Proctor and Gamble 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

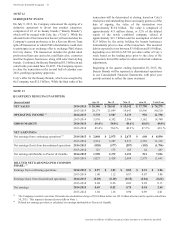

69 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

ongoing matters for which we have accrued liabilities may

result in fines or costs in excess of the amounts reserved, it is

difficult to estimate such amounts at this time. Currently,

however, we do not expect any such incremental losses to

materially impact our financial statements in the periods in

which they are accrued and paid, respectively.

ith respect to other litigation and claims, while considerable

uncertainty exists, in the opinion of management and our

counsel, the ultimate resolution of the various lawsuits and

claims will not materially affect our financial position, results

of operations or cash flows.

e are also subject to contingencies pursuant to environmental

laws and regulations that in the future may require us to take

action to correct the effects on the environment of prior

manufacturing and waste disposal practices. ased on

currently available information, we do not believe the ultimate

resolution of environmental remediation will have a material

effect on our financial position, results of operations or cash

flows.

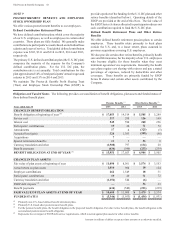

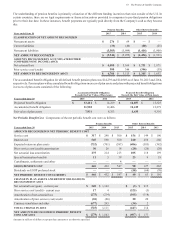

SEGMENT INFORMATION

Our Global usiness Units (GUs) are organized into four

industry-based sectors, comprised of 1) Global eauty, 2)

Global Health and Grooming, 3) Global Fabric and Home Care

and 4) Global aby, Feminine and Family Care. The Company

completed the divestiture of its Pet Care business during the

current fiscal year. On November 13, 2014, the Company

announced that it plans to divest the atteries business via a

transaction with erkshire Hathaway. The Company expects

to complete the atteries transaction in the beginning of

calendar year 2016, pending necessary regulatory approvals.

These GUs are reported as discontinued operations for all

periods presented (see Note 13).

Under U.S. GAAP, the remaining GUs underlying the four

sectors are aggregated into five reportable segments: 1) eauty,

Hair and Personal Care, 2) Grooming, 3) Health Care, 4) Fabric

Care and Home Care and 5) aby, Feminine and Family Care.

Our five reportable segments are comprised of:

eaty air ad ersoal are: Skin and Personal Care

(Antiperspirant and Deodorant, Personal Cleansing, Skin

Care) Cosmetics Hair Care and Color Prestige (SKII,

Fragrances) Salon Professional

roomi: Shave Care (Female lades & Razors, Male

lades & Razors, Pre- and Post-Shave Products, Other

Shave Care) Electronic Hair Removal

ealth are: Personal Health Care (Gastrointestinal,

Rapid Diagnostics, Respiratory, itaminsMinerals

Supplements, Other Personal Health Care) Oral Care

(Toothbrush, Toothpaste, Other Oral Care)

Faric are ad ome are: Fabric Care (Laundry

Additives, Fabric Enhancers, Laundry Detergents) Home

Care (Air Care, Dish Care, Surface Care, P&G

Professional) and

ay Femiie ad Family are: aby Care (aby

ipes, Diapers and Pants) Feminine Care (Adult

Incontinence, Feminine Care) Family Care (Paper

Towels, Tissues, Toilet Paper).

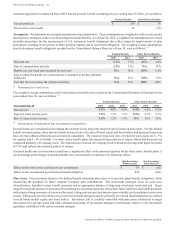

The accounting policies of the segments are generally the same

as those described in Note 1. Differences between these

policies and U.S. GAAP primarily reflect income taxes, which

are reflected in the segments using applicable blended statutory

rates. Adjustments to arrive at our effective tax rate are

included in Corporate.

Corporate includes certain operating and non-operating

activities that are not reflected in the operating results used

internally to measure and evaluate the businesses, as well as

items to adjust management reporting principles to U.S. GAAP.

Operating activities in Corporate include the results of

incidental businesses managed at the corporate level.

Operating elements also include certain employee benefit

costs, the costs of certain restructuring-type activities to

maintain a competitive cost structure, including manufacturing

and workforce optimization and other general Corporate items.

The non-operating elements in Corporate primarily include

interest expense, certain acquisition and divestiture gains and

interest and investing income.

Total assets for the reportable segments include those assets

managed by the reportable segment, primarily inventory, fixed

assets and intangible assets. Other assets, primarily cash,

accounts receivable, investment securities and goodwill, are

included in Corporate.

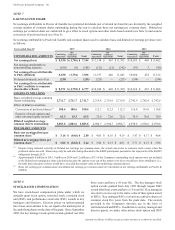

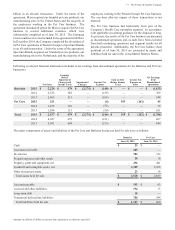

Our business units are comprised of similar product categories.

Nine business units individually accounted for 5 or more of

consolidated net sales as follows:

of Sales Business Unit

Years ended une 0 2015 2014 201

Fabric Care 20 21 21

aby Care 14 14 13

Hair Care and Color 11 11 12

Shave Care 9 9 9

Home Care 8 8

Family Care 7 7

Oral Care 7 7

Feminine Care 6 6

Skin and Personal Care 6 6

ll ther 11 11

TOTAL 100 100 100

of sales by business unit excludes sales held in Corporate.

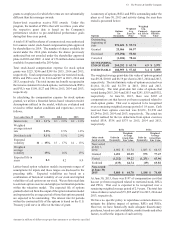

The Company had net sales in the U.S. of $28.3 billion, $28.3

billion and $28.1 billion for the years ended June 30, 2015,

2014 and 2013, respectively. Long-lived assets in the U.S.

totaled $8.4 billion and $8.7 billion as of June 30, 2015 and

2014, respectively. Long-lived assets consists of property,

plant and equipment. No other country's net sales or long-lived

assets exceed 10 of the Company totals.

Our largest customer, al-Mart Stores, Inc. and its affiliates,

accounted for approximately 14 of consolidated net sales in

2015, 2014 and 2013.