Proctor and Gamble 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Proctor and Gamble annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

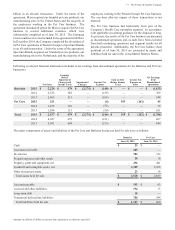

71 The Procter & Gamble Company

Amounts in millions of dollars except per share amounts or as otherwise specified.

billion in an all-cash transaction. Under the terms of the

agreement, Mars acquired our branded pet care products, our

manufacturing sites in the United States and the majority of

the employees working in the Pet Care business. The

agreement included an option for Mars to acquire the Pet Care

business in several additional countries, which were

substantially completed as of June 30, 2015. The European

Union countries were not included in the agreement with Mars.

In December 2014, the Company completed the divestiture of

its Pet Care operations in estern Europe to Spectrum rands

in an all-cash transaction. Under the terms of the agreement,

Spectrum rands acquired our branded pet care products, our

manufacturing site in the Netherlands, and the majority of the

employees working in the estern Europe Pet Care business.

The one-time after-tax impact of these transactions is not

material.

The Pet Care business had historically been part of the

Companys Health Care reportable segment. In accordance

with applicable accounting guidance for the disposal of long-

lived assets, the results of the Pet Care business are presented

as discontinued operations and, as such, have been excluded

from both continuing operations and segment results for all

periods presented. Additionally, the Pet Care balance sheet

positions as of June 30, 2014 are presented as assets and

liabilities held for sale in the Consolidated alance Sheets.

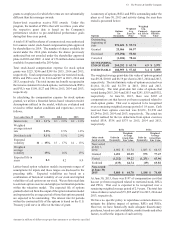

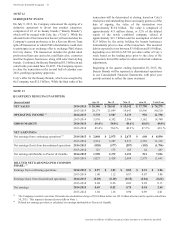

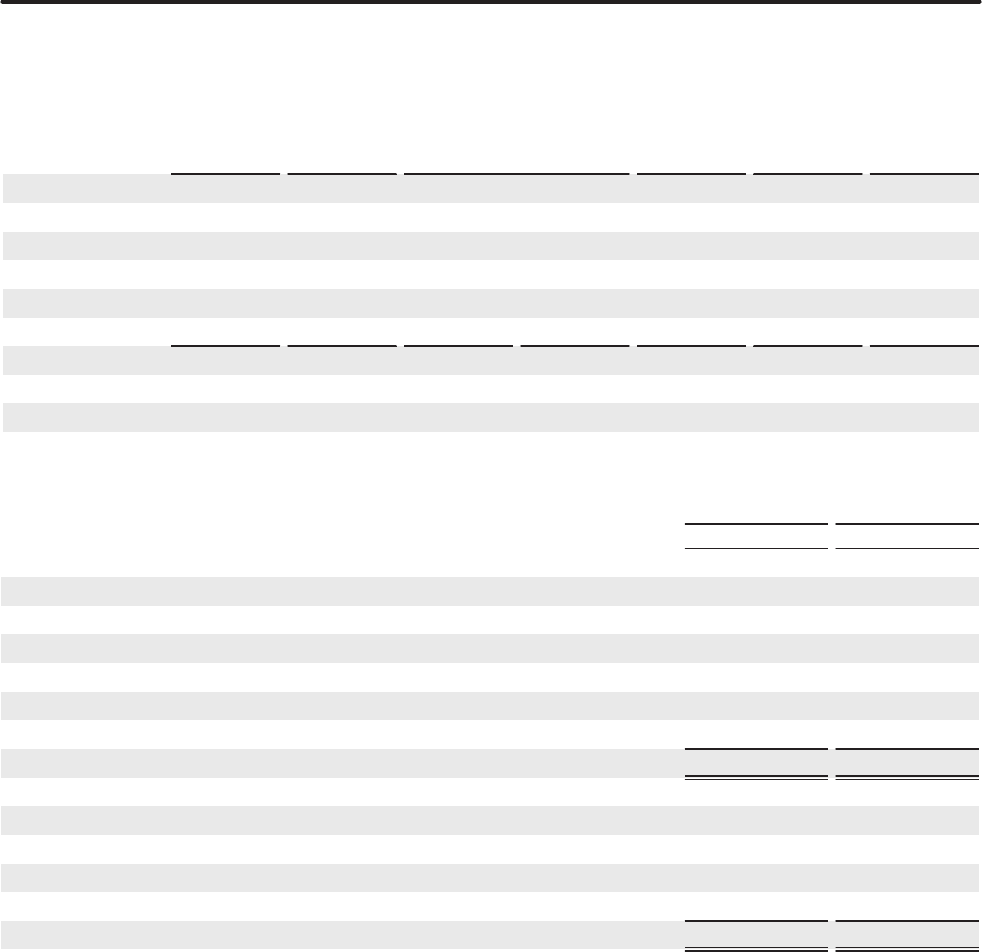

Following is selected financial information included in net earnings from discontinued operations for the atteries and Pet Care

businesses:

Net Sales

Earnings

Before

Imairment

Charges and

Income Taxes

Imairment

Charges

Income Tax

Exense

Gain on Sale

Before Income

Taxes

Income Tax

Exense on

Sales

Net Earnings

from

Discontinued

Oerations

Batteries 2015 2,22 49 2,14 140 1,5

2014 2,552 548 (159) 389

2013 2,465 513 (165) 348

Pet Care 2015 251 4 195 142 49

2014 1,475 130 (52) 78

2013 1,586 151 (50) 101

Total 2015 2,4 49 2,14 144 195 142 1,

2014 4,027 678 (211) 467

2013 4,051 664 (215) 449

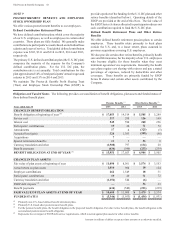

The major components of assets and liabilities of the Pet Care and atteries businesses held for sale were as follows:

Batteries Pet Care

une 0, 2015 une 0, 2014

Cash 25 $

Accounts receivable 245

Inventories 04 122

Prepaid expenses and other assets 2 14

Property, plant and equipment, net 49 441

Goodwill and intangible assets, net 2,9 2,258

Other noncurrent assets 2 14

Total assets held for sale ,510 $ 2,849

Accounts payable 195 $63

Accrued and other liabilities 194 13

Long-term debt 1

Noncurrent deferred tax liabilities 0 584

Total liabilities held for sale 1,1 $ 660