Proctor and Gamble 2015 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25 The Procter & Gamble Company

O-TSR performance is highly correlated with market total

shareholder returns. O-TSR is a balanced measure that requires

strong performance across the three primary drivers of value

creation: sales growth, profit margin expansion and efficient

utilization of assets to generate strong, reliable operating cash

flow. e operationalize O-TSR deep within the Company by

defining tight linkages between business activities and the key

drivers of value creation, from strategic choices of global

business units, brands and country teams down to individual

employees daily work plans.

The Company has recently undertaken an effort to focus and

strengthen its business portfolio to compete in categories and

brands that are structurally attractive and that play to P&G

strengths. This will enable us to allocate resources to leading

brands - marketed in the right set of countries, channels and

customers - where the size of the prize and probability of

winning is highest. hen the major portion of this work is

complete, we expect to compete in four industry-based sectors

made up of approximately ten product categories and 65

leading brands.

Innovation has always been - and continues to be - P&G's

lifeblood. To consistently win with consumers around the

world across price tiers and preferences and to consistently win

versus our best competitors, each P&G product category needs

a full portfolio of innovation, including a mix of commercial

programs, product improvements and game-changing

innovations. e are also innovating to improve our category,

brand and market business models to better serve consumers

and customers.

Productivity is a core strength for P&G, which creates

flexibility to fund our growth efforts, offset cost challenges

andor improve operating margins. e have taken significant

steps to accelerate productivity and savings across all elements

of costs, including cost of goods sold, marketing expense and

non-manufacturing overhead. These efforts are yielding

significant benefits to our operating margin.

Finally, we are focused on improving execution and operating

discipline in everything we do. Operating discipline and

execution have always been - and must continue to be - core

capabilities and competitive advantages for P&G.

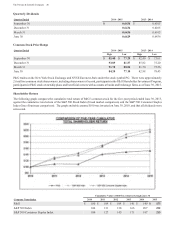

The Company expects the delivery of the following long-term

annual financial targets will result in total shareholder returns

in the top third of the competitive peer group:

Organic sales growth above market growth rates in the

categories and geographies in which we compete

Core EPS growth of high single digits and

Adjusted free cash flow productivity of 90 or greater.

In periods with significant macroeconomic pressures, we will

maintain a disciplined approach to investing so as not to

sacrifice the long-term health of our businesses to meet short-

term objectives in any given year.

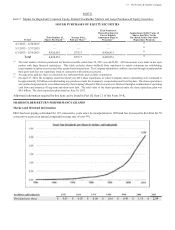

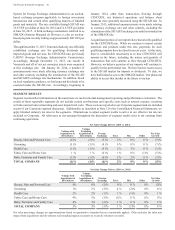

SUMMARY OF 2015 RESULTS

Amounts in millions, excet er share amounts 2015

Change s.

Prior Year 2014

Change s.

Prior Year 201

Net sales ,29 (5) $ 80,510 $ 80,116

Operating income 11,90 (20) 14,740 7 13,817

Net earnings from continuing operations ,90 (21) 11,318 3 10,953

Net earnings(loss) from discontinued operations 1,(482) 467 4 449

Net earnings attributable to Procter & Gamble ,0 (40) 11,643 3 11,312

Diluted net earnings per common share 2.44 (39) 4.01 4 3.86

Diluted net earnings per share from continuing operations .0 (21) 3.86 4 3.71

Core earnings per common share 4.02 (2) 4.09 5 3.89

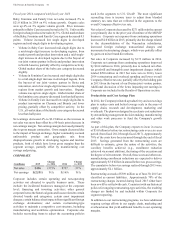

Net sales decreased 5 to $76.3 billion including a

negative 6 impact from foreign exchange.

Organic sales increased 1.

Unit volume decreased 1. olume grew low single

digits in Fabric Care and Home Care. olume

decreased low single digits in aby, Feminine and

Family Care, Grooming and Health Care, and

declined mid-single digits in eauty, Hair and

Personal Care.

Net earnings from continuing operations decreased $2.4

billion or 21 due to a $2.1 billion after tax charge related

to the deconsolidation of our enezuelan subsidiaries and

the decline in net sales, partially offset by reduced selling,

general and administrative expenses (SG&A). Foreign

exchange impacts negatively affected net earnings by

approximately 12.

Net earnings from discontinued operations decreased $2.3

billion due primarily to impairment charges in our

atteries business, which is included in discontinued

operations due to the pending divestiture.

Net earnings attributable to Procter & Gamble were $7.0

billion, a decrease of $4.6 billion or 40 versus the prior

year period due primarily to the enezuelan

deconsolidation charge and impairment charges in our

atteries business.

Diluted net earnings per share decreased 39 to $2.44

Diluted net earnings per share from continuing

operations decreased 21 to $3.06.

Core EPS decreased 2 to $4.02.

Cash flow from operating activities was $14.6 billion.

Adjusted free cash flow was $11.6 billion.

Adjusted free cash flow productivity was 102.