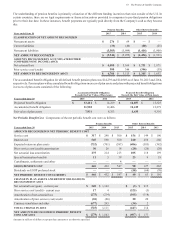

Earnings from continuing operations before income taxes

consisted of the following:

Years ended une 0 2015 2014 201

United States , $ 8,816 $ 8,020

International 2,9 5,521 6,159

TOTAL 11,4 $14,337 $ 14,179

Income taxes on continuing operations consisted of the

following:

Years ended une 0 2015 2014 201

CURRENT TAX EXPENSE

U.S. federal 2,22 $ 1,524 $ 1,745

International 1,195 1,301 1,502

U.S. state and local 252 237 278

,19 3,062 3,525

DEFERRED TAX EXPENSE

U.S. federal 11 142 185

International and other 192 (185) (484)

0 (43) (299)

TOTAL TAX EXPENSE 2,91 $ 3,019 $ 3,226